KEY POINTS

1. Platinum group metals (PGM) mining sector valuations appear attractive amid signs that earnings are bottoming out.

2. The private sector is taking action to meet energy and transportation challenges.

3. The next PGM up cycle should produce a very strong return for patient investors.

New York - Based on our key indicators, South African assets have rarely been more attractively valued in absolute as well as relative terms. There was nascent optimism for the macro backdrop when Jacob Zuma resigned as president in March 2018, leading to expectations that governance and structural reforms would produce better economic and financial outcomes.

The outlook has changed dramatically. The state-run utility Eskom has experienced massive power-shortage issues, and most of the country lacks electricity for several hours each day. The state-run rail and transport service is severely disrupted, and many mining and resources companies are unable to ship products to port. The political situation is beset with long-simmering problems that seem hard to overcome. The economy is moribund, the South African Rand (ZAR) has been weak, undershooting its fair value on our models.

As a result, South African equities are among the world's the most beat up and loathed stocks. Yet most South Africans will tell you there has been improvement from a low base. In our view, the lack of belief is startling. The private sector has been increasing investments for 15 quarters in a row, a sign of strong internal confidence. Yet historically low valuations for South African equities and high measures of negative sentiment indicate that global investors are on the verge of giving up hope.

Amid this uncertainty, the platinum group metals (PGM) mining equities captured our attention. Mining has always been a large industry within South Africa and, like any commodity industry, has experienced large cycles. Today, the PGM industry is suffering from low commodity prices that have the left about 50% of the mines uneconomical at the prevailing basket price. Besides the commodity price downturn that has led to negative free cash flow (FCF) for a significant part of the industry, South Africa's utility and rail service disruptions have put a further damper on the entire PGM mining industry.

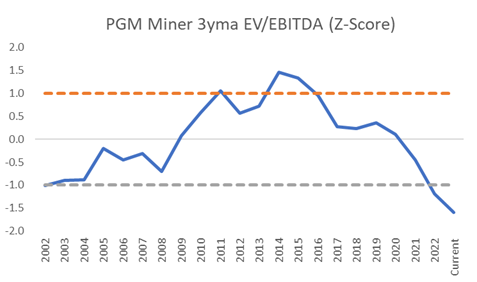

We find this interesting, given that investors typically put a higher multiple on equities during commodity down cycles to normalize for earnings power during the up cycle. This is the equivalent of a hiker looking through a valley to the next mountain top. However, as can be seen in the chart below, this is not happening currently, which is highly atypical during a cyclical earnings downturn.

Therefore, today's rock-bottom and still contracting multiples on weak earnings power are quite different from prior downcycles. That implies the market views the industry as being uneconomical forever.

Therein lies the opportunity

The last PGM mining industry down cycle resulted in marginal players exiting and the most economical operators consolidating to create one of the world's most consolidated industries. Moreover, the industry cost curve enables all players to have a portion of production in higher cost areas that can be curtailed until PGM prices recover. This gives the industry the means and motive to act to curtail production, which should raise PGM prices and lead to a strong recovery in earnings power.

We expect this to play out over the next few quarters as corporates make budget plans for capital expenditure and production while FCF tumbles. We also believe that expectations about Eskom and Transnet service disruptions may be too low. We suspect the private sector is increasingly investing in private generation as well as renewables, to limit the impact of Eskom outages. At the same time, multi-industry groups have made preliminary strides working with the government to solve the rail issues.

Bottom line: With multiples and sentiment at all-time low, we believe the next PGM up cycle may produce a very strong return for investors patient enough to endure weak prices.