KEY POINTS

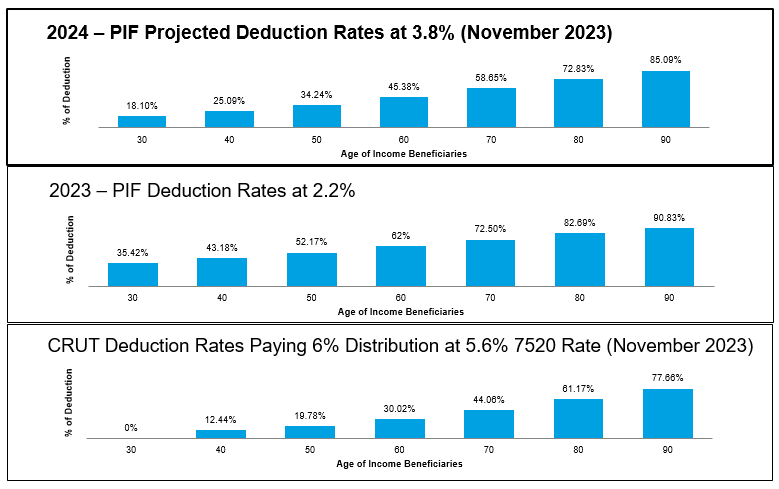

1. Pooled income funds (PIFs) established in 2023 use a 2.2% rate for deductions (lower rate equates to higher deduction).

2. Rates are expected to rise, and there's value in the deduction available by contributing to a PIF this year.

3. Potential benefits include avoiding capital gains, a lifetime income stream and a higher deduction.

Boston - A pooled income fund (PIF) may be a very favorable option for charitably inclined donors who are seeking a deduction and who want to receive tax-advantaged income stream for life, while carrying on a family legacy of giving.

As interest rates continue to rise, generally so will the associated rates that are used in part to calculate donors' charitable deductions for life income gifts. For young PIFs with less than three years of operating history, funds use the highest annual average Internal Revenue Code Section 75201 rate to calculate the deductions. PIFs established in 2023 use a 2.2% rate for deductions. This is more favorable than similar vehicles like Charitable Remainder Unitrusts (CRUTs) which use the Section 7520 rate for the current month or prior two months.

What is happening?

The IRS Section 7520 rate has averaged 4.80% so far in November. If this average holds through the end of 2023, the projected rate for PIFs in 2024 is forecasted to be 3.80%. PIFs are looking at the highest annual average Section 7520 rate from the prior three years, but these rates may change again. What we do know for certain is that the rates will be higher, and there is value in the deduction that is available by contributing to a PIF this year.

A PIF can be more beneficial than a CRUT

Like contributing to a CRUT, adding to a PIF allows gifts of appreciated assets without recognition of capital gains, so income can be distributed to the donor and their beneficiaries, and the remainder of the gift has the potential to grow. A PIF may offer several advantages over a CRUT, such as lower setup cost and a potentially higher income stream.

PIFs can accommodate younger and more beneficiaries to participate in the income stream, as opposed to the remainder value, which must equal at least 10% of the fair market value of the property added to the CRUT at the time of contribution.

Source: IRS Section 7520 Interest Rates. PIFs assumes a single income beneficiary, with an annualized distribution rate of 6.46% to 7.71% (as of 9/30/23). CRUTs assume a single income beneficiary, with an average distribution/payout rate of 6%. For CRUTs, we use the 7520 rate of the current month or the prior two months when establishing a CRT. The latest 7520 rate is 5.6% as of November 2023.

Bottom line: If the Section 7520 rate holds for the remainder of the year, the forecast of the projected rate for 2024 is 3.80%, resulting in a lower deduction moving forward. Nonetheless, we believe opportunity remains to capture higher charitable deductions in a young PIF.

1 Pursuant to Internal Revenue Code 7520, the interest rate for a particular month is the rate that is 120% of the applicable federal midterm rate (compounded annually) for the month in which the valuation date falls. That rate is then rounded to the nearest two-tenths of one percent.