The rapid pace at which markets and the macro environment are shifting can make it difficult for investors to determine where, when and how to allocate capital. We believe that being “long flexibility” is key to navigating these turbulent times."

The current tariff situation facing the financial markets is incredibly fluid, and there will certainly be winners and losers from a country and sector standpoint. However, we believe the end result will be that the effective U.S. tariff rate is likely to surpass even the most bearish expectations.

While today’s heightened uncertainty has shaken consumer and business confidence, the resulting volatility in risk markets has also created opportunities for active managers. Below are the views of the Eaton Vance Strategic Income team on the current macro environment and our portfolio positioning.

Economic headwinds and the expected impact on the Treasury yield curve

The uncertainty and volatility stemming from President Trump’s tariff policies have made it nearly impossible for U.S. businesses to operate with a high level of confidence, a sentiment clearly reflected in recent survey data. This weakening business confidence is likely to lead to decreased capital expenditures, a slower pace of hiring and an overall step down in economic growth. Meanwhile, consumer data has deteriorated, with rising credit card and auto loan delinquencies among lower-income consumers, while the sharp price drop in equities may cause upper-income households to tighten their purse strings.

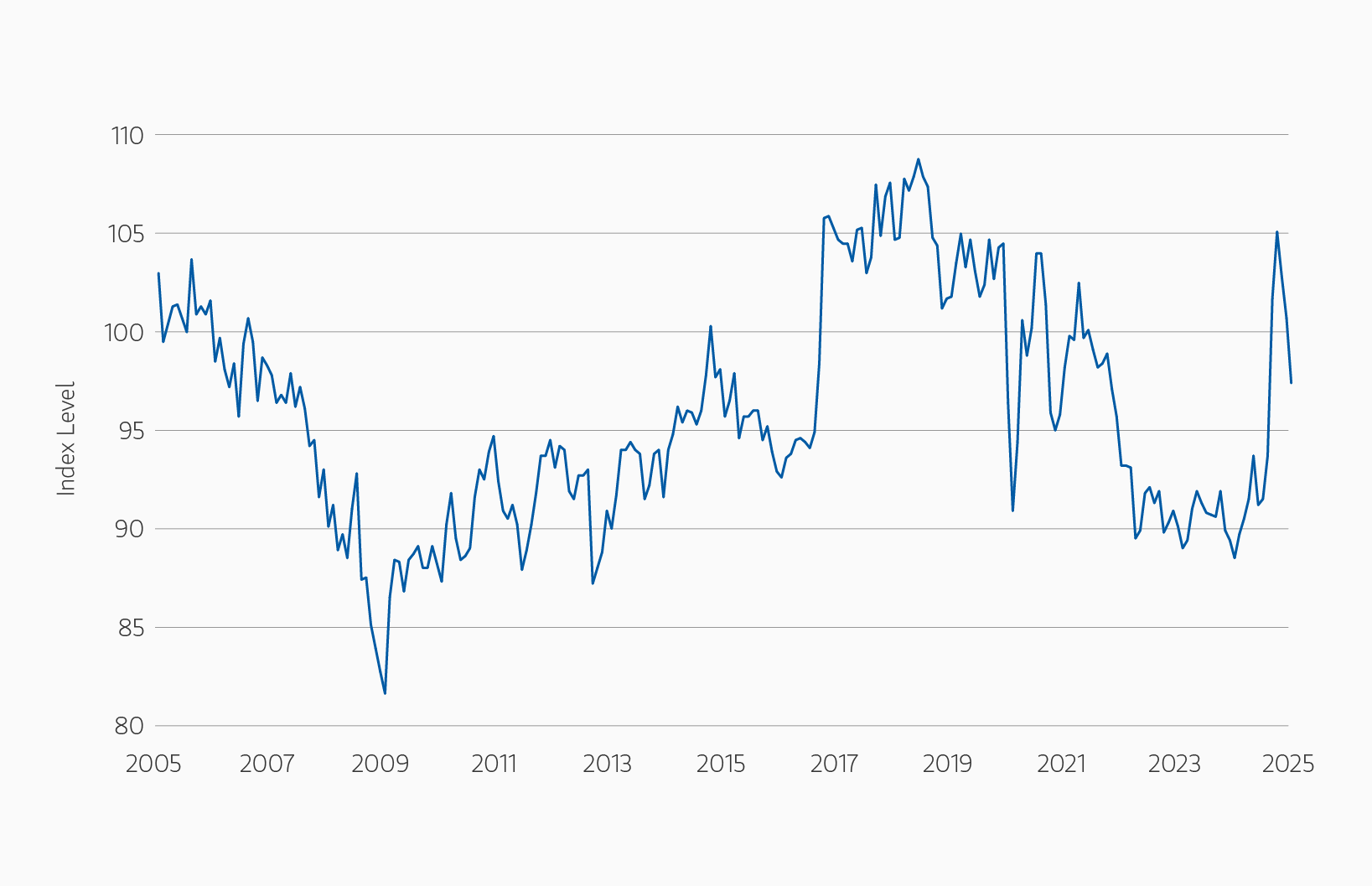

We expect these headwinds to spill into the labor market, prompting the Fed to cut rates sooner than previously anticipated. We also believe the long-term inflationary impact of President Trump’s tariff policies, and the sky-high level of policy uncertainty, will cause a rising term premium for longer-dated assets. This sets the stage for a steepening yield curve, where front-end interest rate exposure, which is more acutely influenced by Fed policy, appears more attractive relative to the long end.

Corporate credit outlook

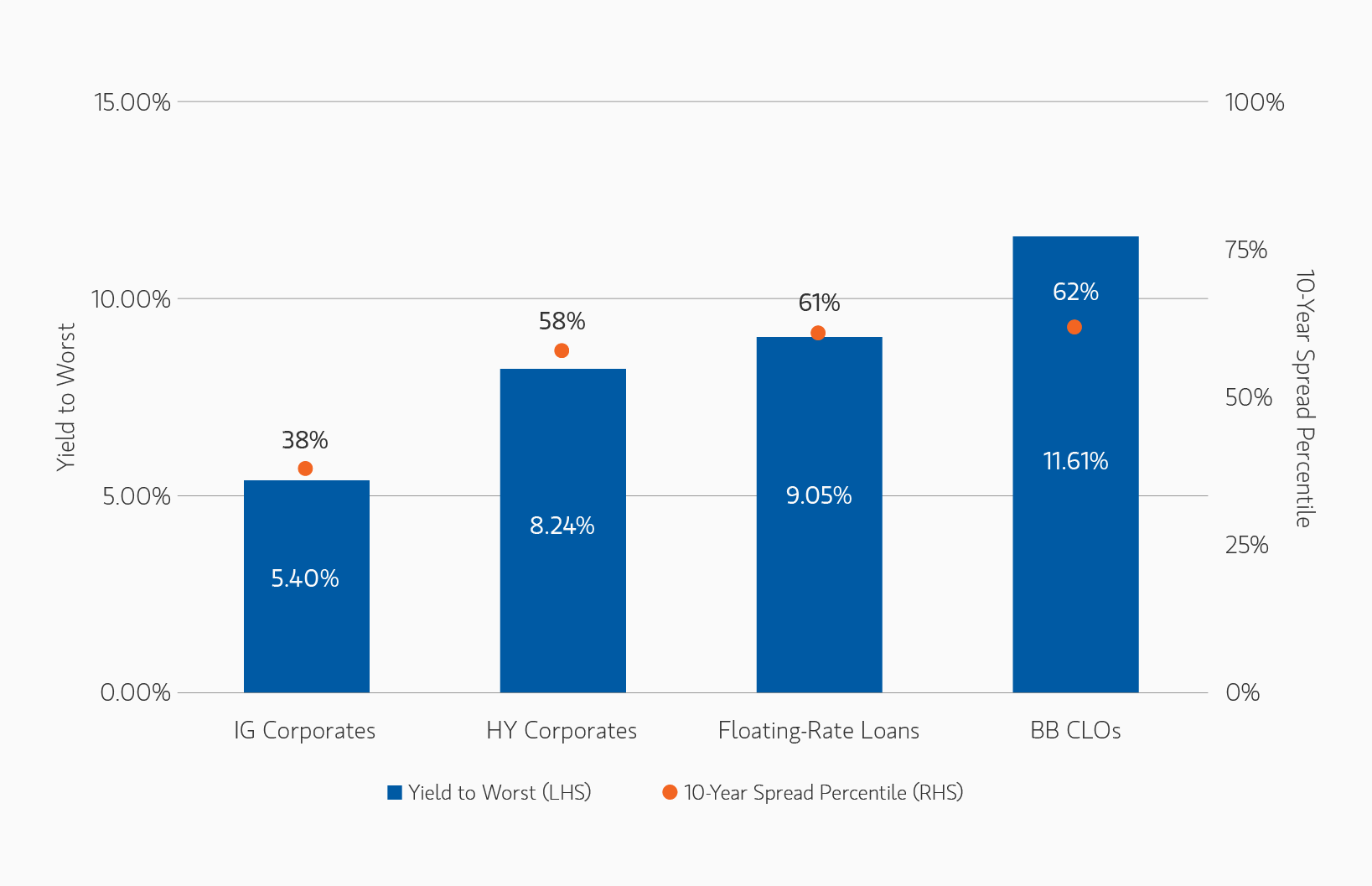

Corporate credit spreads entered 2025 at historically tight levels, and while valuations have improved since the April 2 “Liberation Day” announcement, we think selectivity will be extremely important.

At year-end 2024, investment-grade (IG) credit spreads were more than 40 basis points (bps) tighter than their 10-year average—placing them in the second richest percentile over that period. Calling them “tight” would be an understatement. Today, IG spreads are 10 bps tighter than long-term averages (as of 4/15/25), which remain uninspiring to us from a risk-return standpoint.

In leveraged credit, we’ve seen an even more pronounced move wider in spreads, making sectors like high yield, bank loans and collateralized loan obligations (CLOs) increasingly attractive. Although valuations have cheapened beyond where we would typically add to positions in a normal market environment, we think index spreads still don’t fully reflect increasing recession risks. We have selectively added exposure to high-quality, high-conviction names in high yield that have sold off, and we continue to favor bank loans and CLOs for their high current income and recovery potential from currently depressed price levels.

Mortgage-backed securities and securitized credit

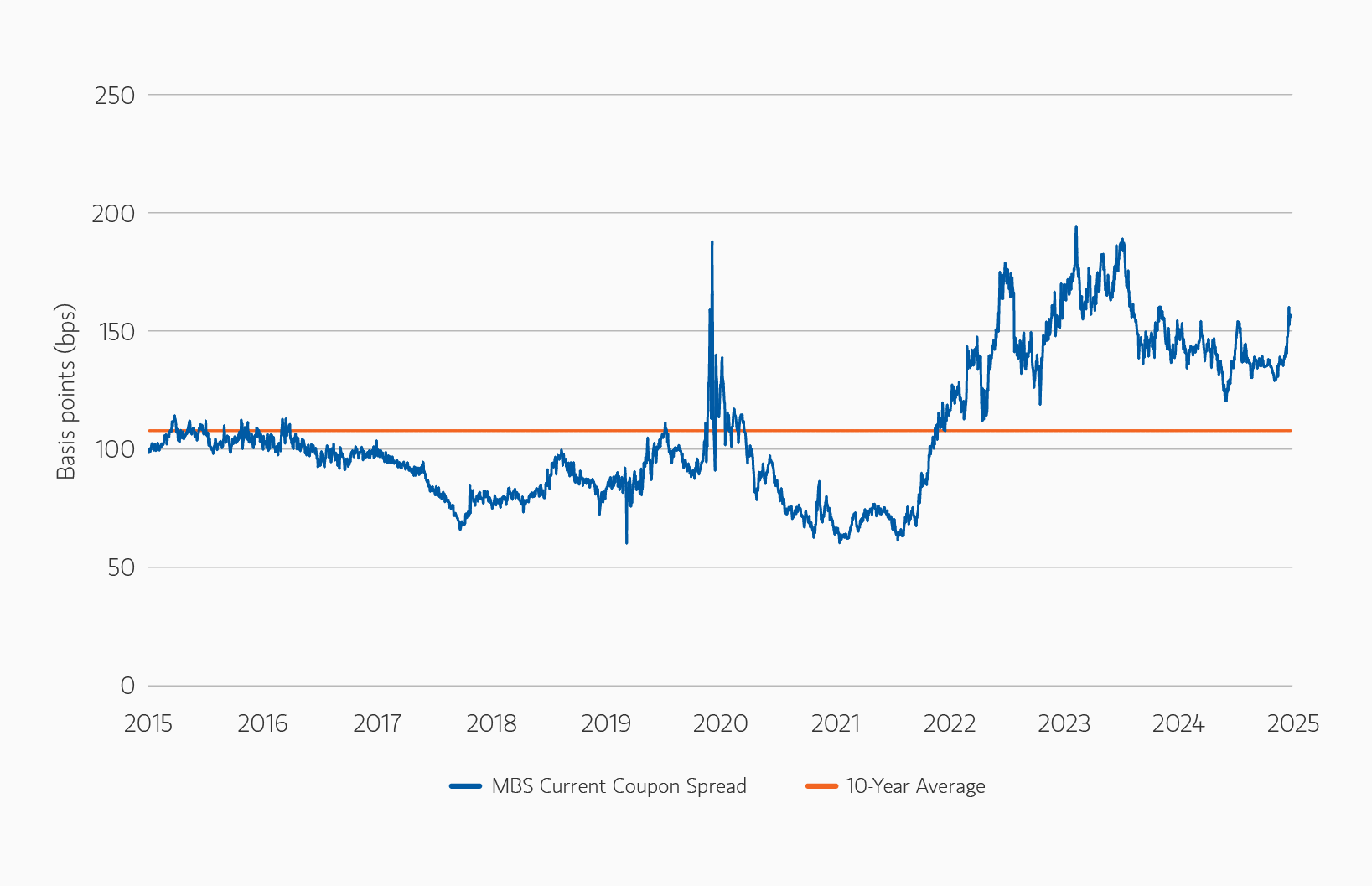

We continue to have a favorable view of agency mortgage-backed securities (MBS), especially in a period of heightened macro volatility, as the sector has historically been a flight-to-quality asset. Spreads in the sector briefly touched 160 bps over Treasuries in the recent market sell-off, nearing their widest levels since the COVID crisis. There remain a variety of potential catalysts to drive spreads tighter from here, including falling interest-rate volatility, a potentially more accommodative Federal Reserve (Fed) or increased levels of bank demand for MBS.

Residential credit, or non-agency MBS, remains one of our highest conviction credit sectors. The housing market is relatively strong, and a potential decline in mortgage rates could improve affordability, strengthening fundamentals in the sector. In commercial mortgage-backed securities (CMBS) and asset-backed securities, selectivity is key. CMBS, in particular, is among the sectors most levered to rates, so it may benefit more from lower interest rates than it would be harmed by wider spreads.

Emerging markets debt and foreign exchange (FX)

As was the case with tightening monetary policy, many emerging market (EM) central banks have been well ahead of their developed market counterparts in cutting rates, which has provided a tailwind to select EM bond markets. With that said, the market remains quite bifurcated, with higher-quality names trading at tight spreads while lower-quality names appear cheap. In our experience, this type of environment offers ample opportunities for active managers to add value.

With regards to foreign currencies, there is evidence that the uncertainty caused by President Trump’s policies is beginning to turn the tide against the U.S. dollar, especially when considering some of the fiscal stimulus efforts in Europe to beef up their defense expenditures. To be sure, reciprocal tariffs may end up hurting the U.S. dollar versus other G10 currencies, but emerging markets FX has often struggled in periods of heightened market volatility. As a result, we’ve maintained less exposure to emerging market local currency debt than in prior years.

Bottom line: The rapid pace at which markets and the macro environment are shifting can make it difficult for investors to determine where, when and how to allocate capital. We believe that being “long flexibility” is key to navigating these turbulent times.

Featured Insights