Now that the long-awaited Fed rate cut has arrived – to the tune of 25 bps – bond investors have the right to ask: So what? As managers of bank loans, here’s our answer: we see it as a good occasion to show why loans deserve consideration for a traditional bond portfolio, especially in this environment. Consider:

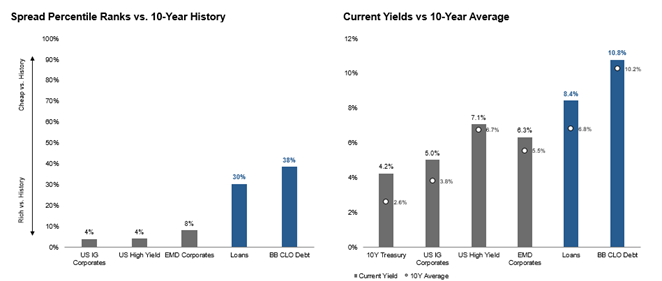

- Yields and spreads are attractive. The current yield on loans of 8.4% (as of Aug. 31, 2025) is 150 bps higher than its 10-year average, and 60 bps ahead of high-yield bonds, the nearest competition among major fixed income sectors (Display 1). While no bond sector is particularly cheap, loans stand out as significantly less expensive than other sectors, based on spreads relative to their 10-year averages. If and when loan rates eventually float down with short-term rates, keep in mind loan yields today start with a significant advantage.

- Loans are a potential hedge against rising rates and/or inflation. Remember that the Fed only controls the short end of the curve. So, hedging the possibility of rising rates at the long end – because of inflation and/or other factors – can be a wise move. Loans have zero duration, which means that they don’t lose value as long-term rates tick up, as long-term bonds do. To see the impact loans can have on a bond portfolio, consider an initial allocation of 100% bonds. Over the past 10 years ended June 30, 2025, it had a total return of 1.8%, with a standard deviation (volatility) of 5%. Had that portfolio been composed of 50% bonds and 50% loans, total return would have risen to 3.5%, with volatility dropping to 4.0%.1

- Lower rates can be a tailwind for loan issuers. Fed easing would further support consumption and consumer activity, which represents 70% of U.S. GDP. Loans have performed well during the early stages of easing prior to September’s cut, and they showcased their durability throughout the Fed’s nearly three-year tightening cycle. The economy has shown resilience this year, and earnings among leveraged issuers continue to grow, albeit at a slower pace. To the extent lower rates going forward support growth, the fundamentals and credit metrics of loan issuers should benefit. Issuers are also helping themselves through a reduction in speculative new issuances – that’s a positive from both fundamental and technical perspectives.

- Technical factors are also supportive of loans. In the past quarter, there has been a reduction in opportunistic refinancing, which reduces loan supply. While refinancing activity is expected to continue, M&A-related supply remains below expectations, constrained by macro uncertainty and tighter deal multiples. In a related trend, more aggressive transactions are increasingly finding homes in private credit markets. Moreover, the loan investor base remains predominantly stable and sticky, anchored by institutional investors such as insurance companies and pension funds that allocate to loans directly or through structured products.

- Macro uncertainty has abated, but still there. On the positive side, the “One Big Beautiful Bill Act” has stimulative measures, like the increased amount of debt leveraged issuers may deduct from taxes, and the tax cuts for businesses and consumers. Thus, we are likely to see larger 2025 tax refunds, and possibly more stimulus ahead of the 2026 mid-term elections. The macro picture has also benefited from a growing list of tariff deals and a de-escalation of tensions in the Middle East. As a result, equities are again near all-time highs, bond spreads remain tight, and the resilience in macro data has reinforced a return in confidence across risk assets, including leveraged finance.

Where do we see potential clouds? The August inflation numbers – a monthly rise of 0.4% and 2.9% over the past year – were both the most since January. At the same time, a weakening job market could confront the Fed with a stagflationary tug-of-war of economic indicators. Such a scenario could induce volatility, especially with the rich valuations in both equity and bond markets. Loans wouldn’t be immune, but have something of a price cushion, given that their valuations are cheaper than other bond sectors.

The importance of active loan management

This review underscores the reasons we believe that the loan market heads into the fourth quarter on solid footing. Of course, risks remain – as noted, loans are cheaper than other sectors, but we do not view them as cheap on an historical spread basis.

This underscores the importance of careful credit selection and active portfolio management for navigating the evolving landscape. Loan issuers span the broad spectrum of businesses and vary in their ability to adapt as the economy changes. Thus, the competing forces in today’s environment, -- between slowing growth and inflationary pressures -- make an active investment approach vital – one that has the flexibility to adjust positioning as credit and market conditions may warrant.

As always, we remain as focused on our portfolio companies; no matter the backdrop, we believe careful credit risk management is the best course to navigating this market, and this is the very centerpiece of our approach.

Featured Insights