Stablecoins have emerged as one of the fastest-growing segments in global finance, blending the stability of fiat currencies— primarily the U.S. dollar—with the efficiency and programmability of blockchain technology. These digital assets have scaled rapidly, acting as foundational scaffolding underpinning a new infrastructure for payments, settlement and value transfer across borders. As the U.S. and EU move toward regulatory clarity, stablecoins are poised to gain broad institutional acceptance, potentially reinforcing the dollar’s dominance.

Understanding Stablecoins

Stablecoins are digital tokens designed to maintain a stable value, typically pegged to an underlying fiat currency. By leveraging blockchain technology’s speed and accessibility, they enable cross-border payments almost instantaneously and at minimal costs, eliminating friction points and fees that plague traditional financial rails.

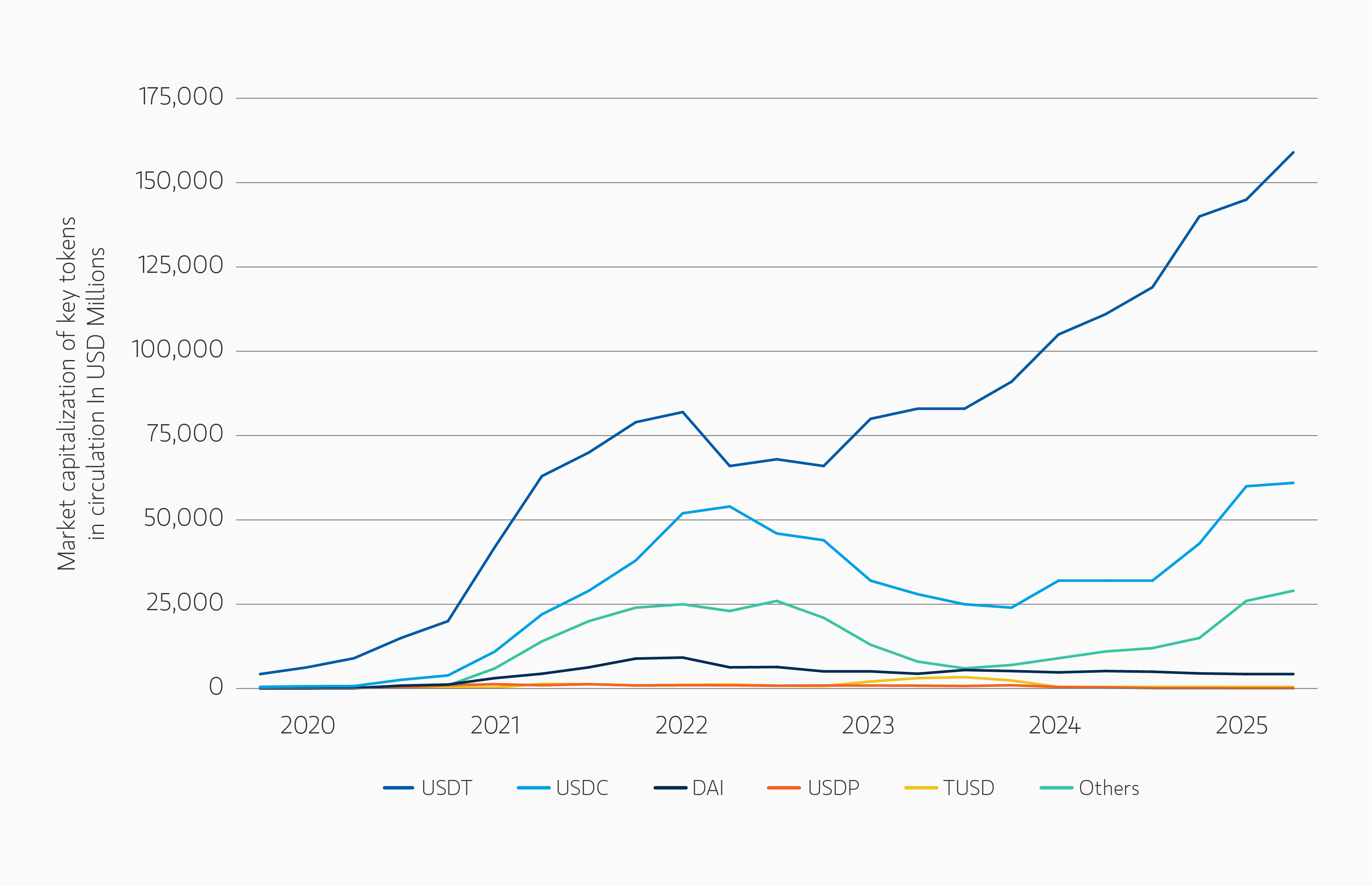

Stablecoin adoption is on the rise. In September 2025, the total stablecoin market capitalization1 reached $300 billion, a 75% increase from a year earlier. By some estimates, the market could exceed $2 trillion by 2028 driven by use cases far beyond crypto trading, from remittances and e-commerce to global B2B settlement. While stablecoins still represent a small slice of global payments ecosystem, their usage is expanding fast, especially in markets with volatile currencies or weak banking infrastructures.

Unlike volatile cryptocurrencies such as Bitcoin or Ethereum, stablecoins are engineered to pursue price stability. Fiat-backed stablecoins maintain a 1:1 exchange ratio with their underlying currency and are backed by reserves of cash, short-term U.S. Treasury bills (if pegged to USD) and other liquid instruments. This makes them uniquely suited for both real-time settlement and store-of-value use cases in high-inflation economies.

Multinational corporations, logistics companies and fintech firms are increasingly using stablecoins for 24/7 cross-border payments and treasury operations. In a sign of mainstream adoption, in early 2025, payments giant Stripe acquired stablecoin firm Bridge for $1.1 billion. Credit card companies, Visa and Mastercard have developed infrastructure to offer cards whose payments can be funded by stablecoins. A number of large banks have announced plans2 to issue their own coins, pending regulatory clarity.

Key Players

Tether, the issuer of USDT stablecoin, remains the dominant player, with over $155 billion in circulation, accounting for more than 60% of global stablecoin supply. In 2024, Tether reported $13.7 billion in net income with only 150 employees, translating to approximately $93 million per employee. Registered in El Salvador, Tether claims to hold the majority of its reserves in cash and U.S. Treasury bills, though it has faced criticism for opacity and lack of third- party audits. In 2021, the Commodity Futures Trading Commission (CFTC) fined Tether for misleading disclosures on its reserves.

The next dominant player, Circle, the issuer of USDC, offers a more transparent, U.S.-regulated alternative, with reserves that are primarily held in cash and short-term U.S. Treasurys. Circle’s recent IPO raised $1 billion and sparked market headlines about the future of cryptocurrencies and stablecoins when its valuation surpassed $40 billion a few days after its public offering.

Ethena’s USDe, launched in February 2024 has quickly grown to become the third-largest stablecoin, with a circulation exceeding $13 billion as of September 12, 2025. Backed by cryptocurrencies and futures, this crypto-native stablecoin uses “delta- neutral” strategies to help minimize volatility and achieve stability. Users deposit cryptocurrencies like Ethereum (ETH) or staked ETH (stETH) as collateral, while the protocol opens equivalent short positions in the derivatives market. The long and short positions help preserve a stable overall asset value, maintaining USDe’s peg to the dollar. Ethena also offers yield generation through staking, and funding rates of its derivatives positions. Notably, this innovative synthetic dollar operates independently of the traditional banking system.

PayPal’s PYUSD, Robinhood Markets’ USDG, and other fintech entrants are accelerating the shift toward regulated fiat-backed stablecoin models which would boost demand for the U.S. dollar. In parallel, EU policymakers are pushing for euro-denominated stablecoins to counterbalance the dollar’s dominance.

Meanwhile retail giants like Amazon and Walmart are exploring stablecoin technology to bypass costly credit and debit card networks and cut billions in interchange fees.3 Large banks are also eyeing stablecoins as programmable alternatives to deposits, marking a structural shift in how value moves across the global economy.

Uncharted Path

This evolution raises a question: Will stablecoins be dominated by a few players or flourish in a diversified world of issuers with easy interoperability? As regulatory clarity improves, we expect a broader array of institutions to issue their own digital currencies as banks integrate stablecoin technology into their offerings.

This shift has sparked concern around potential disruption to credit card networks. Credit card stocks have been impacted this year on fears of stablecoin disruption, but we believe this may be overstated. While more efficient rails, such as blockchain, may help operational efficiency, companies like Visa and Mastercard are also prepared to invest heavily in the technology needed for seamless digital payments at retailers and point of sale infrastructure.

Still, disruption looms, particularly in regions with low credit card penetration, where stablecoins offer a leapfrog solution. Credit card penetration varies drastically across regions.

■ UNITED STATES: Roughly 82% of adults hold at least one credit card. Stablecoin use may complement rather than cannibalize card rails.

■ EUROPE: Credit card penetration averages around 38% with wide variance by country.

■ ASIA: Lagging behind, with only 18% of population owning a credit card. Mobile-first economies like India, Indonesia and Philippines are ripe for stablecoin-based payment rails.

Regulatory measures

On July 18, 2025, President Trump signed the Guiding and Establishing National Innovation in U.S. Stablecoins, better known as the GENIUS Act, establishing a regulatory framework and oversight for payment stablecoins. The Act requires tokens to be backed by liquid assets such as U.S. dollars or Treasurys, and for issuers to disclose publicly the composition of their reserves on a monthly basis.

Stablecoins and Treasury Market

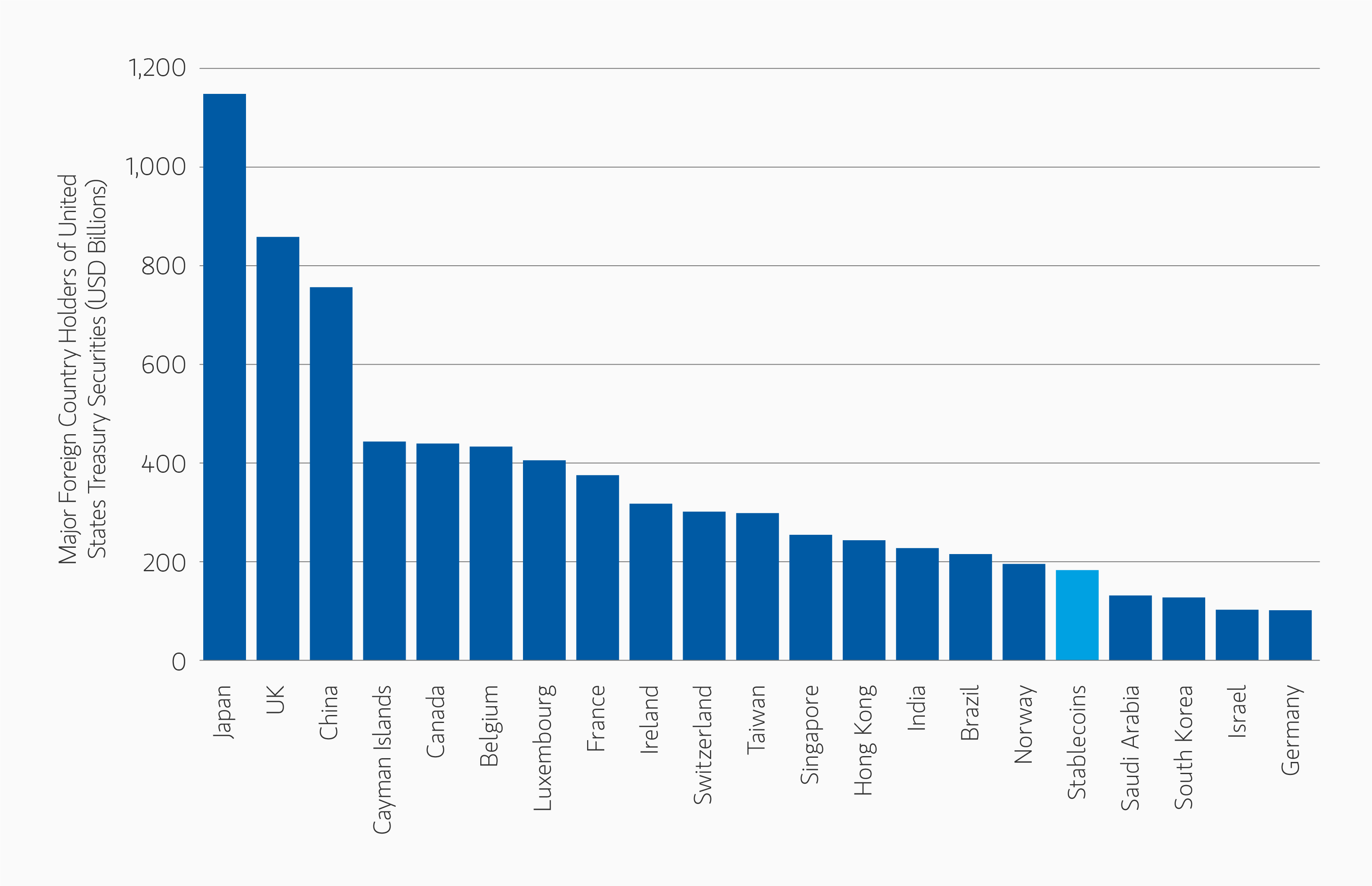

Because stablecoins are predominantly pegged to USD, they have bolstered the dollar’s dominance, overcoming the gap left by the decline in foreign ownership of U.S. debt. While foreign ownership has fallen to 25% from 34% over the past decade, with big holders like China and Japan, reducing their exposure, stablecoins issuers have risen to become the 17th-largest holder of U.S. debt4— trailing Norway but surpassing Saudi Arabia and South Korea.

The reserve requirements outlined in the GENIUS Act will provide an additional and growing source of demand for Treasurys. The legislation requires stablecoin issuers to hold short term T-bills, driving a concentration of Treasury holdings to the front-end. This is intentional as President Trump has framed U.S. stablecoin policy as a strategic measure to maintain the global dominance of the dollar.

Today, dollar-backed issuers of stablecoins are important buyers of U.S. Treasurys. In 2024, Tether ranked as the seventh-largest buyer of Treasurys globally, trailing behind countries like the U.K. and Singapore, while China and Japan were the largest sellers. Projections suggest that by 2030, stablecoin issuers could hold as much as $1.2 trillion in U.S. Treasurys, potentially surpassing all major foreign sovereign holders.

Because most stablecoins are U.S. dollar denominated, people immediately think about use cases in the United States. I think most people who study this and are active in this really understand that the product market fit is outside the U.S.” – Visa CEO Ryan McInerney

Stablecoins in EM

In emerging economies, stablecoins are often considered a store of value, protecting against local currency depreciation, inflation and inadequate banking infrastructure. Stablecoins allow individuals and businesses in non-U.S. dollar economies to effectively hold a digital U.S. dollar account at a relatively low-cost. It’s often cheaper and faster to move money cross borders via stablecoins than through local banks.

According to blockchain firm Chainalysis’s 2024 Geography of Crypto Report,5 India, Nigeria and Indonesia are among the world’s most active users of stablecoins, driven by grassroots demand for cross-border payments and remittances.

In 2024, Turkey alone processed over $63 billion in cross-border stablecoin payments. Argentina and Nigeria also saw sharp rises in usage, demonstrating how quickly stablecoins are filling the gap where traditional finance has fallen short.

Remittances, a lifeline for many in emerging markets, are especially ripe for disruption. Traditional cross-border payments are slow, expensive and opaque, often taking 3-7 days to clear with fees averaging 6.62%. Stablecoins streamline this process, and significantly reduce transaction fees while increasing transparency.

However, the benefits come with a warning: Dollar-based stablecoins could accelerate capital flight and undermine local currencies. During periods of financial distress, stablecoins offer an off-ramp, draining domestic liquidity and weakening central bank control.

In response, emerging market governments have taken a tougher stance, viewing stablecoins as a threat to monetary sovereignty. Nigeria, for example, has cracked down on cryptocurrency traders, blaming stablecoin users for accelerating the naira’s devaluation.

CBDCs

A number of developed and emerging economies are betting on central bank digital currencies (CBDC), which are state-backed digital currency that incorporate some benefits of cryptocurrency rails. CBDCs allow countries to address potential risks associated with dollarization of their economies by combining the security of fiat with the programmability of digital money.

However, CBDC rollout has been slow. While stablecoins have grown rapidly, driven by market forces, CBDCs have remained largely pilot projects. Future implementation remains uncertain amid opposition by the U.S. Treasury.

Impact on Corporations

The impact of digital finance on corporations is fast becoming a focal point at treasury management conferences. Corporations are closely monitoring the developments of stablecoins and tokenized deposits by their major banking partners. While the potential for fast, frictionless and cheap payments is enticing, many corporations perceive limited immediate changes to their treasury operating models. However, with the passage of the GENIUS Act and the potential for widespread adoption of stablecoins and tokenized liquidity products by large banks and traditional financial services companies, the timeframe for corporate adoption could accelerate more quickly than expected.

Money Market Fund Tokenization

Another area of focus in the evolving landscape of digital finance is the tokenization of money market funds (MMFs). The industry’s current objective is to digitally represent units of existing funds on a permissioned blockchain. This innovation primarily enables the posting or pledging of tokenized MMF units as collateral. By reducing the need for investors to redeem shares to post cash as margin or collateral, tokenized MMFs can help reduce volatility within both the funds themselves and the broader financial system. As the digital asset ecosystem continues to develop alongside the growth of stablecoins, tokenized MMFs are poised to adapt further, potentially creating the possibility for seamless transferability and associated opportunities.

We anticipate the continued evolution of collateral tokenization supported by stablecoins. Analysts at Boston Consulting Group have estimated that the tokenized asset market could reach $16 trillion by 2030, driven by interest from investors, institutions, and governments.

Risks to Consider

Bank regulators will need to establish regulations related to stablecoins, including around capital requirements and reserve composition for issuers. One concern is whether stablecoin issuers will compete with banks by luring away customer deposits. A U.S. Treasury report in April estimated that stablecoin adoption could trigger as much as $6.6 trillion in deposit outflows, reshaping the funding base of the banking sector. A broader shift by consumers away from holding money in traditional bank deposits could have far-reaching economic implications for credit creation and financial stability.

Conclusion

We believe that the future is “onchain”, driven by the extensive adoption of blockchain technology across various sectors of society, moving data, assets, and economic activity onto a shared, transparent, and decentralized ledger replacing traditional, siloed systems. Stablecoins are an important building block of a new financial operating system. By being pegged to the dollar and integrated into programmable infrastructures, stablecoins offer real- time settlement and low transaction costs. This foundation can drive the creation of new digital native investment products, boost tokenization across asset classes, and unlock both greater liquidity in private assets while expanding access to public markets.

Originally created for cryptocurrency traders, stablecoins have gained greater acceptance supported by a shift toward clearer regulation. We believe stablecoin adoption will advance as institutional involvement grows, and user experience becomes safer and more accessible.

We expect demand for Treasurys to increase because of legislative efforts and formalized reserve mandates.

Stablecoins open up access for underbanked markets, reduce the cost of cross-border remittances and can provide protection from currency devaluation. As the boundaries between digital assets and traditional finance continue to blur, we believe stablecoins will also provide the next generation solution that is needed for a more integrated global financial system.

Featured Insights

Risk Considerations

Digital assets, sometimes known as cryptocurrency, are a digital representation of a value that function as a medium of exchange, a unit of account, or a store of value, but generally do not have legal tender status. Digital assets have no intrinsic value and there is no investment underlying digital assets. The value of digital assets is derived by market forces of supply and demand, and is therefore more volatile than traditional currencies’ value. Investing in digital assets is risky, and transacting in digital assets carries various risks, including but not limited to fraud, theft, market volatility, market manipulation, and cybersecurity failures—such as the risk of hacking, theft, programming bugs, and accidental loss. Additionally, there is no guarantee that any entity that currently accepts digital assets as payment will do so in the future. The volatility and unpredictability of the price of digital assets may lead to significant and immediate losses. It may not be possible to liquidate a digital assets position in a timely manner at a reasonable price.

Regulation of digital assets continues to develop globally and, as such, federal, state, or foreign governments may restrict the use and exchange of any or all digital assets, further contributing to their volatility. Digital assets stored online are not insured and do not have the same protections or safeguards of bank deposits in the US or other jurisdictions. Digital assets can be exchanged for US dollars or other currencies, but are not generally backed nor supported by any government or central bank.

IMPORTANT INFORMATION

The views and opinions and/or analysis expressed are those of the author or the investment team as of the date of preparation of this material and are subject to change at any time without notice due to market or economic conditions and may not necessarily come to pass. Furthermore, the views will not be updated or otherwise revised to reflect information that subsequently becomes available or circumstances existing, or changes occurring, after the date of publication. The views expressed do not reflect the opinions of all investment personnel at Morgan Stanley Investment Management (MSIM) and its subsidiaries and affiliates (collectively “the Firm”), and may not be reflected in all the strategies and products that the Firm offers.

Forecasts and/or estimates provided herein are subject to change and may not actually come to pass. Information regarding expected market returns and market outlooks is based on the research, analysis and opinions of the authors or the investment team. These conclusions are speculative in nature, may not come to pass and are not intended to predict the future performance of any specific strategy or product the Firm offers. Future results may differ significantly depending on factors such as changes in securities or financial markets or general economic conditions.

This material has been prepared on the basis of publicly available information, internally developed data and other third-party sources believed to be reliable. However, no assurances are provided regarding the reliability of such information and the Firm has not sought to independently verify information taken from public and third-party sources.

This material is a general communication, which is not impartial and all information provided has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy. The information herein has not been based on a consideration of any individual investor circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal or regulatory advice. To that end, investors should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.

Charts and graphs provided herein are for illustrative purposes only. Past performance is no guarantee of future results.

The Firm has not authorised financial intermediaries to use and to distribute this material, unless such use and distribution is made in accordance with applicable law and regulation. Additionally, financial intermediaries are required to satisfy themselves that the information in this material is appropriate for any person to whom they provide this material in view of that person’s circumstances and purpose. The Firm

shall not be liable for, and accepts no liability for, the use or misuse of this material by any such financial intermediary.

This material may be translated into other languages. Where such a translation is made this English version remains definitive. If there are any discrepancies between the English version and any version of this material in another language, the English version shall prevail.

The whole or any part of this material may not be directly or indirectly reproduced, copied, modified, used to create a derivative work, performed, displayed, published, posted, licensed, framed, distributed or transmitted or any of its contents disclosed to third parties without the Firm’s express written consent. This material may not be linked to unless such hyperlink is for personal and non-commercial use. All information contained herein is proprietary and is protected under copyright and other applicable law.

Morgan Stanley Investment Management is the asset management division of Morgan Stanley.

DISTRIBUTION

This material is only intended for and will only be distributed to persons resident in jurisdictions where such distribution or availability would not be contrary to local laws or regulations.

MSIM, the asset management division of Morgan Stanley (NYSE: MS), and its affiliates have arrangements in place to market each other’s products and services. Each MSIM affiliate is regulated as appropriate in the jurisdiction it operates. MSIM’s affiliates are: Eaton Vance Management (International) Limited, Eaton Vance Advisers International Ltd, Calvert Research and Management, Eaton Vance Management, Parametric Portfolio Associates LLC, and Atlanta Capital Management LLC.

This material has been issued by any one or more of the following entities:

EMEA

This material is for Professional Clients/Accredited Investors only.

In the EU, MSIM and Eaton Vance materials are issued by MSIM Fund Management (Ireland) Limited (“FMIL”). FMIL is regulated by the Central Bank of Ireland and is incorporated in Ireland as a private company limited by shares with company registration number 616661 and has its registered address at 24-26 City Quay, Dublin 2, DO2 NY19, Ireland.

Outside the EU, MSIM materials are issued by Morgan Stanley Investment Management Limited (MSIM Ltd) is authorised and regulated by the Financial Conduct Authority. Registered in England. Registered No. 1981121. Registered Office: 25 Cabot Square, Canary Wharf, London E14 4QA.

In Switzerland, MSIM materials are issued by Morgan Stanley & Co. International plc, London (Zurich Branch) Authorised and regulated by the Eidgenössische Finanzmarktaufsicht (“FINMA”). Registered Office: Beethovenstrasse 33, 8002 Zurich, Switzerland.

Outside the US and EU, Eaton Vance materials are issued by Eaton Vance Management (International) Limited (“EVMI”) 125 Old Broad Street, London, EC2N 1AR, UK, which is authorised and regulated in the United Kingdom by the Financial Conduct Authority.

Italy: MSIM FMIL (Milan Branch), (Sede Secondaria di Milano) Palazzo Serbelloni Corso Venezia, 16 20121 Milano, Italy. The Netherlands: MSIM FMIL (Amsterdam Branch), Rembrandt Tower, 11th Floor Amstelplein 1 1096HA, Netherlands. France: MSIM FMIL (Paris Branch), 61 rue de Monceau 75008 Paris, France. Spain: MSIM FMIL (Madrid Branch), Calle Serrano 55, 28006, Madrid, Spain. Germany: MSIM FMIL Frankfurt Branch, Große Gallusstraße 18, 60312 Frankfurt am Main, Germany (Gattung: Zweigniederlassung (FDI) gem. § 53b KWG). Denmark: MSIM FMIL (Copenhagen Branch), Gorrissen Federspiel, Axel Towers, Axeltorv2, 1609 Copenhagen V, Denmark.

MIDDLE EAST

Dubai: MSIM Ltd (Representative Office, Unit Precinct 3-7th Floor-Unit 701 and 702, Level 7, Gate Precinct Building 3, Dubai International Financial Centre, Dubai, 506501, United Arab Emirates. Telephone: +97 (0)14 709 7158).

This document is distributed in the Dubai International Financial Centre by Morgan Stanley Investment Management Limited (Representative Office), an entity regulated by the Dubai Financial Services Authority (“DFSA”). It is intended for use by professional clients and market counterparties only. This document is not intended for distribution to retail clients, and retail clients should not act upon the information contained in this document.

U.S.

NOT FDIC INSURED. OFFER NO BANK GUARANTEE. MAY LOSE VALUE. NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY. NOT A DEPOSIT.

ASIA PACIFIC

Hong Kong: This material is disseminated by Morgan Stanley Asia Limited for use in Hong Kong and shall only be made available to “professional investors” as defined under the Securities and Futures Ordinance of Hong Kong (Cap 571). The contents of this material have not been reviewed nor approved by any regulatory authority including the Securities and Futures Commission in Hong Kong. Accordingly, save where an exemption is available under the relevant law, this material shall not be issued, circulated, distributed, directed at, or made available to, the public in Hong Kong. Singapore: This material is disseminated by Morgan Stanley Investment Management Company and may not be circulated or distributed, whether directly or indirectly, to persons in Singapore other than to (i) an accredited investor (ii) an expert investor or (iii) an institutional investor as defined in Section 4A of the Securities and Futures Act, Chapter 289 of Singapore (“SFA”); or (iv) otherwise pursuant to, and in accordance with the conditions of, any other applicable provision of the SFA. This publication has not been reviewed by the Monetary Authority of Singapore. Australia: This material is provided by Morgan Stanley Investment Management (Australia) Pty Ltd ABN 22122040037, AFSL No. 314182 and its affiliates and does not constitute an offer of interests. Morgan Stanley Investment Management (Australia) Pty Limited arranges for MSIM affiliates to provide financial services to Australian wholesale clients. Interests will only be offered in circumstances under which no disclosure is required under the Corporations Act 2001 (Cth) (the “Corporations Act”). Any offer of interests will not purport to be an offer of interests in circumstances under which disclosure is required under the Corporations Act and will only be made to persons who qualify as a “wholesale client” (as defined in the Corporations Act). This material will not be lodged with the Australian Securities and Investments Commission.

JAPAN

This material may not be circulated or distributed, whether directly or indirectly, to persons in Japan other than to (i) a professional investor as defined in Article 2 of the Financial Instruments and Exchange Act (“FIEA”) or (ii) otherwise pursuant to, and in accordance with the conditions of, any other allocable provision of the FIEA. This material is disseminated in Japan by Morgan Stanley Investment Management (Japan) Co., Ltd., Registered No. 410 (Director of Kanto Local Finance Bureau (Financial Instruments Firms)), Membership: the Japan Securities Dealers Association, The Investment Trusts Association, Japan, the Japan Investment Advisers Association and the Type II Financial Instruments Firms Association.