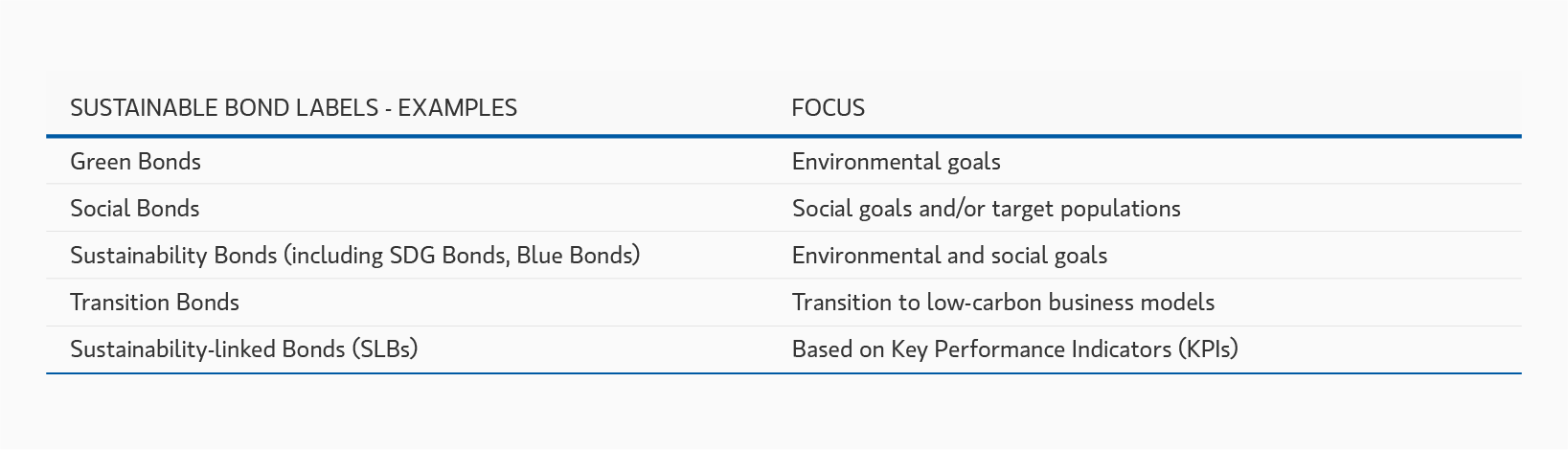

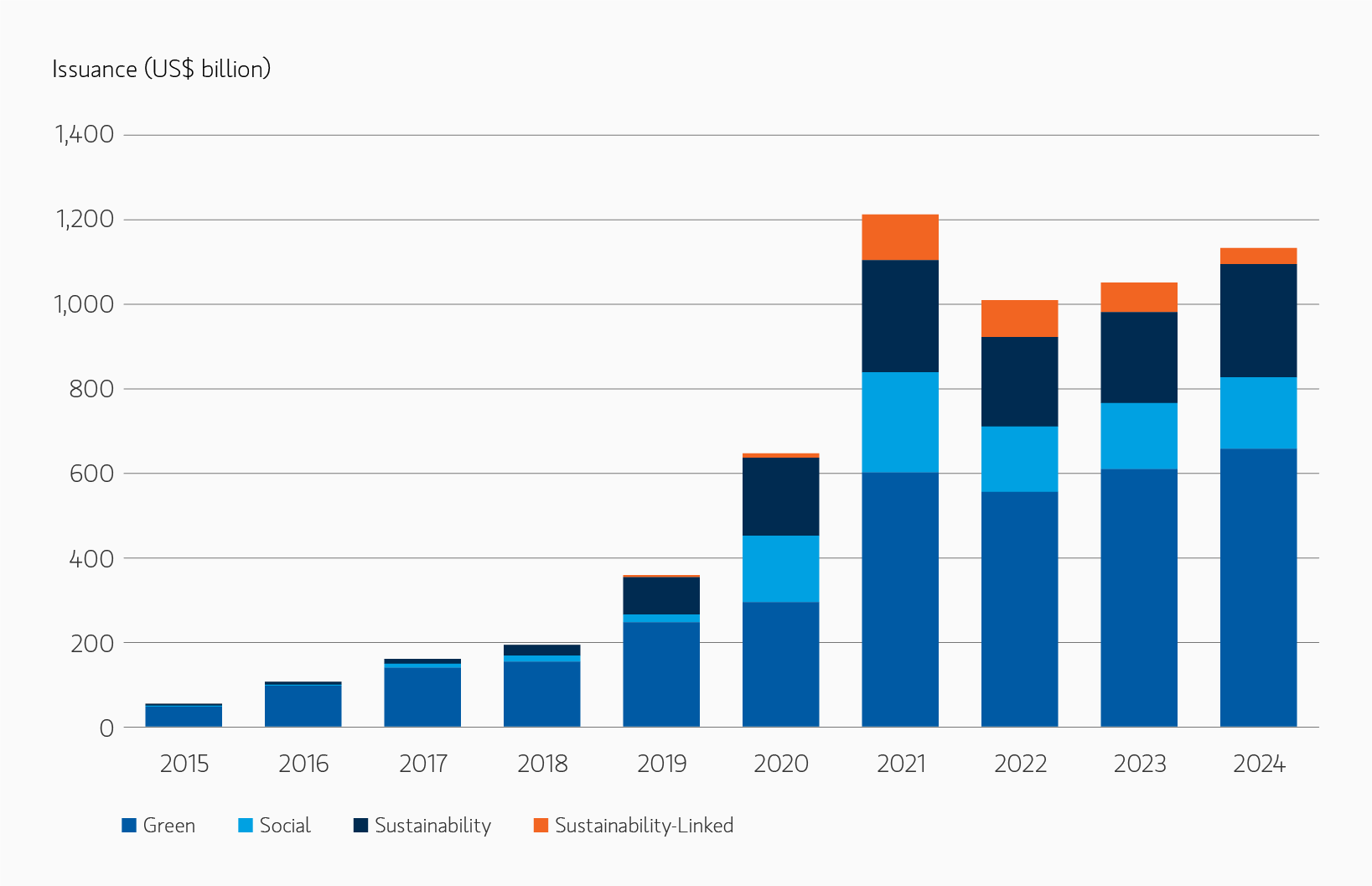

Thanks to a consistent $1+ trillion in issuance per year since 2021, the market for Green and other Sustainable-labelled Bonds (or "Sustainable Bonds" – see table below) has reached almost US$5 trillion1 in outstanding value globally. As a result, sustainable investors can tap into a large universe, with improved liquidity and lowered pricing trade-offs versus vanilla bonds compared to the early days of these labels.2

As sustainable finance standards and regulation evolve, the bar is raising for issuers to also adapt their frameworks and to provide increased transparency on the underlying features of the projects financed and their impact. At Calvert, we see growing opportunities associated with this market and the merits of conducting in-depth research on each transaction to determine the legitimacy of green and social claims and discusses whether these instruments can contribute to an issuer’s decarbonisation and other sustainability objectives.

Sustainable Bonds are an Important Instrument to Finance the Low-Carbon Transition

- TRANSPARENCY OF USE OF PROCESS: Sustainable Bonds allow issuers to signal environmental and/or social objectives, with robust allocation and impact reporting on the use of proceeds helping to evaluate financed projects and outcomes. Even Sustainability-Linked Bonds, which are tied to specific targets, often provide supporting information on issuers’ actions plans and planned investments to achieve those targets.

- LIMITED TRADE-OFFS: Increasing volume of green bond issuance and frequent issuers has improved liquidity, with evidence suggesting that “greeniums” (i.e. the additional new issue premium associated with a bond’s label) are reducing. Furthermore, since green bonds are often held by institutional investors with long-term ‘buy and hold’ investment strategies, there is often less volatility associated.

- DIVERSIFICATION BY SECTOR AND REGION: Variety in issuer type from different geographies and sectors provides diversification options for investors. For example, about half of sovereign issuers in the Bloomberg Global Aggregate Index3 are now also issuing in labelled Sustainable Bond format.

Cutting Through the Noise of Labels With Proprietary Sustainable Bond Evaluations and Research

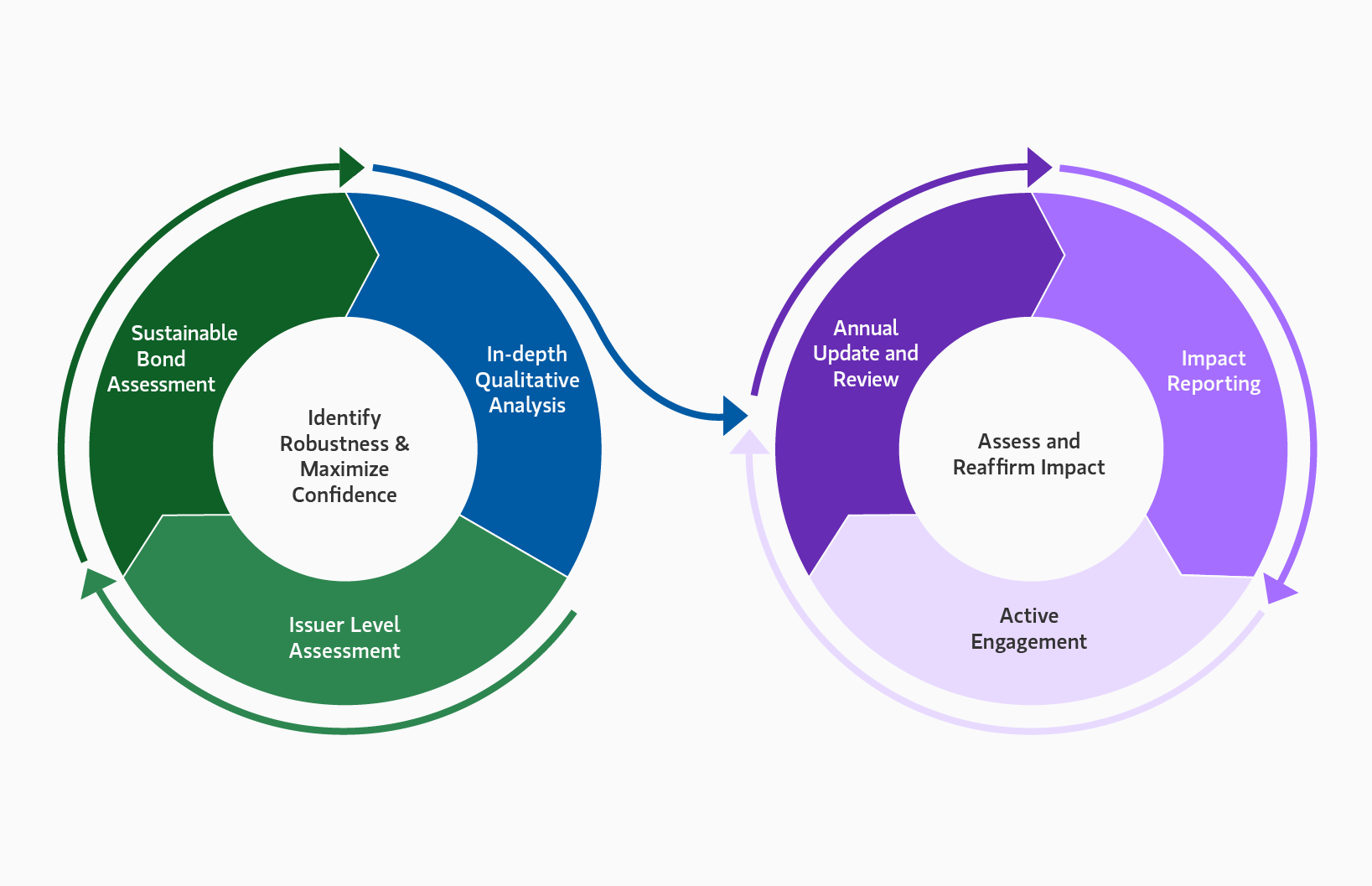

The rapid growth and development of the Sustainable Bond market, and the large quantity of unique information available to investors in these instruments, makes it a priority for investors to conduct an in-depth assessment of each transaction. This process helps ensure these securities live by the issuer’s claims, abide by market standards, and, if intended to be purchased for a Sustainable Bond portfolio, align with the product’s objectives.

At Calvert, we believe that undertaking a rigorous process to evaluate the sustainability characteristics of these investments not only maintains the quality of bonds held in our portfolios but also shows our commitment to supporting positive environmental and social outcomes alongside financial returns.

As issuers expand their green financing programmes to a larger portion of their capital structures, including more complex instruments, our structured diligence process helps ensure that even in the case of transactions that involve a significant degree of refinancing and proceeds allocation to existing projects, we are able to appraise the potential additional benefits but also any risks, such as green asset double-counting, associated with those structures. This is the case, for example, of green hybrid bonds, which are growing amongst European utility companies.

Second Party Opinions (SPOs) and other verifications by external providers play an important role in providing Sustainable Bond investors with a more standardised set of information while increasing the transparency surrounding labelled sustainable bond issuance frameworks and transactions. However, we believe that the true value of this granular information lies in its interaction with our proprietary Calvert ESG research platform. The investment team’s own view on the materiality of a labelled bond transaction in the context of an issuer’s sustainability strategy and its performance on related topics allows for a nuanced assessment of the credibility of these investments, supplementing the underlying fundamental credit analysis.

Calvert has developed a comprehensive Sustainable Bond Evaluation Framework (Display 2) to drive a structured, systematic assessment of our investments in Sustainable Bonds, both at issuance and throughout the life of the bond. Our Sustainable Bond Evaluation Framework is aimed at:

- Determining whether a labelled transaction is aligned with, and can materially contribute to, the issuer’s overall sustainability objectives;

- Assessing the extent to which the use of proceeds or targets associated with the bond can help catalyse additional financing towards innovative, low-carbon or other environmental solutions, and identify any risks of lock-in of high-carbon, polluting technologies; and

- Verifying the transaction’s alignment with applicable market standards, including the International Capital Market Association’s (ICMA) Green and Social Bond Principles and additional guidance, international taxonomies such as the one developed by the EU, and the Climate Bonds Standard, and benchmarking it against leading practices within the applicable peer group and jurisdiction.

These evaluations enhance the information available to portfolio managers and credit research analysts, furthering their understanding of how effectively issuers are managing material ESG issues and leveraging opportunities stemming from the low-carbon transition, and they are an integral component of the investment decision process for these instruments. Calvert’s Green Bond strategies only invest in labelled bonds that have been assessed positively through this framework.

We rely on our deep experience in the market to uphold standards for the additionality of selected projects or targets to be financed. In particular, the Sustainable Bond market offers a unique opportunity for fixed income investors to engage with issuers, at a time when issuers and their management are particularly sensitive to investor feedback on sustainability. Applying a robust research process provides us with an effective platform to push for improvements in the structure of these instruments as well as surrounding disclosure. We do this through bilateral engagement with issuers during their preparation of new transactions, especially for inaugural Sustainable Bond issuances, but also by communicating with structuring advisors and contributing to multistakeholder platforms.

With over 10 years of experience in managing Calvert Green Bond strategies, we believe we have a duty to contribute our viewpoints and encourage issuers and underwriters to strive to implement best practices to achieve meaningful positive sustainability outcomes through the issuance of robust sustainable bonds. Hence, Calvert actively engages with Sustainable Bond market players, and participates in industry initiatives, to promote robust sustainable financing frameworks that help effectively catalyse capital towards environmentally and socially impactful projects, transparent disclosures, and reporting.

DISPLAY 2 (CONT.)

Key elements of our Sustainable Bond Evaluation Framework:

- MATERIALITY ASSESSMENT: Analysing the fit between the labelled bond and the issuer’s business model and sustainability strategy, as well as the likelihood that the issuer will continue to generate eligible projects throughout the life of the bond, leveraging Calvert’s deep ESG research expertise and the application of the Calvert Principles for Responsible Investment.

- USE OF PROCEEDS/TARGETS DEEP-DIVE: Identifying the additionality of selected projects and indicators specific to the security being issued; ensuring that projects and business activities receiving financing align with Calvert’s view on what represents a credible effort to address environmental and social challenges; engaging issuers and underwriters to transparently disclose expected use of proceeds allocation and performance trajectories ahead of issuance.

- DYNAMIC WEIGHTING OF EVALUATION FACTORS: Depending on whether a Sustainable Bond is assessed at or after issuance, the relative importance of different factors will vary. During the ex-ante period—up to one year from the bond issuance date, when allocation and impact reporting becomes due—investors need to rely more heavily on information pertaining to the issuer’s commitments, included in their Bond Framework, presentations, prospectus, and other third-party reviews. During the ex-post period, we expect issuers to publish information on the actual allocations of their green proceeds, or progress on their sustainability-linked targets, as well as on the impact achieved through the deployment of the allocated sustainable funds. Hence, the quality of reporting and the magnitude of reported impact will bear greater weight in our periodic review of the bond.

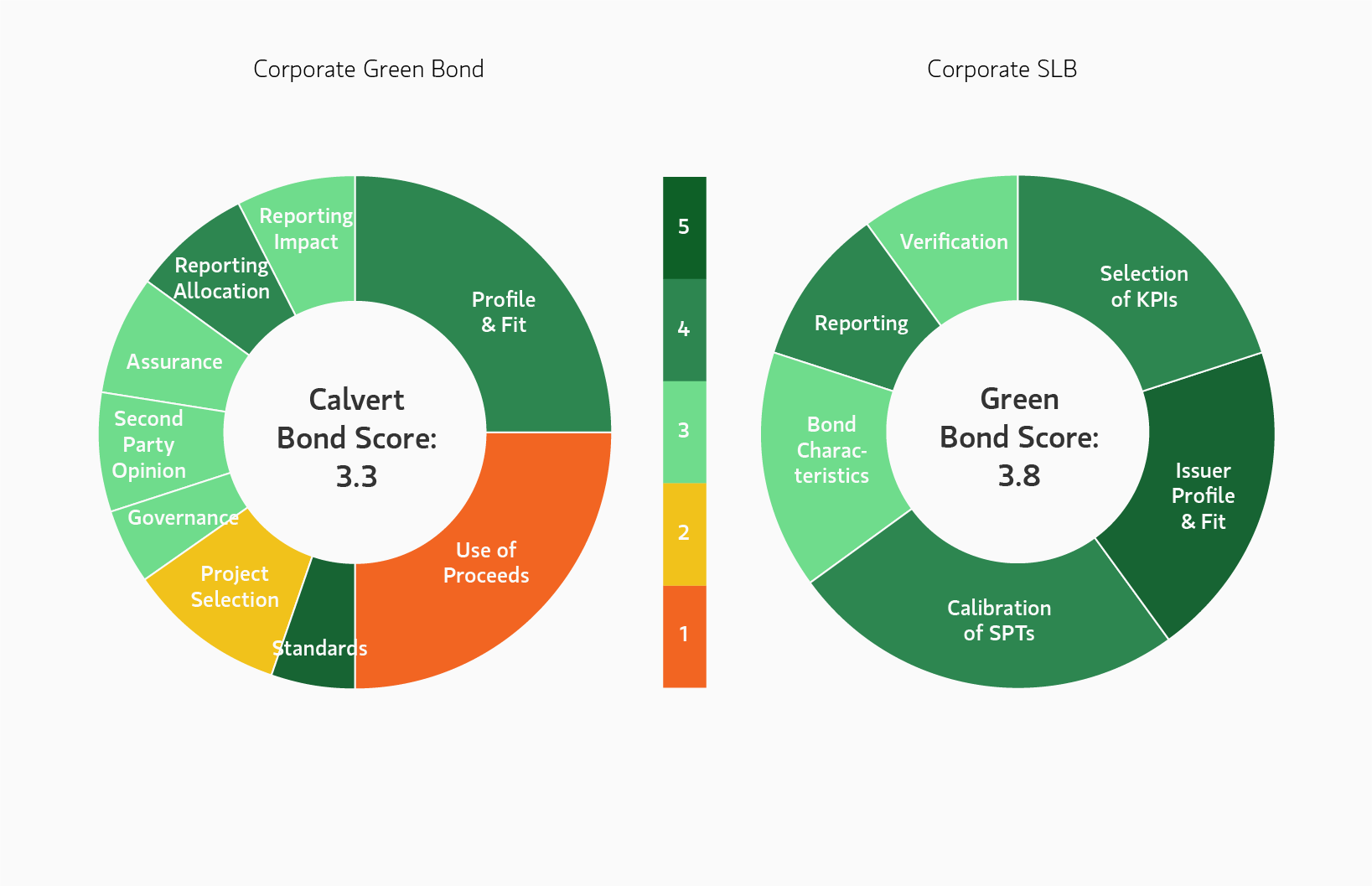

DETERMINING A GREEN BOND’S ELIGIBILITY FOR CALVERT’S STRATEGIES

Calvert’s ESG research analysts score each Green or other Sustainable Bond they assess from 1 to 5, where 5 is best, based on multiple factors from Calvert Sustainable Bond Evaluation Frameworks. The chart below presents illustrative evaluations per our Frameworks for use of proceeds and sustainability-linked bonds respectively.

The final, weighted score is not intended to be used in isolation: it is an informative input, accompanied by a detailed qualitative review by the analyst, ultimately resulting in an eligibility decision for investing in the bond.

CASE STUDY

Ambitions vs Realities in Marine Shipping

Ambitions vs Realities in Marine Shipping

Overview

- Issuer: independent global marine shipping lessor.

- ‘Blue Bond’ from issuer to finance fuel efficiency projects in vessels.

- Sector faces a patchwork of emissions regulations increasing pressure to decarbonise the fleet. Bilateral agreements to implement green shipping routes and the International Maritime Organisation (‘IMO’) outlined a net-zero emissions target by 2050 for the sector. Global fleet supply exceeds demand, creating structural market overcapacity, adding to the challenges of decarbonisation.

- The issuer, although a non-operating owner of its assets, must address fleet decarbonisation in alignment with industry initiatives and regulatory requirements, potentially affecting rates charged to clients. In addition, company is undergoing an aggressive acquisition strategy to expand fleet in contrast with increased pressure on marine shipping to decarbonize. Significant percentage of company’s fleet is LNG-powered; fuel with long lifespans— typically 20 to 30 years—posing a considerable obstacle and effectively locking in emissions until 2050.

Key Issues

- Issuer’s climate targets lacked ambition compared to peers. The issuer followed the IMO’s 2018 target of a 50% reduction in GHG emissions by 2050, but not the IMO’s more aggressive 2023 strategy. None of the issuer’s new ships are zero-emission enabled, falling behind industry practices.

- Project categories selected for this blue bond did not meet our expectations. Particularly concerning as the categories include the refinancing of new LNG ships, which raises further questions about additionality, and the refurbishment of existing vessels to support LNG or green fuels, even though the issuer does not currently use them.

- Proceeds disbursed to date supported entirely LNG vessels, with only smaller, future expected disbursements to more impactful projects like green methanol.

Calvert's Assessment

- Calvert did not participate in the blue bond issuance, as the company fell short in its emissions reduction strategy and eligible project categories.

![]() Encouraging more granular green bond reporting

Encouraging more granular green bond reporting

Overview

- Issuer: an infrastructure asset investment company, focused on investing in companies facilitating the low-carbon transition such as in renewable energy and energy efficiency.

- Green Bond programme from issuer.

- The investment team engaged with the company to encourage improvement in their allocation and impact reporting.

Key Issues

- Despite having already allocated all of the Green Bond’s proceeds, the issuer initially did not report sufficient information on the allocations and estimated impact achieved at the asset level. The investment team requested a breakdown of green projects financed receiving allocations of green proceeds and project-level climate impact reporting, while providing the issuer with clear examples of best practice in green bond reporting as a guidance.

- Within a relatively short delay, the company was able to produce an investor fact sheet with some of this information for previous green bond issuances, and then published this data on their website.

- The issuer appreciated the investment team’s constructive approach and guidance and later contacted us at their own initiative for additional feedback on their corporate sustainability disclosures, demonstrating the collaborative nature of this engagement relationship.

Calvert's Assessment

- Calvert remains invested in this company’s green bonds, given the issuer’s responsiveness in providing requested information and their action on our recommendations.

Featured Insights