Global Fixed Income Market Recap

Rates Reprice Higher Amid Resilient Growth and Sticky Inflation

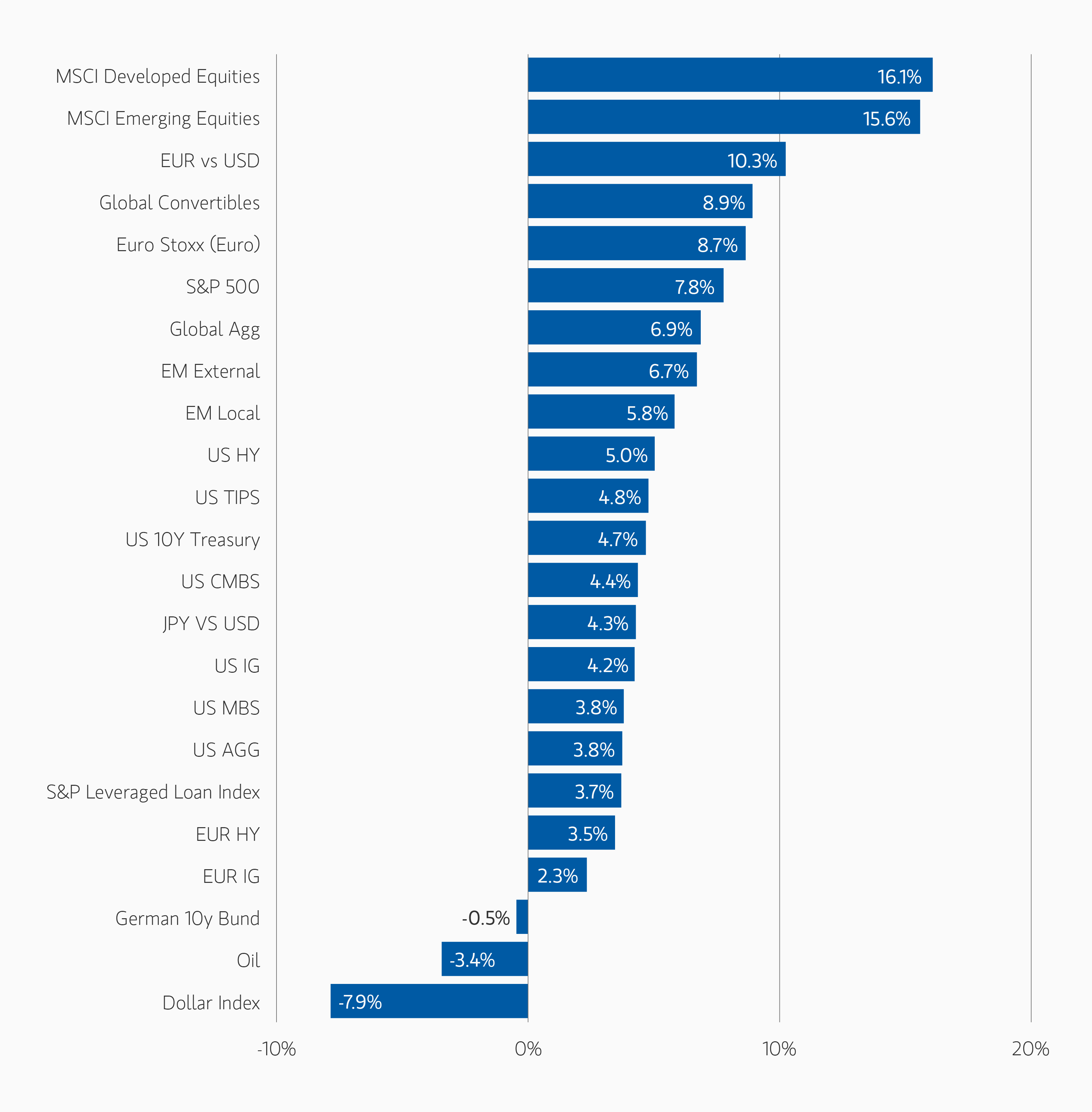

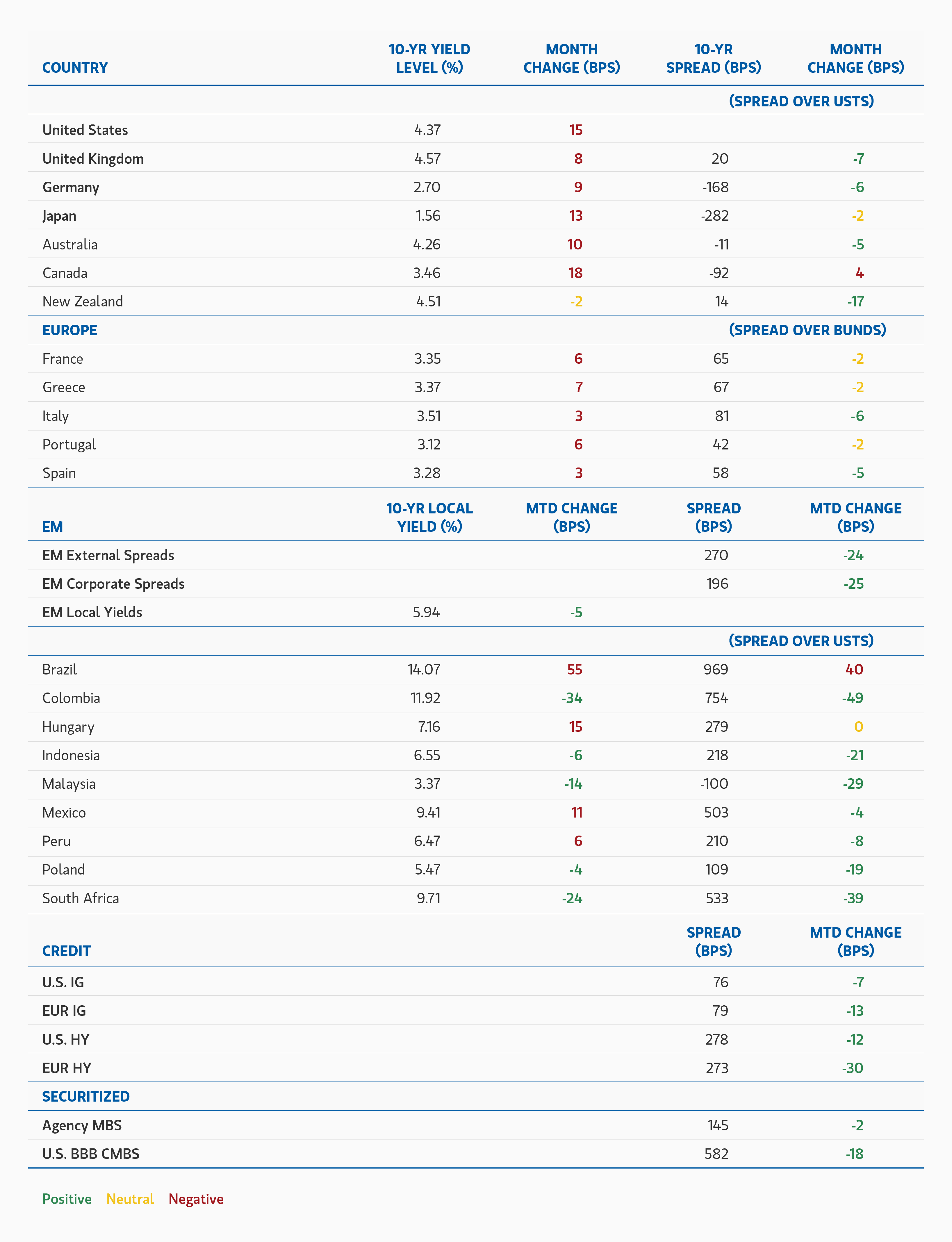

Global government bond yields rose across most developed markets in July, led by the U.S. 10-year yield, which climbed ~15 basis point (bps) to 4.37%, reflecting stronger-than-expected economic data and persistent inflation pressures. Canada (+18 bps) and Japan (+12.5 bps) also saw notable moves, while Germany (+9 bps) and the UK (+8 bps) followed suit. The upward pressure on yields was broad-based, driven by hawkish central bank rhetoric and a reassessment of terminal rate expectations.

Credit Markets Rally on Technicals and Risk Appetite

Credit spreads tightened across the board, supported by strong fundamentals and demand. U.S. Investment Grade (IG) spreads narrowed by 7 bps to 76, while U.S. High Yield (HY) tightened by 12 bps to 278, with similar moves in Euro IG (-13 bps) and Euro HY (-30 bps). Emerging Markets (EM) corporates and sovereigns saw meaningful spread compression, with EM External spreads tighter by 24 bps and EM Corporate spreads tighter by 26 bps, reflecting improved sentiment and demand.

Securitized Credit Outperforms

Agency Mortgage-Backed Securities (MBS) yields rose ~14 bps, but spreads tightened modestly, suggesting stable demand. Commercial MBS (CMBS) and Asset-Backed Securities (ABS) spreads narrowed across ratings buckets, with CMBS AAA down ~5 bps and CMBS BBB down ~20 bps, supported by improving fundamentals and technicals.

Breakevens Rise as Inflation Expectations Rebuild

Inflation breakevens widened in the U.S. (+11 bps), Germany (+6 bps), and the UK (+6 bps), indicating a rebound in inflation expectations across the globe. The move was more muted in Japan and Southern Europe.

FX Volatility Returns as USD Strengthens

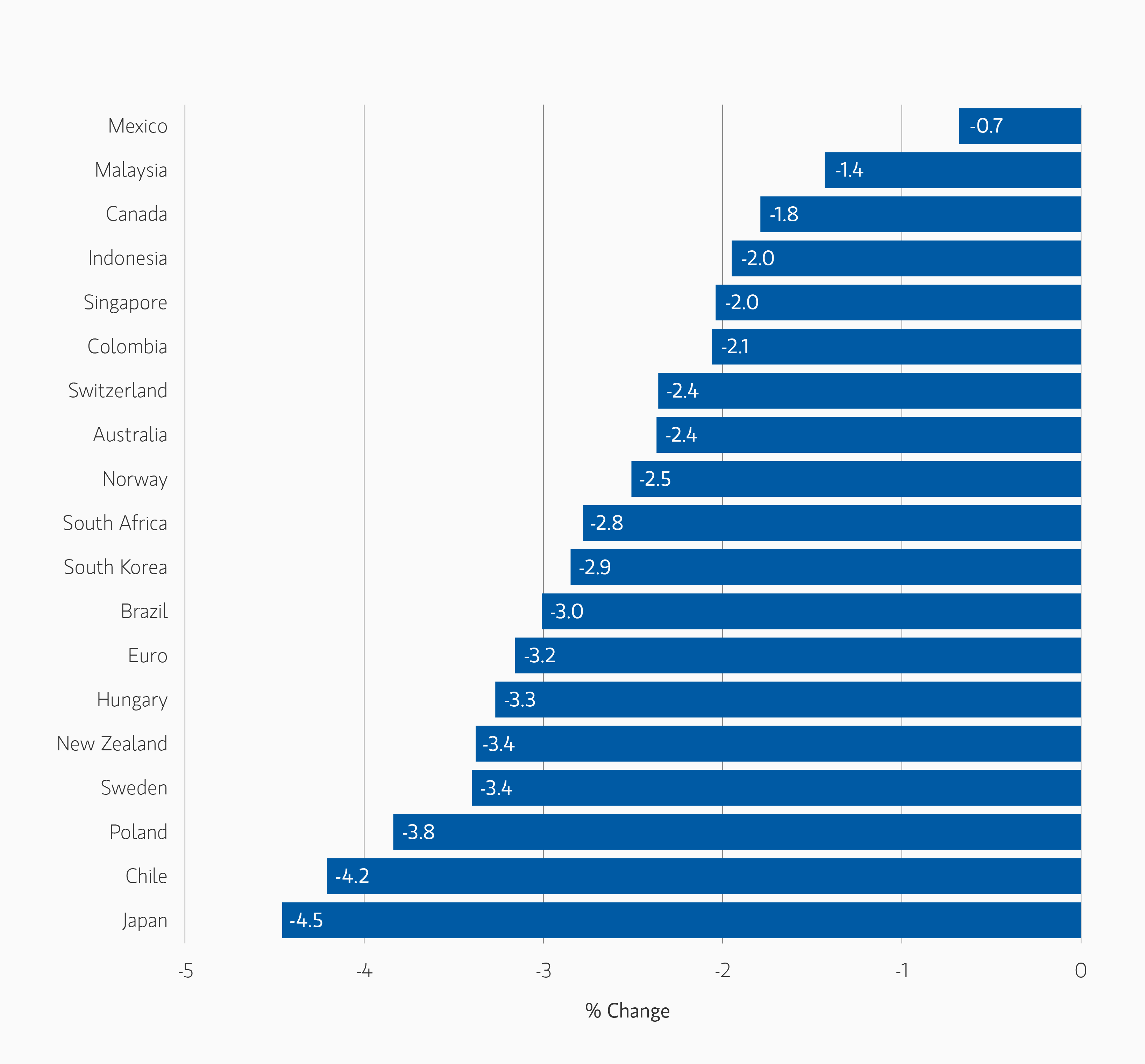

The USD appreciated broadly, with notable moves against the JPY (-4.5%), EUR (-3.2%), and GBP (-3.8%). The DXY index rose ~3.2%, driven by higher U.S. yields and safe-haven flows. EM currencies were broadly lower, with BRL and ZAR weakening -3.0% and -2.7% respectively.

Fixed Income Outlook

Fixed Income markets in July reflected investor sentiment that the U.S. economy had largely moved past the tariff-related uncertainty of the prior three months and was progressing at a steady—if unspectacular—pace. However, core inflation data releases for June (CPI and PCE) remained stubbornly sticky, showing a slight uptick from May.

Early in the month, the initial non-farm payrolls report for June exceeded expectations (147,000 vs. 106,000 forecast), reinforcing market confidence in the economy’s resilience. Yet subsequent revisions—amounting to a two-month downward adjustment of 258,000—revealed that labor market strength in May and June had been significantly overstated. At the time, though, traders interpreted the preliminary data as indicative of benign growth.

The Fed held rates steady as expected, but dissent from Governors Bowman and Waller—who cited labor market concerns and advocated for a rate cut—marked a notable shift. By month-end, 10-year Treasury yields had risen 15 bps. Fed Funds futures, which had priced in a 65% chance of up to three cuts by year-end at the end of June, revised expectations to just over a 30% chance of only two cuts by July 31.

As is typical for mid-summer, market activity was subdued and liquidity, thin. Credit spreads in both investment grade and high yield touched year-to-date lows. Securitized assets tightened, and the MOVE index—a measure of Treasury bond volatility—closed at its lowest level since January 2022, just before the Fed began its hiking cycle. With reduced expectations for Fed easing, the yield curve flattened, narrowing the 5-year vs. 30-year Treasury spread by 5 bps.

Other G10 rates markets largely mirrored U.S. moves. The ECB, Bank of Japan, Bank of Canada, and Reserve Bank of Australia all held rates steady, while the Bank of England did not meet. Ten-year yields rose across developed markets in sympathy with the U.S. Treasury move.

As the President’s self-imposed August 1 deadline for trade negotiations approached, the tariff structure became clearer. Deals struck after the initial post-Liberation Day pause suggest a 15% tariff baseline for trade agreements with the U.S., except for the UK, which agreed to 10%. The EU, Japan, and South Korea accepted 15% tariffs with no reciprocal duties on U.S. goods, alongside commitments for hundreds of billions in U.S. investment. India (25%), Switzerland (39%), and Brazil (50%) face higher rates. Canada remains in negotiations and currently faces a 35% tariff on non-USMCA-compliant goods, while Mexico received a 90-day extension to finalize its deal.

Additional tariffs on steel, aluminum, copper, and the removal of the WTO exemption on pharmaceuticals have pushed the average effective tariff rate on U.S. goods imports to 18.3%, up from 2.4% in January, according to the Budget Lab at Yale University. These tariffs are estimated to have raised U.S. consumer prices by 1.5%, accounting for substitution effects. As these deals were announced, Treasury TIPS breakevens—a key market gauge of inflation expectations—rose, with 5-year breakevens moving from 2.31% at the start of July to 2.48% by month-end.

We also gained clarity on another major Trump administration initiative: the One Big Beautiful Bill Act (OBBBA), signed into law on July 4. From a fixed income perspective, the primary concern is the likely expansion of the deficit from already elevated levels, despite a growing and fully employed economy. As previously noted, we expect these persistent deficits to exert upward pressure on real interest rates across the curve.

We’ve titled this monthly outlook “If We Knew Then What We Know Now” because July’s muted market movements were based on assumptions of steady economic growth. However, the August 1 employment report and significant downward revisions to prior payroll data suggest the picture may have been more fragile than it appeared. The months ahead promise to be revealing.

Developed Market Rate/Foreign Currency

Monthly Review

Developed market interest rates rose in the first half of July before retracing in the second half. Overall, bonds traded within a narrower range than in June, and 10-year U.S. Treasury yields ended the month 15 bps higher at 4.38%. The recent trend of curve steepening paused, as July’s data generally supported the Fed’s continued hawkish stance. June’s jobs report was strong, with the unemployment rate unexpectedly falling to 4.1%. Notably, the CPI report indicated price pressures in tariff-affected goods sectors, while other categories aligned with expectations.

President Trump’s initial trade negotiation window expired in early July, but the administration held off on re-imposing tariffs, extending the effective deadline to early August. Toward month-end, the U.S. announced trade agreements with key partners—including Japan, the EU, and Korea—featuring reduced tariff rates in exchange for FDI commitments and market access concessions. Talks with China were also underway. At the FOMC meeting, Fed Chair Powell’s press conference was more hawkish than anticipated, suggesting no urgency to cut rates given a balanced labor market.

Outside the U.S., other major markets experienced volatility. Gilts underperformed amid speculation that the Labour government might struggle to deliver welfare reforms and instead resort to growth-negative tax hikes. The ECB held rates steady at its July meeting but signaled that further easing would require a high threshold. Markets now price in approximately one more full cut for the remainder of the cycle. Inflation data met expectations, while PMIs pointed to some stabilization in the outlook. In Japan, expectations for further rate hikes resurfaced following the trade deal with Washington, though the Bank of Japan was more dovish than expected at its July policy meeting.

In foreign exchange markets, the dollar strengthened against peers, with the Bloomberg Dollar Index rising 2.6% over July. Exchange rates were particularly volatile in the second half of the month due to thinner liquidity and pressure on dollar-bearish positions, which were challenged by strong data and a hawkish Fed. The euro weakened notably after the trade deal confirmation, as did regional equities. The dollar-yen rate also crossed 150 following the Bank of Japan meeting.

Outlook

We have scaled back our duration longs in Developed Markets (DM) markets as economic data suggests no great urgency for rate cuts. We also retain our long-standing curve steepening exposures in U.S. Treasuries and Bunds, with a view that rising deficits and increased term premia can lead the long end of yield curves to underperform, even in the absence of aggressive rate cuts. In Japan, we remain underweight duration given a strong wage and inflation picture, which we think will lead to more hikes than the market currently prices. We also hold onto our inflation breakeven positions. We are short the U.S. dollar against a basket of currencies.

Emerging Market Rate/Foreign Currency

Performance across Emerging Markets Debt was mixed in July. The U.S. dollar strengthened during the period, supported by strong economic data and reduced uncertainty as several countries finalized trade agreements with the U.S. Both sovereign and corporate credit spreads tightened month-over-month, bolstering hard currency index performance. Notable trade deals included agreements with the EU, Indonesia, and Japan. In negotiations with India, the U.S. raised the possibility of penalties due to India’s purchases of Russian oil. Meanwhile, the U.S. announced potential 50% tariffs on Brazil in connection with former President Jair Bolsonaro’s pending trial.

Tensions between Russia and Ukraine remained volatile, though the U.S. renewed military support for Ukraine and set a deadline for President Putin to agree to a ceasefire. Asset class flows were positive for both local and hard currency funds for the third consecutive month. Following record annual outflows from 2022 to 2024, the asset class returned to net inflows in June.

Outlook

Valuations for emerging markets debt continue to look attractive, specifically for currencies and local interest rates. EM currencies continue to be supported by improving country level fundamentals and policy measures in the U.S. that are putting downward pressure on the U.S. dollar. Real yield differentials between emerging and developed markets are quite wide and will likely further benefit if EM central banks continue to cut rates. As countries continue to make trade agreements a level of uncertainty will likely be reduced in the macro economy. While tariffs may not be as severe and sweeping as initially announced in April, many countries are still likely to be hit with elevated tariff level and this will likely have disinflationary impacts. The International Monetary Fund slightly raised its global growth expectations citing a drop in the effective U.S. tariff rate, but the global economy does still face many potential economic headwinds due to continued trade negotiations and ongoing wars. Focusing on bottom-up country level fundamentals remains critical due to the differentiated nature of the asset class.

Corporate Credit

Monthly Review

Risk assets advanced modestly in July, supported by announced tariff agreements with the EU and Japan, easing concerns over Fed independence, and resilient corporate earnings. EUR IG outperformed U.S. IG, driven by lighter supply and strong technicals. The month featured a series of trade agreements, including U.S. deals with Japan and the EU that reduced auto tariffs, expanded market access, and unlocked over $1.9 trillion in investment pledges. President Trump also signaled progress with China and increased pressure on pharmaceutical firms regarding pricing. Central banks held policy steady. The ECB maintained optionality, while the Fed showed internal division for the first time since 1993. Economic data pointed to modest improvement: Eurozone PMIs and U.S. retail sales surprised to the upside, and Q2 GDP reflected normalization following earlier frontloading. Inflation remained sticky but stable, with Euro area Harmonised Index of Consumer Prices holding at 2.0% and U.S. core CPI showing pressure in tariff-sensitive categories. Corporate earnings were broadly resilient, led by banks and non-cyclicals, though autos and chemicals showed softness. M&A activity picked up across sectors. Technicals remained strong, with record July issuance of €31 billion—driven by financials—and continued robust inflows into IG credit.

In the U.S. and global high yield markets, performance moderated. The U.S. made mixed progress in trade negotiations, Q2 GDP growth exceeded expectations, and early corporate earnings showed continued resilience. Capital market activity accelerated, with U.S. high yield recording its busiest month of gross issuance this year. The leveraged loan market also saw a surge in repricing activity. Lower-quality segments generally outperformed amid strong risk appetite and a 17-basis point rise in 5-year Treasury yields, which weighed on higher-quality BB-rated bonds1.

Global convertible bonds performed well alongside other risk assets. Despite mixed progress in U.S. trade negotiations, Q2 earnings remained resilient. Global convertibles outperformed both global equities and bonds. The primary market was strong for a typically quiet month, with $11.4 billion in issuance—the highest July total since 2007 and 2.5 times the historical average. Issuance was led by the U.S., with solid contributions from Asia and Japan, though Europe saw no new deals. Year-to-date supply reached $82 billion, up 18% from the same period in 2024.2

Outlook

We remain cautiously constructive on credit, expecting low growth without a significant rise in downgrade or default risk. European policy remains supportive, while the U.S. fiscal outlook is more mixed. Corporate fundamentals are solid, with firms maintaining low-risk strategies. Technicals are favorable, supported by manageable issuance and strong demand for IG yields. While carry is expected to remain a key driver of returns, we are mindful of the current extreme tightness in credit spreads. As the full impact of newly announced trade policies has yet to materialize, we remain selective in our credit exposures—favoring issuers with strong fundamentals, lower cyclicality, and positioning to benefit from a moderate growth environment. The growth outlook remains uncertain as we await the effects of higher global tariff rates. Given this backdrop, we have limited confidence in material spread tightening.

We remain cautious on high yield credit heading into the third quarter. While peak risk and volatility from evolving trade policy may be behind us, the final framework of international trade with key partners remains unclear. We expect the evolving trade landscape to continue weighing on growth and contributing to inflationary pressures. Yields remain historically attractive, but high yield spreads are tight and vulnerable to widening. Our cautious stance reflects a comprehensive analysis of U.S. and global growth, central bank policy, consumer health, issuer fundamentals, technicals, and valuations. While we view recession risk this year as low, we anticipate further bouts of volatility.

We continue to be constructive on the fundamentals of the global convertible bond market. Convertibles maintain their asymmetric profiles, with balanced deltas and strong bond floors. While trade-related volatility may have peaked, the long-term structure of global trade remains uncertain. Tensions in the Middle East have eased, but the durability of the ceasefire remains to be seen. The bond floor feature will be especially valuable if volatility resurfaces, as seen in Q2. Despite our constructive view on fundamentals, we are cautious on the primary market, which is on pace to exceed 2024’s totals. Most issuers are refinancing maturing debt in a high-rate environment, but the growing trend of crypto-linked issuance—where companies issue debt to buy cryptocurrency—warrants caution. That said, it also presents opportunities for well-resourced investment teams focused on bottom-up fundamental research.

Securitized Products

Monthly Review

Agency MBS spreads continued their gradual tightening, narrowing by 2 bps to +145 bps over comparable-duration Treasuries. Despite this move, spreads remain historically wide and relatively cheap versus other core fixed income sectors. The Fed reduced its MBS holdings by $19 billion to $2.120 trillion, marking a $583 billion decline from its 2022 peak. Bank holdings were unchanged at $2.683 trillion, though expectations for increased demand are rising with potential SLR easing and lower short-term rates.3 Money managers remain the dominant buyers, attracted by favorable valuations. The Agency MBS Index returned -0.41% in July, matching Treasury performance on a duration-adjusted basis, but still lagging YTD by 62 bps. The current yield rose to 5.18%, while 30-year mortgage rates fell to 6.72%, keeping most outstanding mortgages out-of-the-money for refinancing.

Securitized Credit sectors saw modest spread tightening, underperforming corporates due to less aggressive spread compression. Issuance remained robust and well-absorbed: ABS issuance reached $41.12 billion, CMBS $13.3 billion (up 45% YoY), and RMBS $13.6 billion (down 17% from June).4 Non-agency RMBS spreads tightened 5-10 bps, supported by strong mortgage fundamentals—low delinquencies, high homeowner equity, and stable home prices despite limited supply and elevated rates. ABS spreads also tightened 5-10 bps, though rising consumer credit delinquencies—especially among lower-income borrowers—pose a growing concern. CMBS spreads followed suit, with strength in high-end apartments, logistics, and luxury hotels, while Class B office properties remain challenged. Tariff impacts on hotels and retail assets are being closely monitored.

Outlook

We anticipate continued tightening in U.S. Agency MBS spreads, driven by inflows from relative value investors and banks seeking attractive return profiles compared to other core fixed income sectors and cash alternatives. However, we expect this tightening to materialize more meaningfully once the Federal Reserve initiates rate cuts, likely in the final quarter of the year. Agency MBS valuations remain compelling, both versus investment-grade corporates and historical averages, positioning the sector well for future performance.

Securitized credit spreads are expected to remain range-bound in the near term, pending greater clarity on the economic implications of evolving tariff policies and further spread compression in Agency MBS. While Agency MBS has underperformed corporates year-to-date, securitized credit has outperformed most investment-grade sectors due to its higher carry. We expect returns to be driven primarily by cashflow carry, supported by attractive yields entering August. Nonetheless, elevated rate levels continue to pressure household balance sheets, particularly impacting consumer ABS tied to lower-income borrowers. Commercial real estate also faces headwinds from current financing costs.

Our highest conviction remains in residential mortgage credit, where strong fundamentals—such as low delinquency rates, high homeowner equity, and stable employment—support performance. This is the one area where we are comfortable extending down the credit spectrum. In contrast, we remain cautious on lower-rated ABS and CMBS, where credit stress is more likely to emerge. Overall, we maintain a constructive view on Agency MBS and select securitized credit sectors, with a focus on carry and credit quality as key drivers of performance in the months ahead.

1 Source: MSIM, ICE Indices, Bloomberg L.P., July 31, 2025

2 Source: Bank of America, July 31, 2025

3 Source: Bloomberg, as of July 31, 2025

4 Source: Bloomberg, as of July 31, 2025

Featured Insights