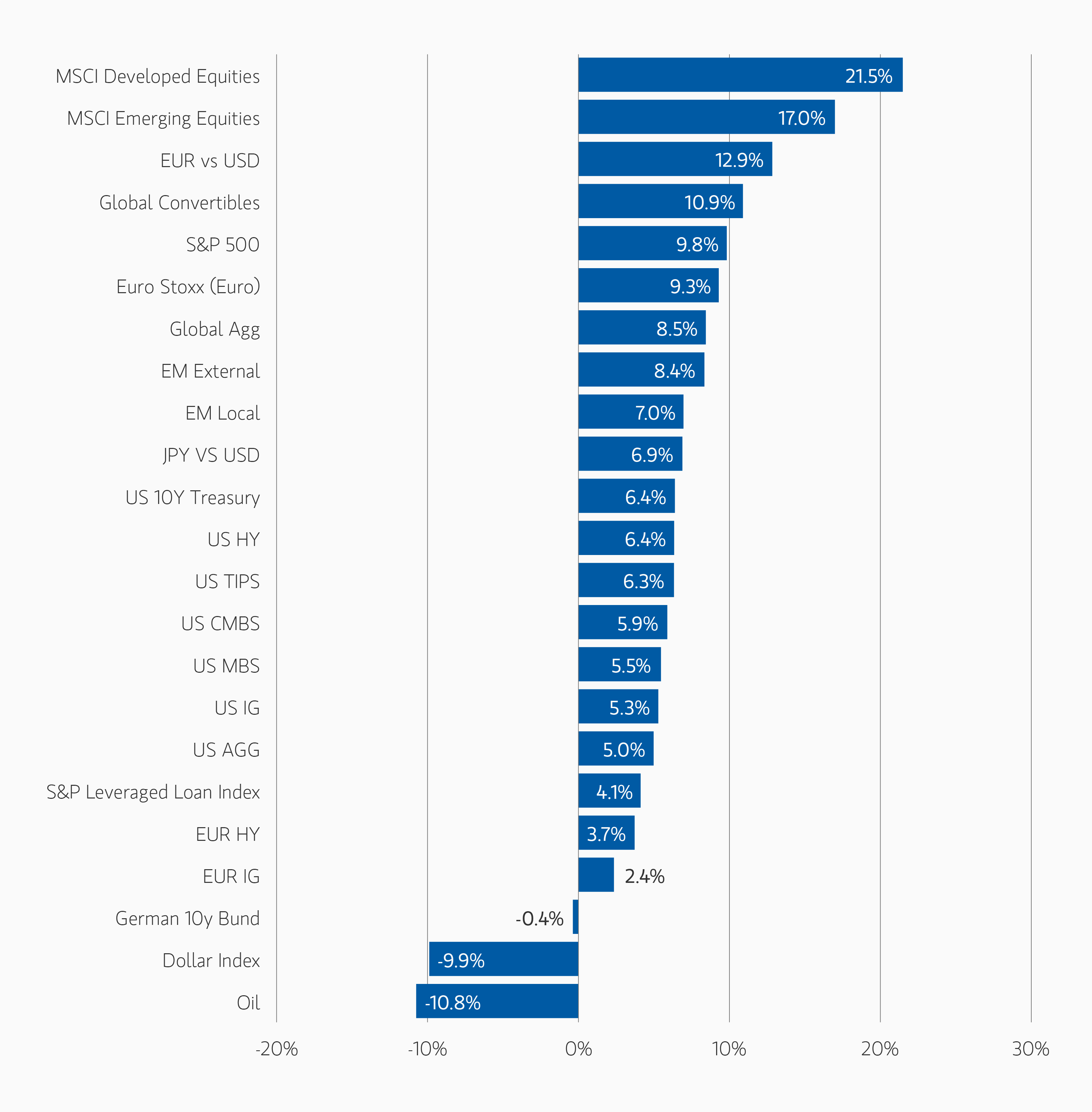

The fixed income market was as “summer-y” as it gets this past month. Volatility in yields remained remarkably muted, and spreads continued to compress in a benign fashion—despite a brief spike following the early-month U.S. jobs data. This calm seemed out of sync with developments that, under normal circumstances, might have triggered more pronounced market reactions. Beneath the surface, however, pressures are building that could spill into more significant moves as we head into fall.

Our theme this month echoes T.S. Eliot’s sentiment: summer ends not with a bang, but a whimper. Yet perhaps a more fitting metaphor comes from naturalist Joseph Wood Krutch, who wrote, “August creates as she slumbers, replete and satisfied.” The seeds of potential volatility have been sown—and while markets may appear quiet, they are quietly preparing for what’s next.

Rates Rally on Weak Jobs Data and Dovish Signals

Developed market curves steepened in August as soft U.S. payrolls and dovish Fed commentary fueled expectations for rate cuts. Political instability in France and concerns over Fed independence added long-end pressure. The U.S. dollar weakened broadly, supporting high-carry currencies.

Emerging Market Debt Gains Amid Dollar Weakness and Policy Easing

Emerging markets (EM) posted solid returns, supported by continued inflows and easing from Turkey and Mexico. Trade tensions persisted, but a U.S.-China truce helped stabilize sentiment. EM currencies benefited from dollar softness and attractive real yields.

Credit Markets Mixed as Issuance Picks Up

Investment grade (IG) credit saw modest spread widening, led by French assets, while high yield (HY) and convertibles rallied on strong risk appetite and falling yields. Primary issuance was active across segments, with refinancing dominating supply. Fundamentals remain solid, but spreads are tight.

Securitized Credit Stable with Strong Technicals

Agency mortgage-backed securities (MBS) spreads tightened but remain wide historically. Asset-backed securities, Commercial MBS, and Residential MBS issuance was well absorbed despite seasonal slowdown. Performance was solid, though shorter duration limited upside versus other sectors.

Fixed Income Outlook

The bond market remains in a fragile equilibrium—caught between persistent growth concerns, as reflected in U.S. employment data, and stubborn inflation pressures both domestically and abroad, particularly in Japan. At the same time, supply concerns in government bond markets are intensifying, driven by expanding deficits and politically challenging paths to fiscal tightening in countries such as France, the UK, and the U.S.

These dynamics point to rising term premia, a theme we continue to favor and express through steepener positions in government bond curves. Markets have repriced real yields to levels last seen in the early 2000s, signaling a clear departure from the era of monetary repression that followed the Global Financial Crisis. This shift has occurred despite still-elevated central bank balance sheets, which continue to unwind. The key question now is whether real yields need to rise further—particularly at the long end—as balance sheets shrink and pension demand for duration appears increasingly met.

Against the backdrop of large deficits and structurally constrained fiscal dynamics—driven by political gridlock and demographic pressures—we continue to assess whether we are witnessing implicit crowding out. Corporate and household balance sheets remain strong relative to incomes and profits, and especially when measured against household net worth and equity valuations. Are spreads historically tight not only because private sector fundamentals are sound, but also because sovereign debt trajectories are not?

We maintain a neutral stance on duration across developed markets, with selective positioning favoring Canadian and New Zealand government bonds over U.S. Treasuries. Curve steepening exposures in U.S. Treasuries and German Bunds reflect our view that rising deficits and term premia will pressure long-end yields. In Japan, we remain long inflation breakevens while tactically reducing short duration exposure. In FX, we continue to favor short U.S. dollar positions against a diversified currency basket.

In emerging markets, fundamentals remain supportive amid ongoing reform momentum and resilient growth expectations. EM currencies are undervalued, and real yield differentials remain attractive. Continued dollar weakness should support local assets, though trade policy uncertainty warrants a bottom-up, country-specific approach.

We remain cautiously constructive on credit. In investment grade, solid corporate fundamentals and favorable technicals support carry-driven returns, though tight spreads and trade policy risks call for selectivity. We favor issuers with strong balance sheets and low cyclicality—particularly financials. In high yield, while recession risk remains low, compressed spreads and evolving trade dynamics suggest potential volatility ahead. We prefer issuers with resilient fundamentals and prudent capital structures.

In convertibles, we are constructive on fundamentals but cautious on the pace of issuance—especially crypto-linked deals. The asset class’s bond floor offers downside risk mitigation, and selectivity will be key. In securitized credit, agency MBS spreads are expected to tighten further, supported by attractive relative valuations and potential Fed rate cuts. Residential mortgage credit remains our preferred sector, alongside targeted exposure to commercial ABS and CMBS backed by hospitality assets and select single-asset trophy office properties.

Developed Market Rate/Foreign Currency

Monthly Review

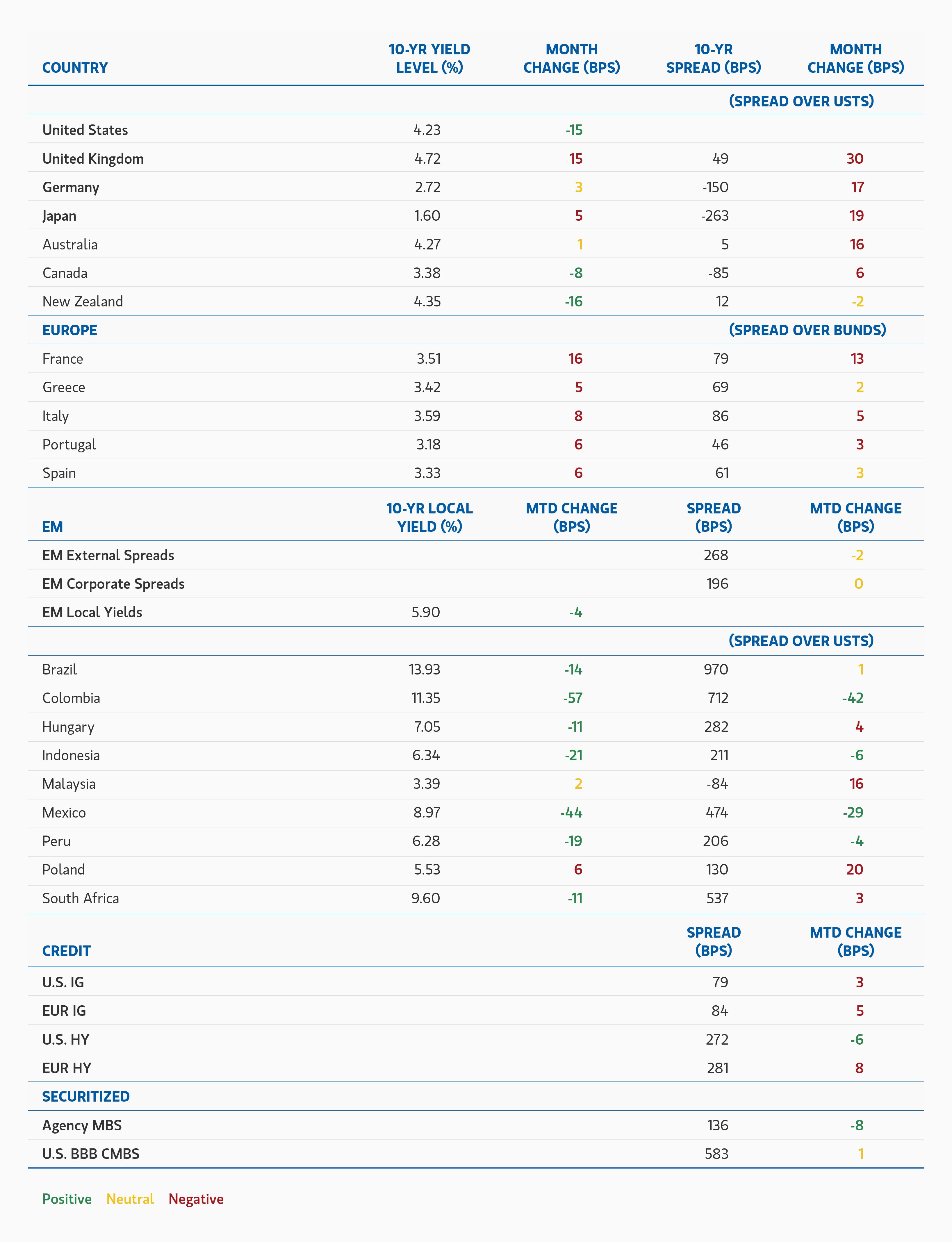

Developed-market yield curves steepened notably in August, reflecting a combination of rising term premia and growing expectations for more aggressive monetary easing. The month opened with a disappointing U.S. payrolls report, which showed only 73,000 jobs added in July. Compounding the weak print were sharp downward revisions to the prior two months, suggesting job growth had slowed to an average of just 35,000 per month. Fed Chair Jerome Powell’s speech at Jackson Hole was interpreted as dovish, emphasizing the potential for rising unemployment amid softening demand. Treasury yields fell across the curve following the speech, and market-implied probabilities for a September rate cut rose significantly. Later in the month, President Trump’s attempt to remove Fed Governor Lisa Cook added further steepening pressure, as markets priced in both a more dovish near-term policy stance and increased long-end risk premia tied to concerns over Fed independence.

In the euro area, monetary policy developments were limited, but political instability in France took center stage. Prime Minister François Bayrou’s announcement of a September 8 confidence vote on his fiscal plan sparked a sharp widening in OAT-Bund spreads and weighed on French risk assets. Encouragingly, the selloff remained largely idiosyncratic, with limited contagion to other regional assets, including the euro. Nonetheless, eurozone sovereign credit spreads drifted wider from their mid-month tights, likely in anticipation of increased government bond issuance in September.

Geopolitical developments had a muted impact on markets. President Trump’s summit with Vladimir Putin in Alaska failed to produce a ceasefire or meaningful progress on Ukraine, despite the symbolic optics. A subsequent high-level meeting in Washington brought together European leaders—including European Commission President von der Leyen, UK Prime Minister Starmer, French President Macron, German Chancellor Merz, and Italian Prime Minister Meloni—to press for stronger U.S. security guarantees for Ukraine. However, markets remained skeptical of any near-term breakthrough.

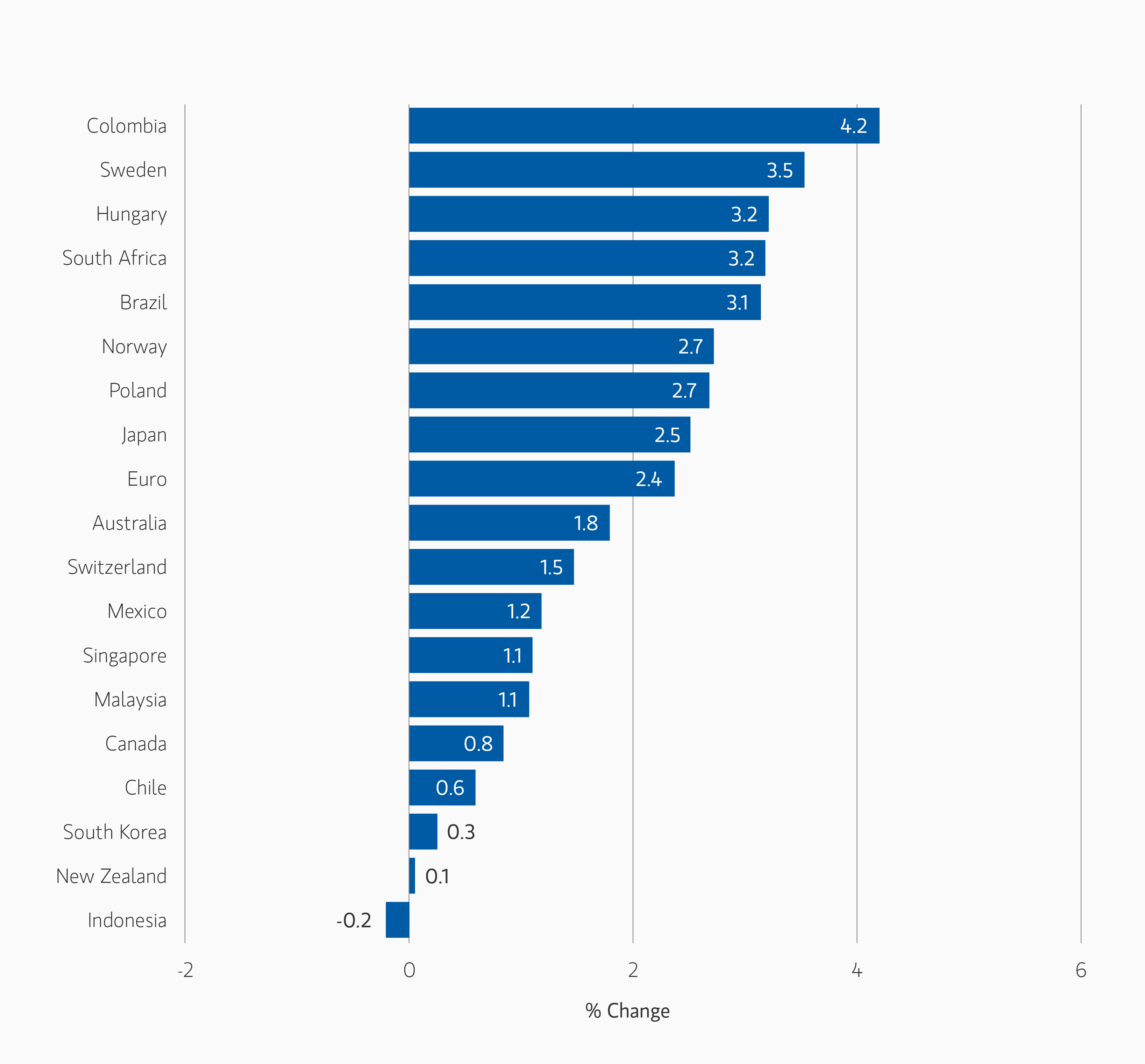

In foreign exchange markets, the U.S. dollar weakened meaningfully amid falling front-end rates. The Bloomberg Dollar Index declined 1.7%, with the greenback depreciating against all G10 currencies. High-carry currencies—both within the G10 and select emerging markets—continued to rally as investors sought yield in a declining rate environment. Scandinavian currencies outperformed on risk sentiment, while the New Zealand dollar posted a modest 0.05% gain following a dovish Reserve Bank of New Zealand policy meeting.

Outlook

We currently hold a neutral stance on overall duration across developed markets, while maintaining selective cross-market positions. We see relative value in Canadian government bonds versus U.S. Treasuries, supported by Canada’s weakening employment and growth outlook, alongside a steeper yield curve.

We continue to favor an overweight duration position in New Zealand relative to the U.S., and retain our long-standing curve steepening exposures in both U.S. Treasuries and German Bunds. These reflect our view that rising deficits and increasing term premia will likely lead to underperformance at the long end of yield curves.

In Japan, we maintain long inflation breakeven positions, though we have tactically reduced our outright short duration exposure. On the currency front, we remain short the U.S. dollar against a diversified basket of currencies.

Emerging Market Rate/Foreign Currency

Monthly Review

Emerging Markets Debt (EMD) delivered positive performance across major segments in August. The U.S. dollar resumed its weakening trend—seen for much of the year—as investors anticipated a potential rate cut following a soft U.S. jobs report. Credit spreads remained broadly unchanged month-over-month for both sovereign and corporate issuers.

Trade tensions continued to make headlines. The U.S. imposed 50% tariffs on a wide range of Indian imports, with similar measures applied to Brazil. However, a trade truce between the U.S. and China was extended through November, offering some relief to markets.

On the monetary policy front, the Central Bank of Turkey cut its policy rate by 300 basis points (bps) as inflation continued to ease, while the Bank of Mexico delivered a more modest 25 bp cut. Investor appetite for EMD remained strong, with another month of inflows: $2.5 billion into hard currency funds and $1.5 billion into local currency funds.

Outlook

Fundamentals across the asset class remain supportive, underpinned by continued reform momentum in many EM countries. Despite lingering uncertainty around U.S. trade policy, economic cycles in emerging markets are generally on an upswing, and growth expectations remain resilient.

Valuations continue to look attractive. Most EM currencies remain relatively undervalued, and real yield differentials between EM and developed markets are still wide and compelling. A likely continuation of U.S. dollar weakness should further support local currency assets.

While uncertainty around U.S. tariffs persists, the impact will vary by country and will ultimately depend on the outcome of ongoing negotiations. Given the differentiated and bifurcated nature of the asset class, bottom-up country analysis remains essential to identifying and capturing value.

Corporate Credit

Monthly Review

August was a mixed month for risk assets, with macroeconomic developments dominating sentiment. The typical post-summer pickup in primary issuance added pressure to spreads. European IG credit underperformed its U.S. counterpart, largely due to spread decompression in French assets. Political instability re-emerged as a key concern, particularly in France. The surprise announcement of a confidence vote for the French Prime Minister pushed the OAT-Bund spread wider, reflecting growing market anxiety over France’s ability to meet its budgetary targets and address its fiscal deficit. Across the Atlantic, concerns about Federal Reserve independence intensified following President Donald Trump’s attempt to dismiss Fed Governor Lisa Cook. On the monetary policy front, it was a relatively quiet month. The ECB reiterated its commitment to managing potential shocks to the Eurozone economy, while Fed Chair Jerome Powell’s speech at Jackson Hole signaled a more dovish stance, opening the door to a possible rate cut in September. In the UK, the Bank of England delivered a 25 bp rate cut to 4%, consistent with its gradual approach to monetary easing. The Bank highlighted two competing forces: a loosening labor market and persistent inflation, both requiring careful policy calibration. Economic data showed signs of convergence between the U.S. and Europe. August flash PMIs surprised to the upside across the Eurozone, while U.S. ISM services data came in slightly softer than expected—though still in expansionary territory. Technical conditions softened toward the end of the month, driven by a surge in primary market activity. Gross issuance exceeded expectations, totalling €37 billion versus a forecast of €35 billion).1

August was a strong month for U.S. and global high yield markets, with solid performance across both total and excess return metrics. Risk sentiment remained robust, supported by record highs in equity markets and spread compression in the lowest-rated segment of leveraged credit. High yield benefited from a sharp month-over-month decline in 5- and 10-year Treasury yields, driven by growing expectations of a potential rate cut by the Federal Reserve in September. This supportive backdrop encouraged issuers to access receptive capital markets, resulting in a seasonally active month for primary issuance. However, the majority of issuance was refinancing-related, leading to limited net-new supply. The combination of modest net supply, seasonally lower trading volumes, and strong investor demand created a favorable technical environment for high yield.2

Global convertible bonds delivered strong performance in August, supported by robust risk sentiment and growing expectations of a potential rate cut by the Federal Reserve in September. While convertibles underperformed global equities, they outpaced global fixed income, highlighting their hybrid nature in a month marked by equity strength and falling yields. The favorable market tone encouraged issuers to access capital markets, resulting in a seasonally active month for primary issuance. Nearly $12 billion in new deals were priced—approximately double the historical August average. The U.S. led the charge, accounting for 87% of total issuance. Notably, crypto-related issuers continued to tap the market, contributing $4 billion from just two deals. Year-to-date supply reached approximately $95 billion, significantly ahead of the same period in 2024.3

Outlook

We remain cautiously constructive on investment grade credit, anticipating a low-growth environment without a meaningful rise in downgrade or default risk. European policy remains broadly supportive, while the U.S. fiscal outlook is more mixed and subject to political uncertainty. Corporate fundamentals continue to be solid, with issuers maintaining conservative balance sheet strategies and low-risk profiles. Technicals are favorable, supported by manageable issuance levels and sustained demand for investment-grade yields. While we expect carry to remain a key driver of returns, we are mindful of the current extreme tightness in credit spreads. With the full impact of recently announced trade policies yet to materialize, we remain selective in our credit exposures—favoring issuers with strong fundamentals, lower cyclicality, and those well-positioned to benefit from a moderate growth backdrop.

As we move through the third quarter, we maintain a cautious stance on high yield corporates. While peak volatility related to tariff and trade policy may be behind us, the final structure of international trade agreements with key partners remains uncertain. We expect that the evolving trade landscape will continue to weigh on economic growth and contribute to upward pressure on inflation—evidenced by recent labor market data and the mid-August CPI report. Yields remain attractive, but have compressed meaningfully over the quarter, and average spreads in the high yield market are historically tight and vulnerable to widening. Our cautious outlook reflects a comprehensive assessment of factors including U.S. and global growth trajectories, central bank policy shifts, consumer health, issuer fundamentals, technical conditions, and valuations. While we believe the probability of a recession in 2025 remains low, we expect continued episodes of volatility. In this environment, selectivity is key. We favor issuers with resilient fundamentals, prudent capital structures, and business models that are less exposed to cyclical pressures.

We remain constructive on the fundamentals of the global convertible bond market as we move through the third quarter. Convertibles continue to demonstrate their asymmetric return profiles, though equity sensitivity (delta) is gradually increasing. While peak volatility related to trade and tariff policy may be behind us, the final structure of international trade agreements remains uncertain. Additionally, geopolitical tensions in the Middle East appear to have eased, but the durability of the ceasefire will need to be monitored over the medium term. The asset class’s bond floor feature remains a key defensive attribute, particularly if volatility resurfaces as it did in Q2. Despite our constructive view on fundamentals, we remain cautious on the primary market, which is on pace to exceed 2024’s issuance totals. While most issuers are refinancing maturing debt in a high-rate environment, the accelerating trend of crypto-linked issuance—where companies raise capital to purchase cryptocurrency—warrants close scrutiny. We believe this evolving landscape presents both risks and opportunities, especially for well-resourced investment teams with strong bottom-up research capabilities. Selectivity will be critical in navigating the balance between innovation and credit discipline.

Securitized Products

Monthly Review

Interest rates rallied in August, leading to a notable steepening of the yield curve. This shift was driven by two weaker-than-expected U.S. jobs reports, which prompted markets to price in three rate cuts for 2025—up from two the previous month—with the first expected in September. U.S. Treasury yields responded accordingly, with the 2-year falling 34 bps to 3.62% and the 10-year dropping 28 bps from 4.23%. Current coupon agency MBS spreads tightened materially, narrowing by 9 bps to +136 over comparable-duration Treasuries. Despite this move, agency MBS spreads remain wide relative to other core fixed income sectors and historical norms. The Federal Reserve’s MBS holdings declined by $25 billion to $2.095 trillion, marking a $608 billion reduction from their 2022 peak. U.S. bank holdings were unchanged at $2.681 trillion, though expectations for increased holdings are rising as SLR easing and lower short-term rates take effect. Money managers continued to be the primary buyers of MBS, attracted by cheaper valuations.

Securitized credit spreads tightened more than those in other fixed income sectors, though performance was broadly in line due to the shorter duration profile of the asset class. Issuance slowed slightly in August due to seasonal factors, but deals were well-subscribed and easily absorbed by the market. U.S. ABS issuance totaled $18.7 billion, keeping pace with year-to-date volumes from 2024. Non-agency CMBS issuance reached $10.3 billion—its second-highest August total since 2016—and is tracking 42% higher year-over-year. Non-agency RMBS issuance came in at $14.1 billion, slightly above July levels.4 Overall, fixed income returns were strong in August, with longer-duration sectors benefiting most from the rate rally. Securitized credit slightly underperformed relative to other sectors, largely due to its inherently shorter interest rate duration.

Outlook

We remain constructive on U.S. agency MBS spreads, which we expect to continue tightening through September and into Q4. While some spread compression occurred in August, we believe the full extent of tightening will materialize once the Federal Reserve initiates rate cuts later this year as expected. The sector’s attractive return profile—relative to other core fixed income segments and cash alternatives—is likely to draw inflows from both relative value investors and banks, especially as short-term rates decline and regulatory constraints such as SLR ease.

In securitized credit, we expect spreads to remain stable in the near term, pending greater clarity on the economic impact of evolving tariff policies and further tightening in agency MBS spreads. Year-to-date, agency MBS has outperformed corporates, and securitized credit—with its higher carry—has outperformed nearly all other investment-grade fixed income sectors. We anticipate that returns will be primarily driven by cashflow carry in the coming months, supported by attractive yield levels entering September.

However, we remain cautious on certain segments. Current rate levels continue to stress household balance sheets, particularly among lower-income borrowers, which could pressure consumer ABS performance. Commercial real estate also faces headwinds from elevated financing costs. In contrast, residential mortgage credit remains our preferred sector, and we are comfortable extending down the credit spectrum in this space. We remain more selective in lower-rated ABS and CMBS exposures.

Overall, we continue to view agency MBS valuations favorably, especially when compared to investment-grade corporate spreads and historical agency MBS levels. Selectivity and bottom-up credit analysis will be key as we navigate a market shaped by macro uncertainty and evolving policy dynamics.

Featured Insights