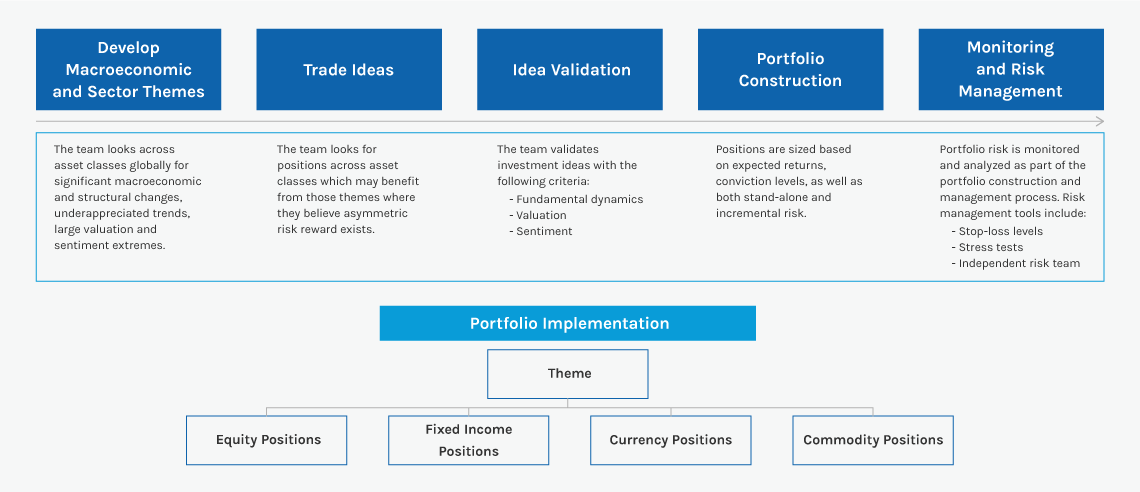

The Global Multi-Asset team Absolute Return Strategy uses a global macro and thematic approach, and invests across equities, fixed income, currencies and commodities. The Strategy seeks to generate a low beta to broad asset classes by taking the majority of risk in uncorrelated, hedged positions. Directional positions are also taken, but on a tactical and opportunistic basis. Rather than individual security selection, the Strategy invests in opportunities at the asset class, country, sector and thematic levels. The research and decision-making process is fundamentally-driven and discretionary, but supported by an extensive quantitative research platform.

The Global Multi-Asset team offers investors access to an investment approach focusing on opportunities arising from macroeconomic changes and structural transformations that have not yet been discounted in valuations. The team’s investment process seeks to identify attractive risk/reward opportunities based on three primary criteria: valuation, fundamental dynamics, and sentiment. The team believes that these three tools are most powerful when used in combination. The team invests in opportunities at the asset class, country, sector and thematic levels, rather than concentrating on individual security selection.