The Core Plus Fixed Income Strategy is a value-oriented fixed income strategy that invests primarily in a diversified mix of U.S. dollar-denominated investment-grade fixed income securities, particularly U.S. government, corporate and securitized assets including commercial mortgage-backed securities (CMBS), residential mortgage-backed securities (RMBS) and asset-backed securities (ABS). The strategy also has the flexibility to invest in below investment-grade bonds and non-U.S. dollar denominated bonds and currencies. To help achieve its objective, the strategy combines top-down macro and asset allocation views with rigorous bottom-up fundamental and quantitative analysis that guides team’s active management decisions.

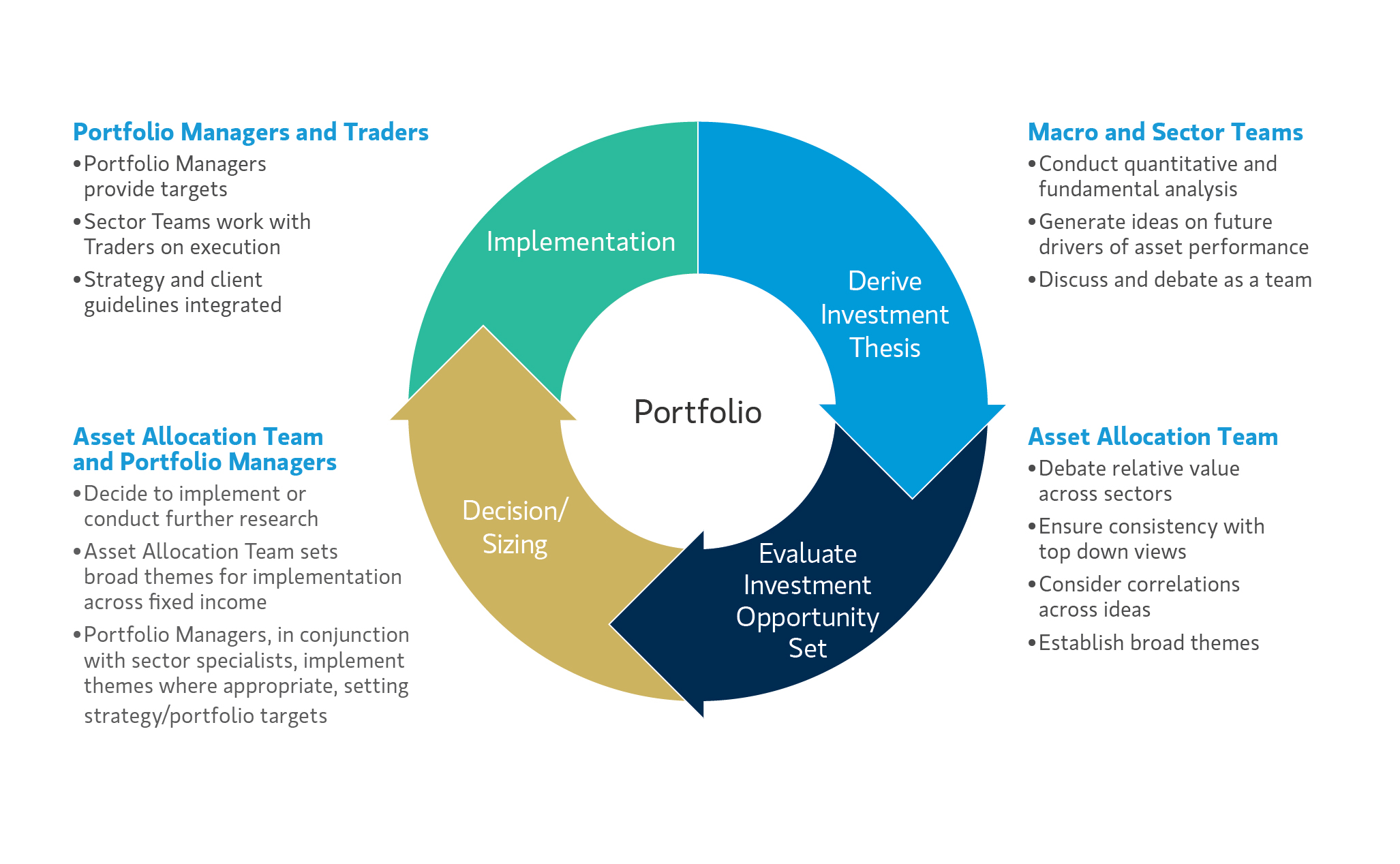

The team seeks to determine what themes are driving asset prices across rates, countries and currencies and to evaluate the investment opportunity set based on a thematic investment thesis. The top-down process uses a combination of fundamental and quantitative analysis to identify and evaluate these investment opportunities.