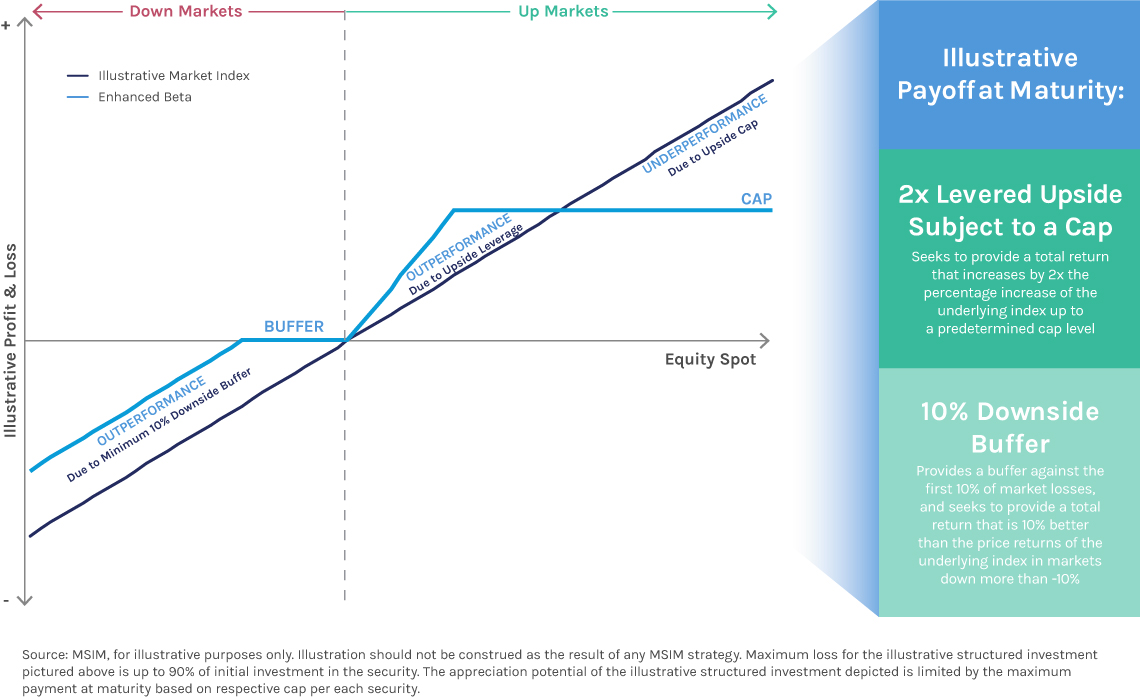

The Defensive European Large Cap Core Equity Strategy invests in structured investments with leveraged upside (within a range of performance) and a minimum 10% downside buffer (the “leveraged upside securities”). An investment in the leveraged upside securities involves significant risks. We urge you to consult your investment, legal, tax, accounting and other advisors before you invest in the leveraged upside securities. Investing in the leveraged upside securities is not equivalent to investing directly in the underlier or any of the securities composing the underlier. Some of the risks that apply to an investment in the leveraged upside securities are summarized below, but we urge you to read the more detailed explanation of risks relating to the leveraged upside securities generally in the “Risk Factors” section of a leveraged upside securities prospectus supplement. You should not purchase the leveraged upside securities unless you understand and can bear the risks of investing in the leveraged upside securities.

The structured investments do not pay interest and provide a minimum payment at maturity of only 10% of your principal. The terms of the structured investments differ from those of ordinary debt securities in that the structured investments do not pay interest and provide a minimum payment at maturity of only 10% of your principal. If the final underlier value is less than the initial underlier value by more than the buffer amount of 10%, the payment at maturity will be an amount in cash that is less than the stated principal amount of each structured investments by a percentage equal to the percentage decrease from the initial underlier value to the final underlier value beyond the buffer amount. You may lose up to 90% of your initial investment in the structured investments.

The appreciation potential of the structured investments is limited by the maximum payment at maturity. The appreciation potential of the structured investments is limited by the maximum payment at maturity based on respective cap per each structured investments. The actual maximum payment at maturity will be determined on the pricing date. Although the leverage factor provides 200% exposure to any increase in the final underlier value as compared to the initial underlier value, because the payment at maturity will be limited to at least a max return of the stated principal amount for the structured investments, any increase in the final underlier value as compared to the initial underlier value by more than the cap (in the case where the maximum payment at maturity is a capped percentage of the stated principal amount) of the initial underlier value will not further increase the return on the structured investments.

Credit of issuer. The structured investments are unsecured and unsubordinated debt obligations of the issuer, and are not, either directly or indirectly, an obligation of any third party. Any payment to be made on the structured investments, including any repayment of principal, is subject to the ability of each issuer to satisfy its obligations as they come due and is not guaranteed by any third party. As a result, the actual and perceived creditworthiness of the issuer may affect the market value of the structured investments and, in the event the issuer were to default on its obligations, you might not receive any amount owed to you under the terms of the structured investments.

Investing in the structured investments is not equivalent to investing in the underlier or the securities composing the underlier. Investors in the structured investments will not have voting rights or rights to receive dividends or other distributions or any other rights with respect to the securities composing the underlier.

The structured investments will not be listed on any securities exchange, and secondary trading may be limited. The issuers intend to offer to purchase the structured investments in the secondary market but are not required to do so and may cease any such market making activities at any time, without notice. Even if a secondary market develops, it may not provide enough liquidity to allow you to trade or sell the structured investments easily. Because other dealers are not likely to make a secondary market for the structured investments, the price, if any, at which you may be able to trade your structured investments is likely to depend on the price, if any, at which the issuers are willing to buy the structured investments. In addition, the issuer may at any time hold an unsold portion of the structured investments which may inhibit the development of a secondary market for the structured investments. The structured investments are not designed to be short-term trading instruments. Accordingly, you should be willing and able to hold your structured investments to maturity.

The final underlier value is not based on the value of the underlier at any time other than the valuation date. The final underlier value will be based solely on the closing level of the underlier on the valuation date and the payment at maturity will be based solely on the final underlier value as compared to the initial underlier value. Therefore, if the value of the underlier has declined as of the valuation date, the payment at maturity, if any, may be significantly less than it would otherwise have been had the final underlier value been determined at a time prior to such decline or after the value of the underlier has recovered. Although the value of the underlier on the maturity date or at other times during the term of your structured investments may be higher than the closing level of the underlier on the valuation date, you will not benefit from the value of the underlier at any time other than on the valuation date.

Adjustments to the underlier could adversely affect the value of the structured investments. The sponsor of the underlier may add, delete, substitute or adjust the securities composing the underlier or make other methodological changes to the underlier that could affect its performance. The calculation agent will calculate the value to be used as the closing level of the underlier in the event of certain material changes in or modifications to the underlier. In addition, the sponsor of the underlier may also discontinue or suspend calculation or publication of the underlier at any time. Under these circumstances, the calculation agent may select a successor index that the calculation agent determines to be comparable to the underlier or, if no successor index is available, the calculation agent will determine the value to be used as the closing level of the underlier. Any of these actions could adversely affect the value of the underlier and, consequently, the value of the structured investments.

Hedging and trading activity by the issuer and its affiliates could potentially adversely affect the value of the structured investments. The hedging or trading activities of the issuer’s affiliates and of any other hedging counterparty with respect to the structured investments on or prior to the pricing date and prior to maturity could adversely affect the value of the underlier and, as a result, could decrease the amount an investor may receive on the structured investments at maturity. Any of these hedging or trading activities on or prior to the pricing date could potentially increase the initial underlier value and, therefore, the value at or above which the underlier must close on the valuation date so that the investor does not suffer a loss on their initial investment in the structured investments. Additionally, such hedging or trading activities during the term of the structured investments, including on the valuation date, could potentially affect the value of the underlier on the valuation date and, accordingly, the amount of cash an investor will receive at maturity, if any.

The market price of the structured investments will be influenced by many unpredictable factors. Several factors will influence the value of the structured investments in the secondary market and the price at which the issuer may be willing to purchase or sell the structured investments in the secondary market. Although we expect that generally the value of the underlier on any day will affect the value of the structured investments more than any other single factor, other factors that may influence the value of the structured investments include:

- the volatility (frequency and magnitude of changes in value) of the underlier;

- dividend rates on the securities composing the underlier;

- interest and yield rates in the market;

- time remaining until the structured investments mature;

- supply and demand for the structured investments;

- geopolitical conditions and economic, financial, political, regulatory and judicial events that affect the securities composing the underlier and that may affect the final underlier value; and

- any actual or anticipated changes in our credit ratings or credit spreads.

The value of the underlier may be, and has recently been, volatile, and we can give you no assurance that the volatility will lessen. You may receive less, and possibly significantly less, than the stated principal amount per structured investments if you try to sell your structured investments prior to maturity.

The estimated value of your structured investments is expected to be lower than the initial issue price of your structured investments. The estimated value of your structured investments on the pricing date is expected to be lower, and may be significantly lower, than the initial issue price of your structured investments. The difference between the initial issue price of your structured investments and the estimated value of the structured investments is expected as a result of certain factors, including the estimated cost that the issuer may incur in hedging its obligations under the structured investments, and estimated development and other costs that may be incurred in connection with the structured investments.

The estimated value of your structured investments might be lower if such estimated value were based on the levels at which our debt securities trade in the secondary market. The estimated value of your structured investments on the pricing date is based on a number of variables, including internal funding rates. Internal funding rates may vary from the levels at which benchmark debt securities trade in the secondary market. As a result of this difference, the estimated values referenced above might be lower if such estimated values were based on the levels at which benchmark debt securities trade in the secondary market.

The estimated value of the structured investments is based on internal pricing models, which may prove to be inaccurate and may be different from the pricing models of other financial institutions. As a result, the secondary market price of your structured investments may be materially different from the estimated value of the structured investments determined by reference to internal pricing models.

The estimated value of your structured investments is not a prediction of the prices at which you may sell your structured investments in the secondary market, if any, and such secondary market prices, if any, will likely be lower than the initial issue price of your structured investments and may be lower than the estimated value of your structured investments. The price at which you may be able to sell your structured investments in the secondary market at any time will be influenced by many factors that cannot be predicted, such as market conditions, and any bid and ask spread for similar sized trades, and may be substantially less than our estimated value of the structured investments. As a result, the price at which the issuer may be willing to purchase the structured investments from you in secondary market transactions, if any, will likely be lower than the price you paid for your structured investments, and any sale prior to the maturity date could result in a substantial loss to you.

The temporary price at which we may initially buy the structured investments in the secondary market and the value we may initially use for customer account statements, if we provide any customer account statements at all, may not be indicative of future prices of your structured investments.

The U.S. federal income tax consequences of an investment in the structured investments are uncertain. There is no direct legal authority regarding the proper U.S. federal income tax treatment of the structured investments, and we do not plan to request a ruling from the Internal Revenue Service (the “IRS”). Consequently, significant aspects of the tax treatment of the structured investments are uncertain, and the IRS or a court might not agree with the treatment of the structured investments as described by the issuer in the relevant offering documents. If the IRS were successful in asserting an alternative treatment for the structured investments, the tax consequences of the ownership and disposition of the structured investments could be materially and adversely affected. In addition, in 2007 the Treasury Department and the IRS released a notice requesting comments on various issues regarding the U.S. federal income tax treatment of “prepaid forward contracts” and similar instruments. Any Treasury regulations or other guidance promulgated after consideration of these issues could materially and adversely affect the tax consequences of an investment in the structured investments, possibly with retroactive effect.