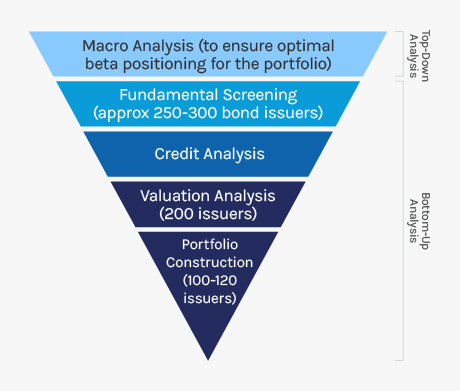

The European Credit Strategy is a value-oriented fixed income strategy that seeks attractive total returns from income and price appreciation by investing in a globally diversified portfolio of primarily euro-denominated debt issued by corporations and nongovernment related issuers. To help achieve this objective, the strategy combines a top-down macroeconomic assessment, to determine optimal beta positioning for the portfolio, with rigorous bottom-up fundamental analysis.

The process begins with a top-down value assessment of the corporate bond universe, including a consideration of macroeconomic conditions, the corporate earnings environment and relative valuations.