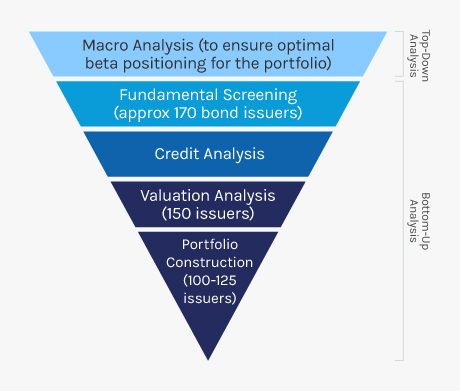

The European High Yield Bond Strategy is a value-oriented fixed income strategy that seeks attractive returns through investing in a diversified portfolio of primarily high yielding fixed income securities. The team invests primarily in euro-denominated debt issued by corporations that offer a yield above that generally available on Investment-Grade debt securities. To help achieve its objective, the strategy combines a top-down macroeconomic assessment, to determine optimal beta positioning for the portfolio, with rigorous bottom-up fundamental analysis.

The team begins with an assessment on the optimal beta positioning for the portfolio based on valuations and a top-down macroeconomic analysis.