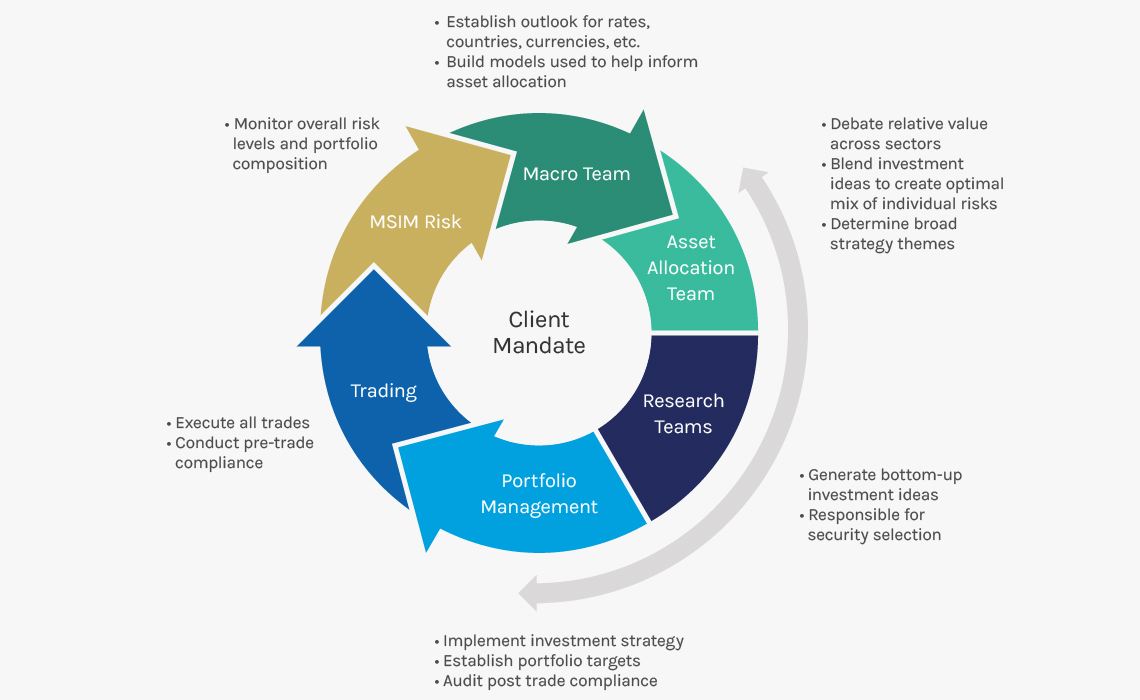

The Global Aggregate Fixed Income Strategy seeks attractive total returns from income and price appreciation by investing in a globally diversified portfolio of multi-currency debt issued by government and non-government issuers. To help achieve this objective, the strategy combines a top-down macroeconomic assessment, to determine optimal beta positioning for the portfolio, with rigorous bottom-up fundamental analysis and active currency management (where appropriate).

The team seeks to determine what themes are driving asset prices across rates, countries and currencies and to evaluate the investment opportunity set based on a thematic investment thesis. The top-down process uses a combination of fundamental and quantitative analysis to identify and evaluate these investment opportunities.