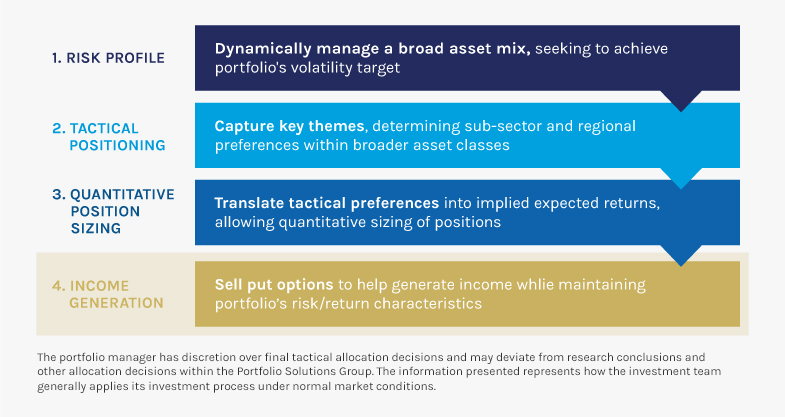

The Morgan Stanley Global Balanced Income (GBI) Strategy follows a top-down global asset allocation approach, investing in equities, fixed income, commodity-linked investments and cash, within a clearly-defined, risk-controlled framework. It aims to provide capital growth over time, while actively managing total portfolio risk, which we define in terms of volatility or value-at-risk (VaR).

The feature that distinguishes this Strategy from others managed by the Portfolio Solutions Group is that it targets an attractive, stable income of 4%* per annum. In pursuit of this goal, the team sells put options on major equity indexes to help enhance the Strategy’s income generation.