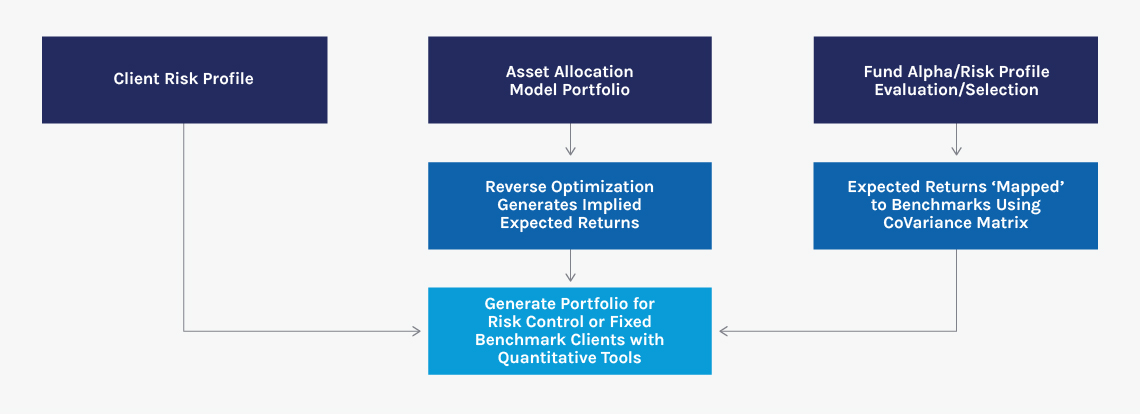

The Global Balanced Risk Control (GBaR): Fixed Weight Benchmark Strategy applies an integrated approach to global balanced investing within a risk-controlled framework. The Strategy aims to manage portfolio tracking error risk around a client specified, fixed weight asset allocation benchmark while simultaneously seeking to enhance returns from tactical insights on global markets. The team uses its top-down research process, involving fundamental and quantitative analysis across asset classes, to determine active positions.

All GBaR mandates are customisable to help meet client objectives regarding specified benchmark, targeted risk, investment restrictions, and other requirements. Once the portfolio’s benchmark has been determined, the team dynamically manages a broad asset mix to help meet the portfolio tracking error risk target.