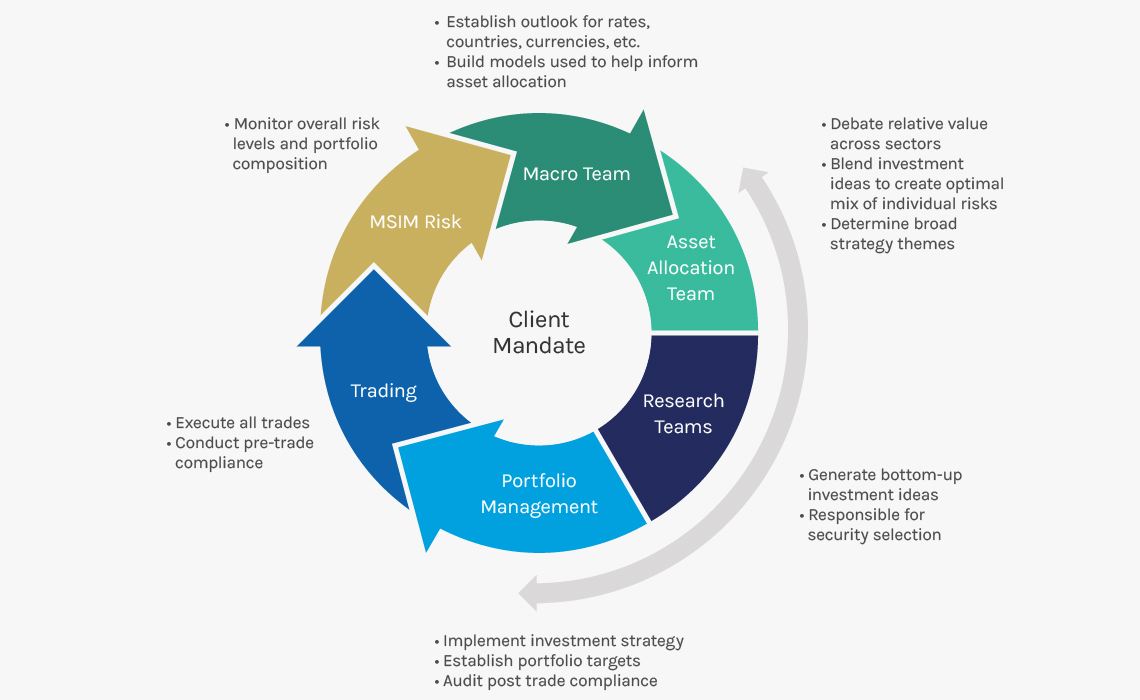

The Global Convertible Bond Strategy is designed to take advantage of the attractive risk/return characteristics of convertible bonds by allowing meaningful participation in equity market growth while attempting to manage downside risk through fixed income. The strategy combines top-down macroeconomic analysis with rigorous bottom-up fundamental research to help mitigate credit risk.

The process begins with a top-down analysis of the macroeconomic environment to determine the portfolio’s target equity sensitivity or delta. The team uses both proprietary and third-party macroeconomic research and asset class analysis to evaluate economic indicators, market dynamics and relative valuations.