The Morgan Stanley Global Fixed Income Opportunities Strategy is a value-oriented fixed income strategy that seeks total return including a high level of current income by investing across the fixed income asset spectrum, inclusive of investment-grade and high-yield credit, convertible bonds, securitized assets including mortgage- and asset-backed securities, and developed and emerging market sovereign debt. To help achieve this objective, the strategy combines a top-down macroeconomic assessment, to determine optimal beta positioning for the portfolio, with rigorous bottom-up fundamental analysis and active currency management.

Global Fixed Income Opportunities Strategy

Quick Facts

- Overview

- Investment Approach

- Investment Process

- Portfolio Managers

- Insights

We deliver our fixed income expertise in a customized, solutions based approach that seeks to optimize the application of our global resources to the investment objectives of the individual client. Our team is client-centric in all aspects of the relationship.

As a nimble, midsize manager with a collaborative structure based on small teams of sector specialists, we are able to confidently implement differentiated investment themes across portfolios.

Our culture of collaboration across fixed income teams in New York, London, Singapore and Tokyo enables us to take a truly global approach in identifying opportunities to capture returns in major markets worldwide.

We have been investing in fixed income assets since 1975 and have developed an intensive risk management framework that includes daily monitoring to ensure compliance with guidelines and to quantify portfolio risk exposures. At the firm level, our risk management team operates independently of business functions, which we believe provides us with a critical system of checks and balances.

Investment Approach

The investment team believes that markets can be inefficient and by performing rigorous analysis, the team can position portfolios appropriately to add value over time. Bond prices reflect market forecasts for a variety of factors, such as economic growth, inflation, monetary policy, credit risk, and prepayment risk; yet markets tend to be poor forecasters of future events, especially when the implied market forecasts are out of line relative to historic trends. They seek to identify these mispricings and position client portfolios to exploit the value inherent in these opportunities.

The team believes that successful portfolio management depends on four factors:

- Global Perspective

- A Value-Driven Process

- Diversified Holdings

- Deep Fundamental Research

Investment Process

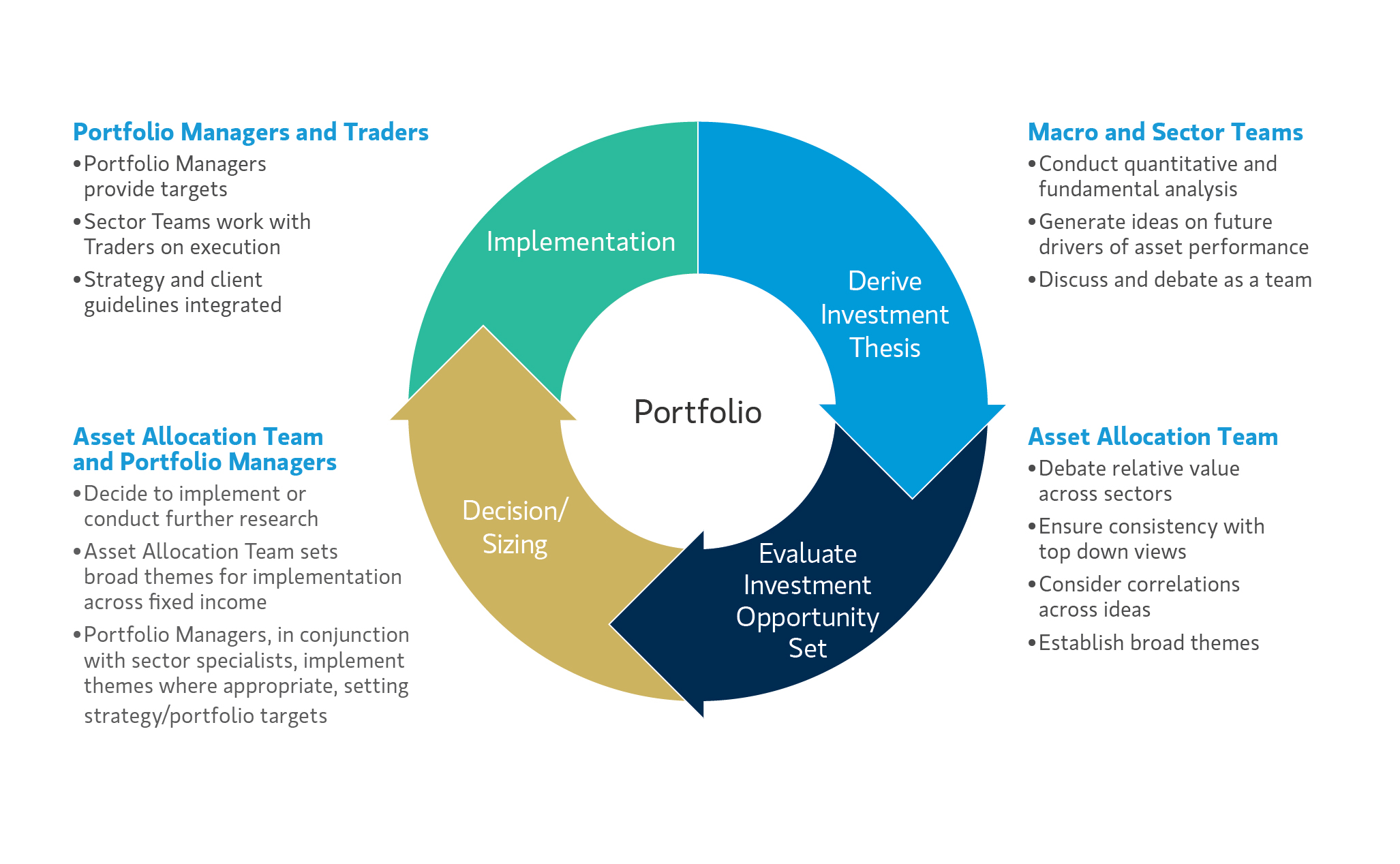

Top-down macro analysis integrated with rigorous fundamental analysis helps provide optimal portfolio positioning

Portfolio Managers

Effective 31 December 2025, Michael Kushma is no longer serving as Portfolio Manager for the Portfolio.

Team Insights

^ The information presented how the portfolio management team generally implements its investment process under normal market conditions.

RISK CONSIDERATIONS

Diversification does not eliminate the risk of loss.

There is no assurance that a portfolio will achieve its investment objective. Portfolios are subject to market risk, which is the possibility that the market value of securities owned by the portfolio will decline. Market values can change daily due to economic and other events (e.g. natural disasters, health crises, terrorism, conflicts and social unrest) that affect markets, countries, companies or governments. It is difficult to predict the timing, duration, and potential adverse effects (e.g. portfolio liquidity) of events. Accordingly, you can lose money investing in this portfolio. Please be aware that this portfolio may be subject to certain additional risks. Fixed-income securities are subject to the ability of an issuer to make timely principal and interest payments (credit risk), changes in interest rates (interest-rate risk), the creditworthiness of the issuer and general market liquidity (market risk). In a rising interest-rate environment, bond prices may fall and may result in periods of volatility and increased portfolio redemptions. In a declining interest-rate environment, the portfolio may generate less income. Longer-term securities may be more sensitive to interest rate changes. Mortgage- and asset-backed securities are sensitive to early prepayment risk and a higher risk of default and may be hard to value and difficult to sell (liquidity risk). They are also subject to credit, market and interest rate risks. Some U.S. Government securities are not backed by the full faith and credit of the U.S., thus these issuers may not be able to meet their future payment obligations. High yield securities (“junk bonds”) are lower rated securities that may have a higher degree of credit and liquidity risk. In addition to the risks associated with common stocks, investments in convertible securities are subject to the risks associated with fixed-income securities, namely credit, price and interest-rate risks. Public bank loans are subject to liquidity risk and the credit risks of lower rated securities. Foreign securitiesare subject to currency, political, economic and market risks. The risks of investing in emerging market countries are greater than risks associated with investments in foreign developed countries. Sovereign debt securities are subject to default risk. Derivative instruments can be illiquid, may disproportionately increase losses and may have a potentially large negative impact on the portfolio’s performance. Restricted and illiquid securities may be more difficult to sell and value than publicly traded securities (liquidity risk). Collateralized mortgage obligations can have unpredictable cash flows that can increase the risk of loss.

Risk management implies an effort to monitor risk, but should not be confused with and does not imply low risk. No assurances can be given that the Strategies risk management and monitoring approaches will be successful.

This communication is only intended for and will be only distributed to persons resident in jurisdictions where such distribution or availability would not be contrary to local laws or regulations.

There is no guarantee that any investment strategy will work under all market conditions, and each investor should evaluate their ability to invest for the long-term, especially during periods of downturn in the market. Past performance is no guarantee of future results.

A separately managed account may not be appropriate for all investors. Separate accounts managed according to the Strategy include a number of securities and will not necessarily track the performance of any index. Please consider the investment objectives, risks and fees of the Strategy carefully before investing. A minimum asset level is required. For important information about the investment manager, please refer to Form ADV Part 2.

Any views and opinions provided are those of the portfolio management team and are subject to change at any time due to market or economic conditions and may not necessarily come to pass. Furthermore, the views will not be updated or otherwise revised to reflect information that subsequently becomes available or circumstances existing, or changes occurring. The views expressed do not reflect the opinions of all portfolio managers at Morgan Stanley Investment Management (MSIM) or the views of the firm as a whole, and may not be reflected in all the strategies and products that the Firm offers.

All information provided has been prepared solely for information purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy. The information herein has not been based on a consideration of any individual investor circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal or regulatory advice. To that end, investors should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.

This material is a general communication, which is not impartial and all information provided has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy. The information herein has not been based on a consideration of any individual investor circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal or regulatory advice. To that end, investors should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.

OTHER CONSIDERATIONS

The indexes are unmanaged and do not include any expenses, fees or sales charges. It is not possible to invest directly in an index. Any index referred to herein is the intellectual property (including registered trademarks) of the applicable licensor. Any product based on an index is in no way sponsored, endorsed, sold or promoted by the applicable licensor and it shall not have any liability with respect thereto.

The Bloomberg Global Aggregate Hedged USD Index provides a broad-based measure of the global investment-grade, fixed rate debt markets. Total Returns shown is hedged USD. The index is unmanaged and does not include any expenses, fees or sales charges. It is not possible to invest directly in an index.

“Bloomberg®” and the Bloomberg Index/Indices used are service marks of Bloomberg Finance L.P. and its affiliates, and have been licensed for use for certain purposes by Morgan Stanley Investment Management (MSIM). Bloomberg is not affiliated with MSIM, does not approve, endorse, review, or recommend any product, and. does not guarantee the timeliness, accurateness, or completeness of any data or information relating to any product.

The information presented represents how the portfolio management team generally implements its investment process under normal market conditions.

Morgan Stanley Investment Management is the asset management division of Morgan Stanley.