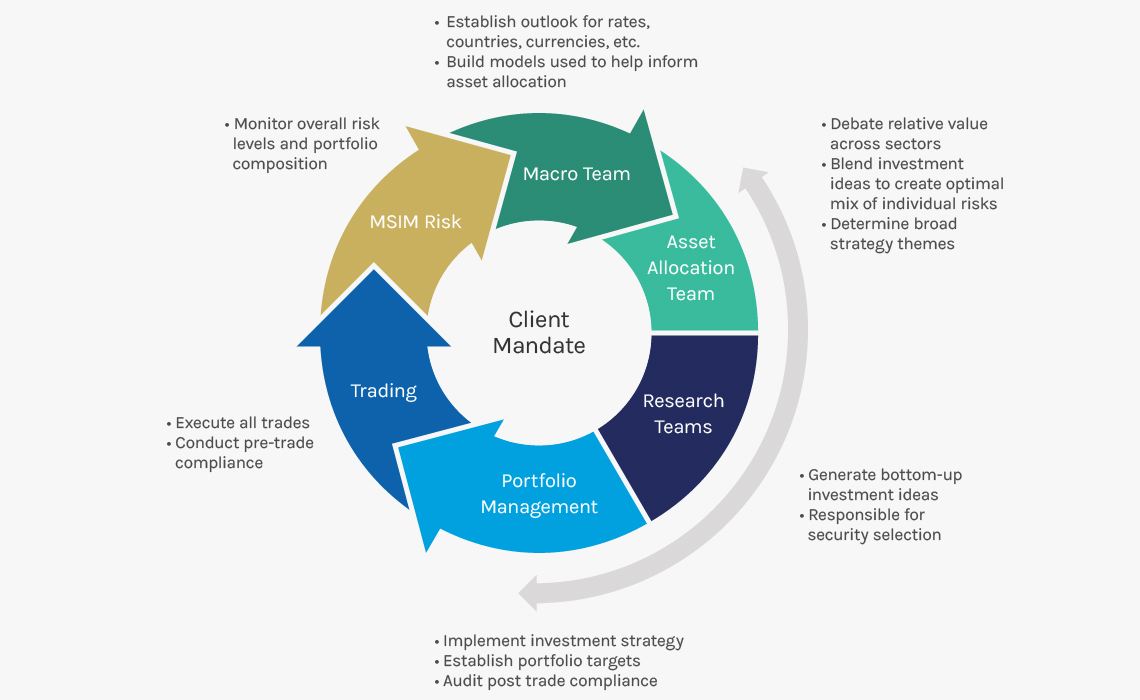

The Global Premier Credit Strategy is a differentiated approach to investing in global credit. The strategy seeks to exhibit an efficient risk profile, capturing returns from global credits while protecting against excessive business cycle risk in a portfolio. The strategy combines rigorous fundamental analysis with proprietary structural credit models to create a diversified portfolio of high quality businesses.

The team uses quantitative tools and signals to complement their fundamental research and enhance their process. An example of this is the use of Moody’s Credit Edge, an industry leading Merton-based structural model. The output offers the ability to to screen and compare credits, model events and monitor portfolio risk.