RISK CONSIDERATIONS

There is no assurance that a portfolio will achieve its investment objective. Portfolios are subject to market risk, which is the possibility that the market values of securities owned by the portfolio will decline. Market values can change daily due to economic and other events (e.g. natural disasters, health crises, terrorism, conflicts and social unrest) that affect markets, countries, companies or governments. It is difficult to predict the timing, duration, and potential adverse effects (e.g. portfolio liquidity) of events. Accordingly, you can lose money investing in this strategy. Please be aware that this strategy may be subject to certain additional risks. In general, equities securities’ values also fluctuate in response to activities specific to a company. Investments in foreign markets entail special risks such as currency, political, economic, market and liquidity risks. The risks of investing in emerging market countries are greater than the risks generally associated with investments in foreign developed countries. Derivative instruments can be illiquid, may disproportionately increase losses and may have a potentially large negative impact on the portfolio’s performance. Illiquid securities may be more difficult to sell and value than publicly traded securities (liquidity risk). China risk. Investments in China involve risk of a total loss due to government action or inaction. Additionally, the Chinese economy is export-driven and highly reliant on trade. Adverse changes to the economic conditions of its primary trading partners, such as the United States, Japan and South Korea, would adversely impact the Chinese economy and the Fund’s investments. Moreover, a slowdown in other significant economies of the world, such as the United States, the European Union and certain Asian countries, may adversely affect economic growth in China. An economic downturn in China would adversely impact the Portfolio’s investments. Risks of investing through Stock Connect. Any investments in A-shares listed and traded through Stock Connect, or on such other stock exchanges in China which participate in Stock Connect is subject to a number of restrictions that may affect the Portfolio's investments and returns. Moreover, Stock Connect A shares generally may not be sold, purchased or otherwise transferred other than through Stock Connect in accordance with applicable rules. The Stock Connect program may be subject to further interpretation and guidance. There can be no assurance as to the program’s continued existence or whether future developments regarding the program may restrict or adversely affect the Portfolio's investments or returns. ESG Strategies that incorporate impact investing and/or Environmental, Social and Governance (ESG) factors could result in relative investment performance deviating from other strategies or broad market benchmarks, depending on whether such sectors or investments are in or out of favor in the market. As a result, there is no assurance ESG strategies could result in more favorable investment performance.

This communication is only intended for and will be only distributed to persons resident in jurisdictions where such distribution or availability would not be contrary to local laws or regulations.

There is no guarantee that any investment strategy will work under all market conditions, and each investor should evaluate their ability to invest for the long-term, especially during periods of downturn in the market. Past performance is no guarantee of future results.

A separately managed account may not be appropriate for all investors. Separate accounts managed according to the Strategy include a number of securities and will not necessarily track the performance of any index. Please consider the investment objectives, risks and fees of the Strategy carefully before investing. A minimum asset level is required. For important information about the investment manager, please refer to Form ADV Part 2.

Any views and opinions provided are those of the portfolio management team and are subject to change at any time due to market or economic conditions and may not necessarily come to pass. Furthermore, the views will not be updated or otherwise revised to reflect information that subsequently becomes available or circumstances existing, or changes occurring. The views expressed do not reflect the opinions of all portfolio managers at Morgan Stanley Investment Management (MSIM) or the views of the firm as a whole, and may not be reflected in all the strategies and products that the Firm offers.

All information provided has been prepared solely for information purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy. The information herein has not been based on a consideration of any individual investor circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal or regulatory advice. To that end, investors should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.

This material is a general communication, which is not impartial and all information provided has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy. The information herein has not been based on a consideration of any individual investor circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal or regulatory advice. To that end, investors should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.

OTHER CONSIDERATIONS

The MSCI Emerging Markets Net Index is a free float-adjusted market capitalization weighted index that is designed to measure equity market performance of emerging markets. The term “free float” represents the portion of shares outstanding that are deemed to be available for purchase in the public equity markets by investors. The MSCI Emerging Markets Index currently consists of 24 emerging-market country indices. The performance of the index is listed in U.S. dollars and assumes reinvestment of net dividends.

The indexes are unmanaged and do not include any expenses, fees or sales charges. It is not possible to invest directly in an index. Any index referred to herein is the intellectual property (including registered trademarks) of the applicable licensor. Any product based on an index is in no way sponsored, endorsed, sold or promoted by the applicable licensor and it shall not have any liability with respect thereto.

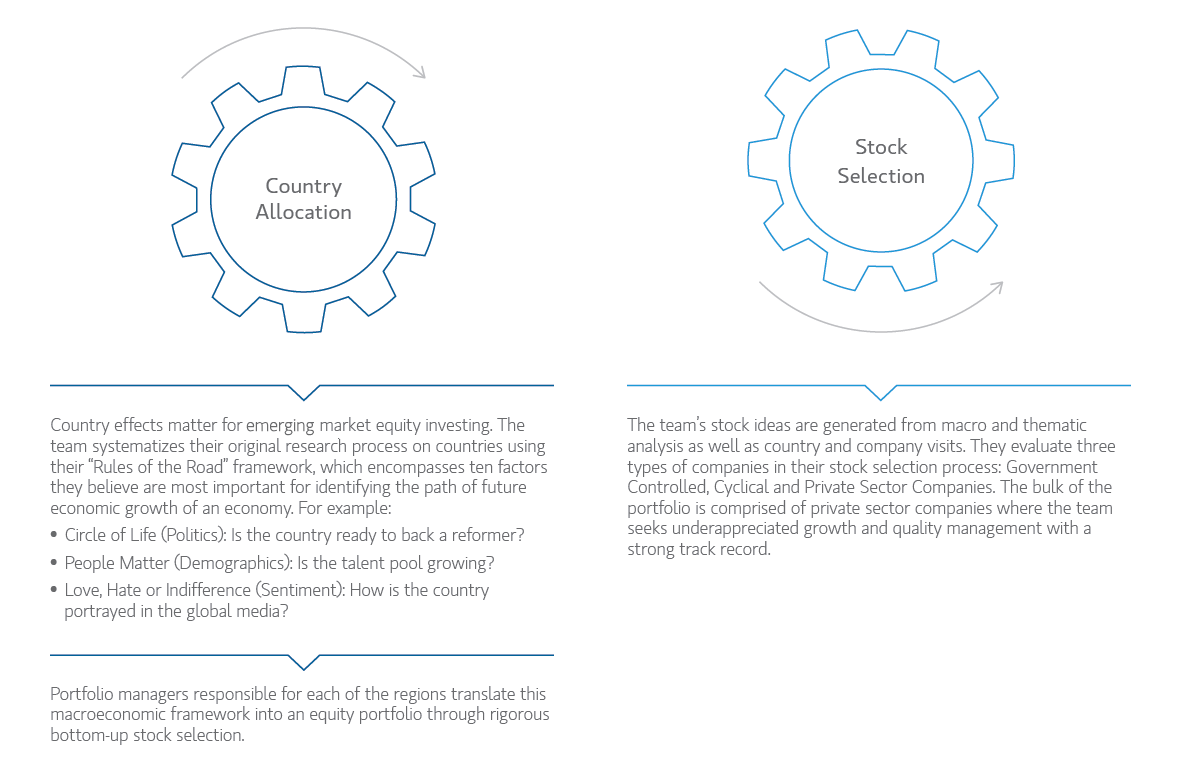

The information presented represents how the portfolio management team generally implements its investment process under normal market conditions.

Morgan Stanley Investment Management is the asset management division of Morgan Stanley.