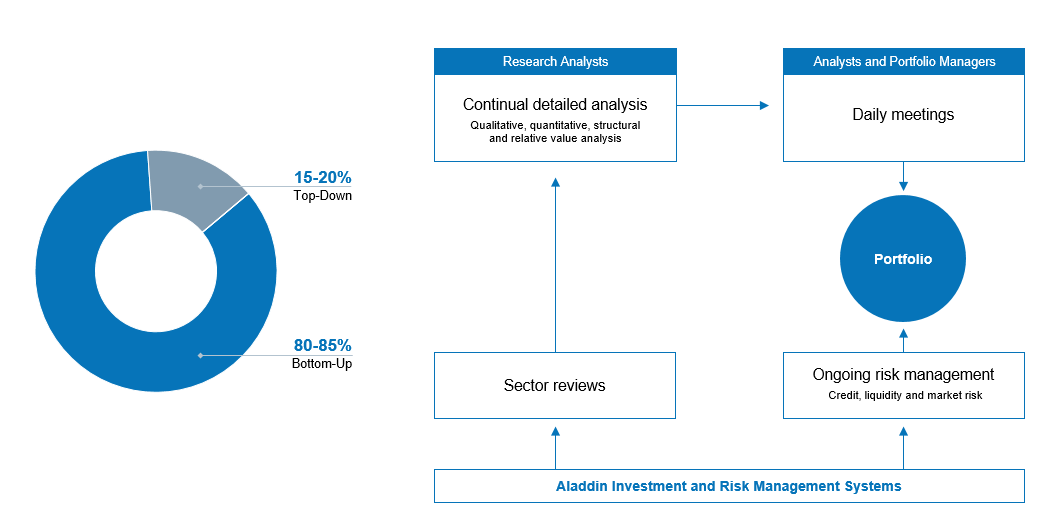

The US Middle Market High Yield Strategy is a value-oriented fixed income strategy that seeks to maximize total returns from income and price appreciation by investing in a diversified portfolio of U.S.-denominated debt issued by corporations and non-government issuers, with a focus on middle market credits, with less than $1 billion of total bonds outstanding. To help achieve this objective, the strategy uses a bottom-up, credit intensive approach that looks for relative value opportunities, integrated with top-down macro analysis.

In order to determine the optimal positioning of the high yield portfolio, the process begins with a top-down, macroeconomic value assessment of the corporate bond universe, including a consideration of macroeconomic conditions, the corporate earnings environment, relative valuations and expectations of future default rates. Sector positioning results from the team's view on the economic cycle and is intended to allow them to focus on those industry sectors that they feel should do best given where they are in the cycle. Sector rotation generally takes place as their view of the economic cycle changes. Input from the Macro and Asset Allocation teams is useful in developing their assessment of broad economic conditions.