The US Limited Duration Strategy seeks current income, preservation of principal and liquidity by investing in a diversified portfolio of securities issued by the U.S. Government and its agencies. To help achieve this objective, the team invests in U.S. Government, corporate bonds, asset-backed and mortgage-backed securities with maturities of less than five years.

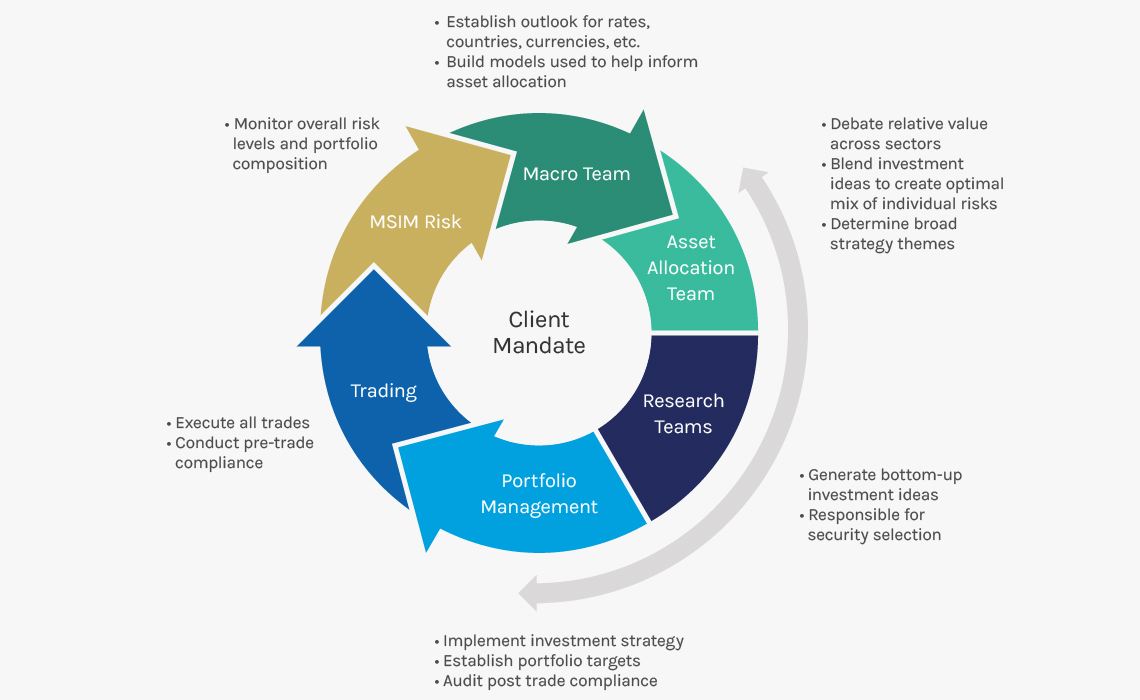

The investment team employs a top-down approach to asset class allocation. The allocation decision starts with macroeconomic analysis. They believe that market participants often misjudge the likely paths of monetary policy, inflation, and credit quality—key paths that, for the most part, are aligned with the business cycle or inflation cycle. The team employs fundamental and quantitative analyses to identify and exploit any mispricing in an effort to generate superior returns over the long term. Mispricing often occurs when market expectations are excessive and unlikely to be realized.