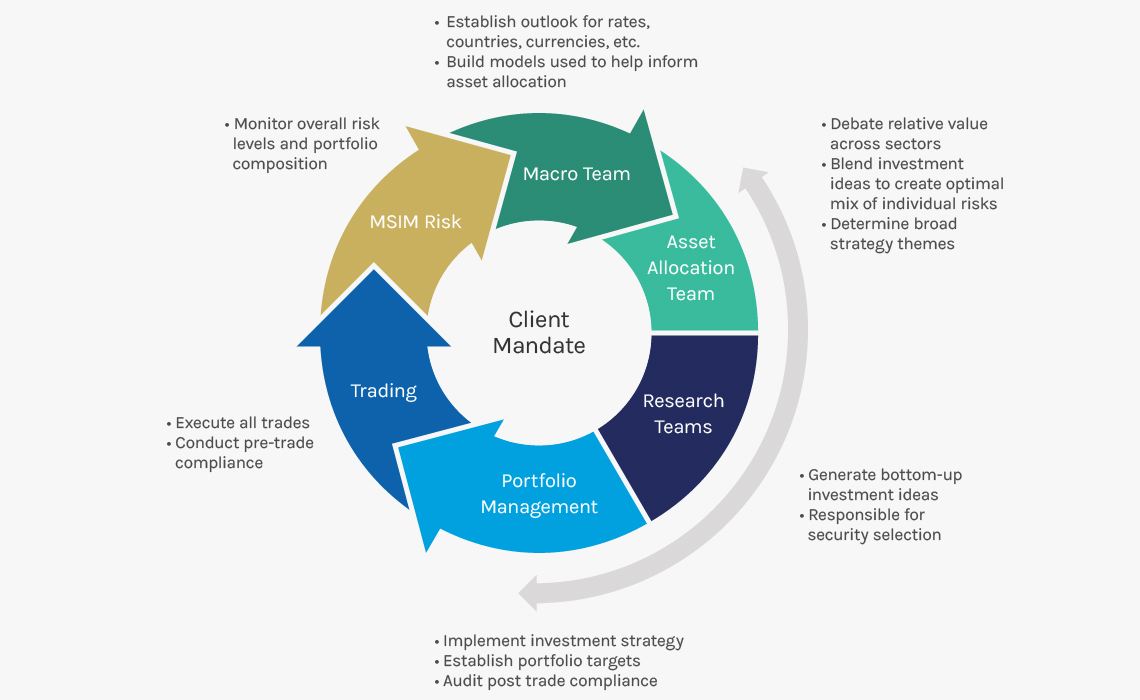

The Morgan Stanley US Mortgage Strategy seeks a high level of current income, by investing in a diversified portfolio of mortgage-related securities. To help achieve this objective, the strategy invests at least 80 percent of its assets in mortgage-related securities such as mortgage pass-through securities, mortgage-backed securities (MBS), asset-backed securities (ABS), collateralized mortgage obligations (CMOs), and commercial mortgage-backed securities (CMBS).

The team is focused on determining where the market stands at each stage of the cycle. To help accomplish this, they evaluate macroeconomic factors such as employment, inflation, corporate/consumer credit and interest rate cycle.