Historically, this quality approach to small-cap investing has delivered attractive risk-adjusted returns, and we believe today’s current valuations point to a compelling, possibly generational, investment opportunity.”

As a young analyst early in my career, I was often accused of “missing the forest for the trees.” I was told that while the micro—understanding businesses—is important, it’s not always enough. Macro factors like economic data, interest rates, geopolitics—and capital flows (benchmark inclusion)—can often overwhelm business fundamentals and equity valuation. While this advice imparts wisdom, at what point has it gone too far?

We believe many investors today focus insufficiently on individual stocks or the construct of the benchmarks they’re investing in. Instead, they are looking at themes, factors and allocations.

In our view, the rise in passive flows and short-term focus have eroded the overall small-cap market.

However, our research shows that quality small caps are now cheaply valued and attractive relative to large caps. Here, we think active management can play a significant role in identifying the quality subset of small caps poised to outperform.

Passive investing and valuation challenges

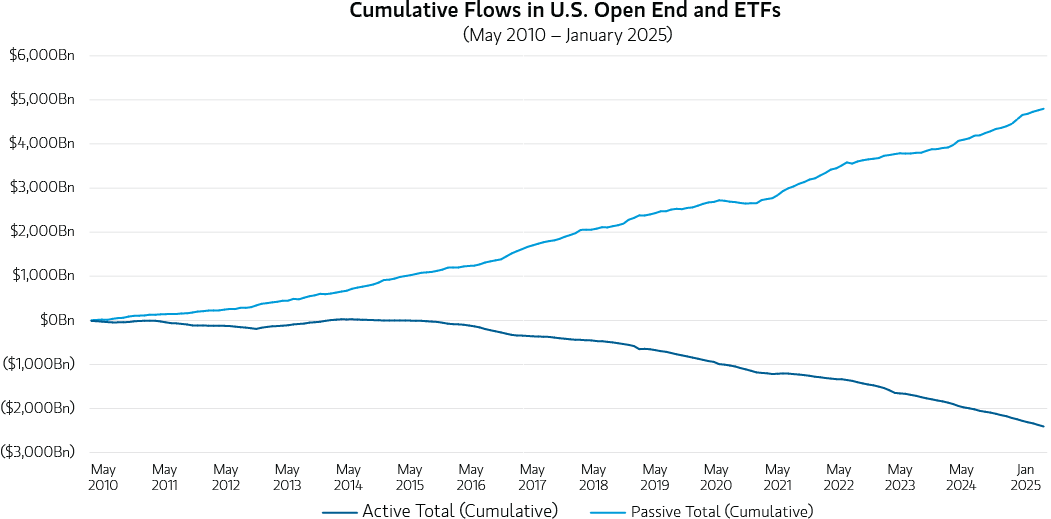

The bulk of equity flows today are into passive vehicles that typically invest in either the forest as a whole or a smaller grove, a subset of a benchmark (Display 1). This approach relies on the “free rider” concept: the idea that if enough participants are valuing each stock accurately, then the overall benchmark will be accurately priced. But as fewer investors look at individual stocks, when do inefficiencies emerge? Many have argued both the positive and negative impacts of passive investing on markets. Few, however, would deny the link between the number of investors independently valuing a business and the quality of that valuation. Crowds have wisdom.

Few are using the “weighing machine”

When investors do buy individual stocks—retail investors in particular—many now use short-dated options, levered single-stock ETFs or thematic funds. These vehicles encourage short-term thinking and less scrutiny of the underlying value of the businesses they're buying. As Benjamin Graham famously said, "In the short run, the stock market is a voting machine. But in the long run, it is a weighing machine." When a short-dated option is used to “invest” in a company, little attention is paid to its long-term prospects. We believe today’s investing environment and new tools have encouraged, if not enticed, many into short-term thinking instead of “stepping on the scale” and focusing long term. The problem for passive strategies is that the forest cannot thrive without healthy trees.

Passive small-cap allocations lack quality control

One of the clearest examples of these issues is in U.S. small caps. Hundreds of billions of dollars are allocated to small-cap index funds despite a deterioration in the quality of many small-cap businesses. The traditional drivers of the small-cap risk premium—early-stage ventures, better growth prospects, higher cyclicality—may still be true for a subset, but the Russell 2000 has many perma-small businesses, unlikely to grow.

Despite small caps’ challenges, passive allocators still want full exposure to the asset class. This has created market distortion, with virtually as much capital flowing to poor quality small companies as great ones. Moreover, when many investors buy small-cap stocks individually, they gravitate to the riskier, lower-quality subset. The meme stock craze of 2021, and its reemergence today, is concentrated in small caps. We believe this focus on the riskier subset of small-cap stocks is misguided.

An active, quality-driven approach is critical

Our work has shown that over the past 30+ years, small caps have had lower returns with more risk than large caps, and we have recommended many times that people not allocate to our asset class, unless they've hired an active manager focused on quality.

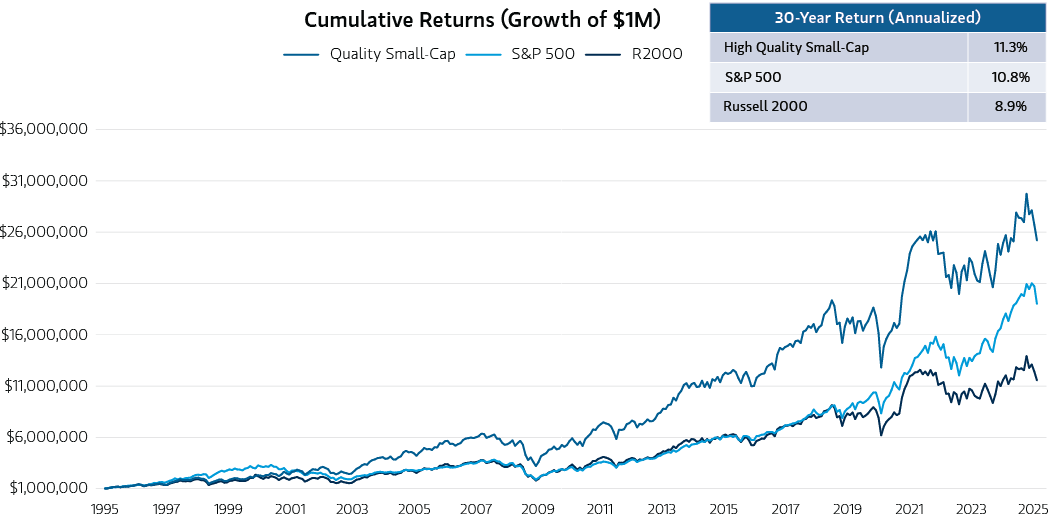

Display 2 shows that a portfolio of quality small-cap stocks can generate superior returns. Over the past 30 years, the higher-quality subset of the Russell 2000® Index, as measured by return on capital, has outperformed both the S&P 500 and broader Russell 2000.

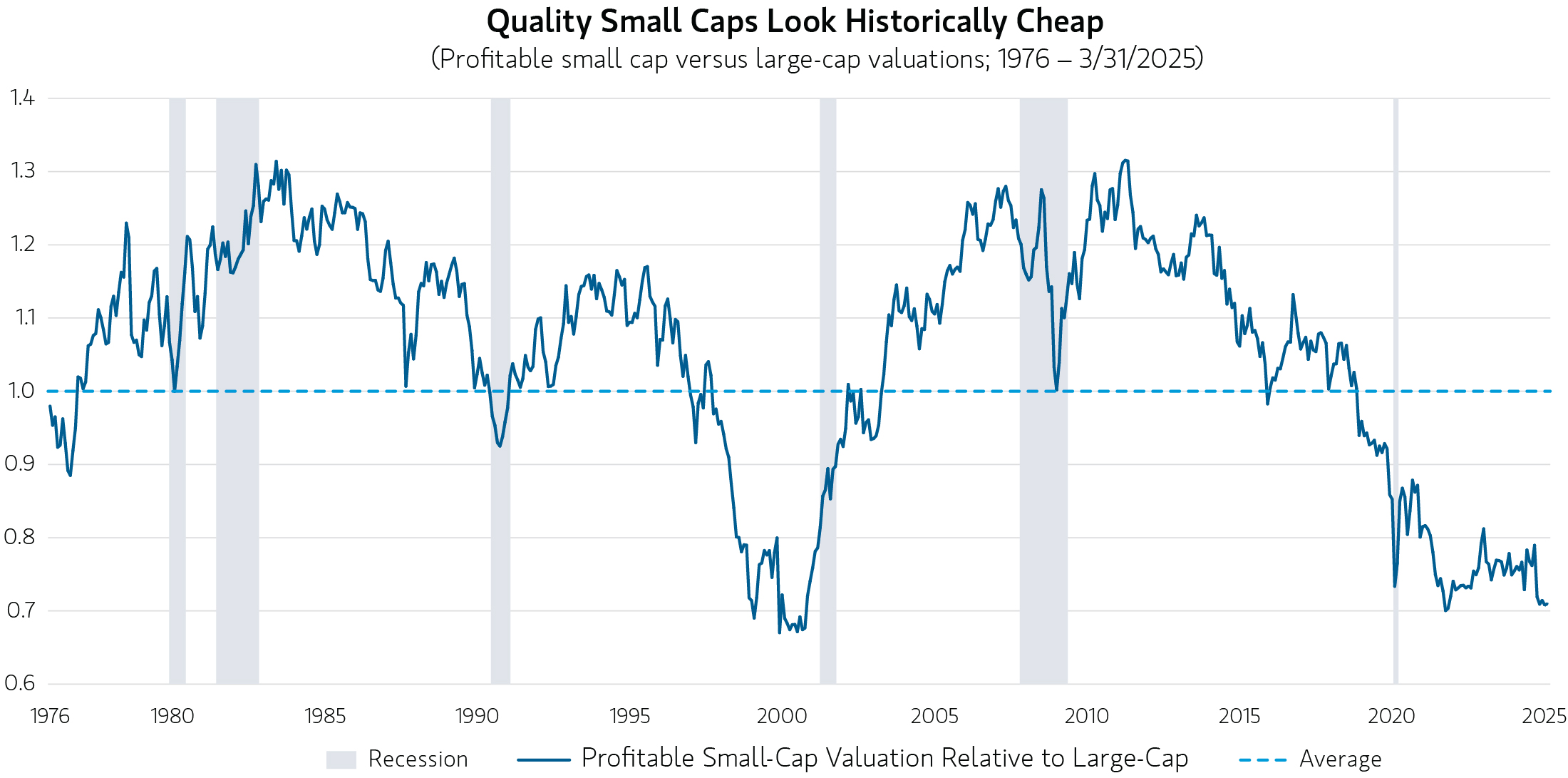

We believe passive investing and lottery-style behavior have led to valuation distortions in small caps. Interestingly, in past story-driven markets—like the Nifty Fifty1 era and the tech bubble—we also saw a relatively low valuation for quality small caps.

Today, however, a significant valuation gap has emerged, with profitable small caps markedly cheaper than large caps, creating a compelling investment opportunity (Display 3).

Bottom line: In our view, the proliferation of new equity investment instruments has encouraged short-termism and weakened investor insight into benchmarks and their diverse, individual components. We believe significant value can be added by investing in differentiated and durable companies. Historically, this quality approach to small-cap investing has delivered attractive risk-adjusted returns, and we believe today’s current valuations point to a compelling, possibly generational, opportunity.

Featured Insights