Health care stocks have underperformed the broader market in 2025, amid pressures from policy uncertainty and company-specific challenges. While traditionally viewed as a resilient and defensive sector, this year so far has proved to be an outlier. Still, the sector’s strong historical performance and powerful secular tailwinds suggest opportunities in health care remain intact.

One of the biggest headwinds for the sector has been political and regulatory uncertainty around the Trump administration’s policies for drug pricing and tariffs—especially affecting pharmaceutical companies. The managed care sub-industry has also been under strain, led by UnitedHealth Group’s ongoing issues, including departure of its CEO, the withdrawal of 2025 guidance, and several investigations.

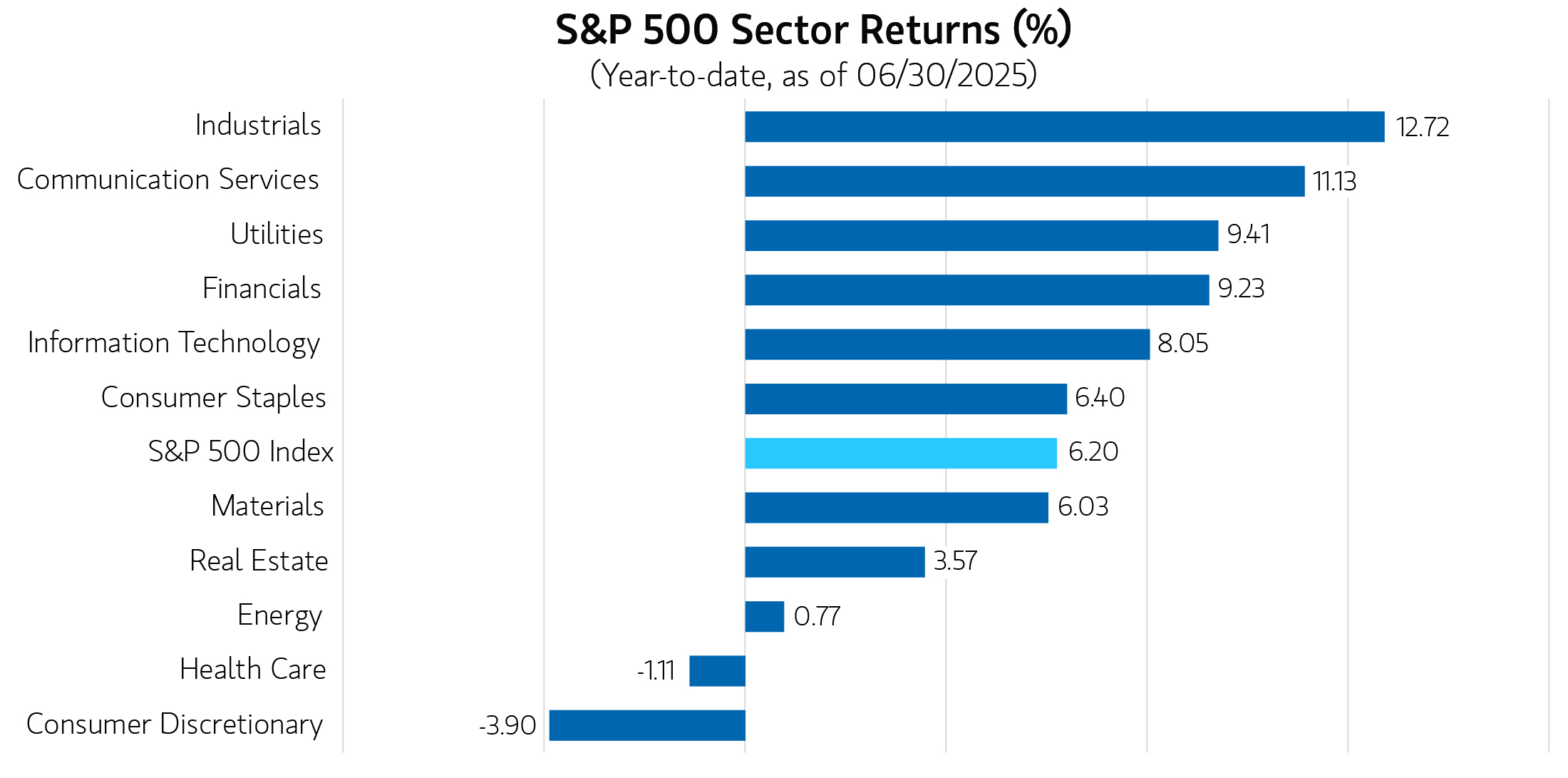

By the end of June, health care stood as the second-worst-performing sector with a year-to-date return of -1.11%, declining alongside consumer discretionary, a more cyclical sector.

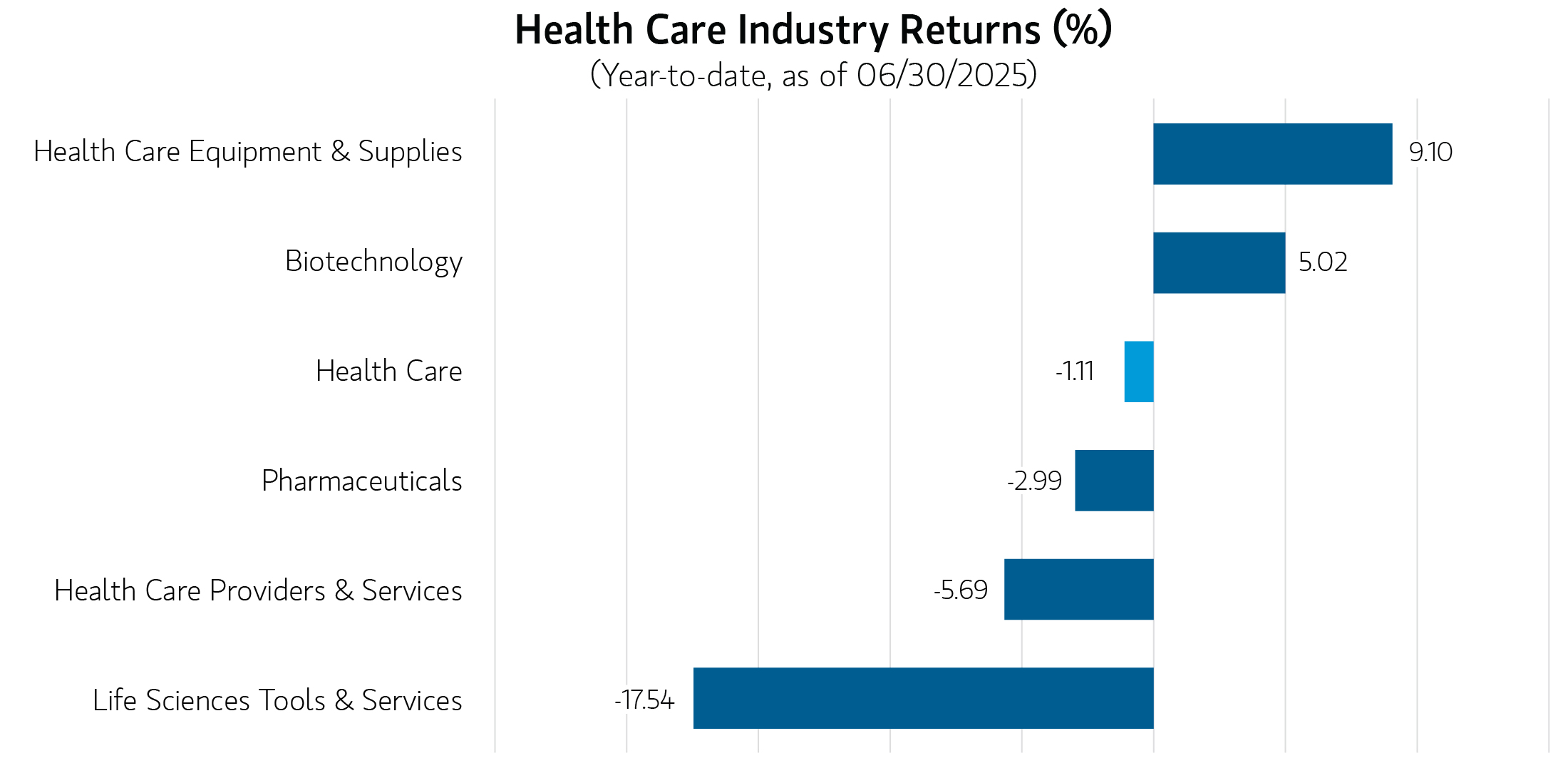

In the life sciences tools and services industry, end markets in China continue to face difficulties, similar to previous years, affecting leaders like Thermo Fisher and Danaher. The chart below illustrates the dispersion of industry returns this year and highlights the areas that have negatively impacted overall sector performance.

Long-term performance and growth drivers

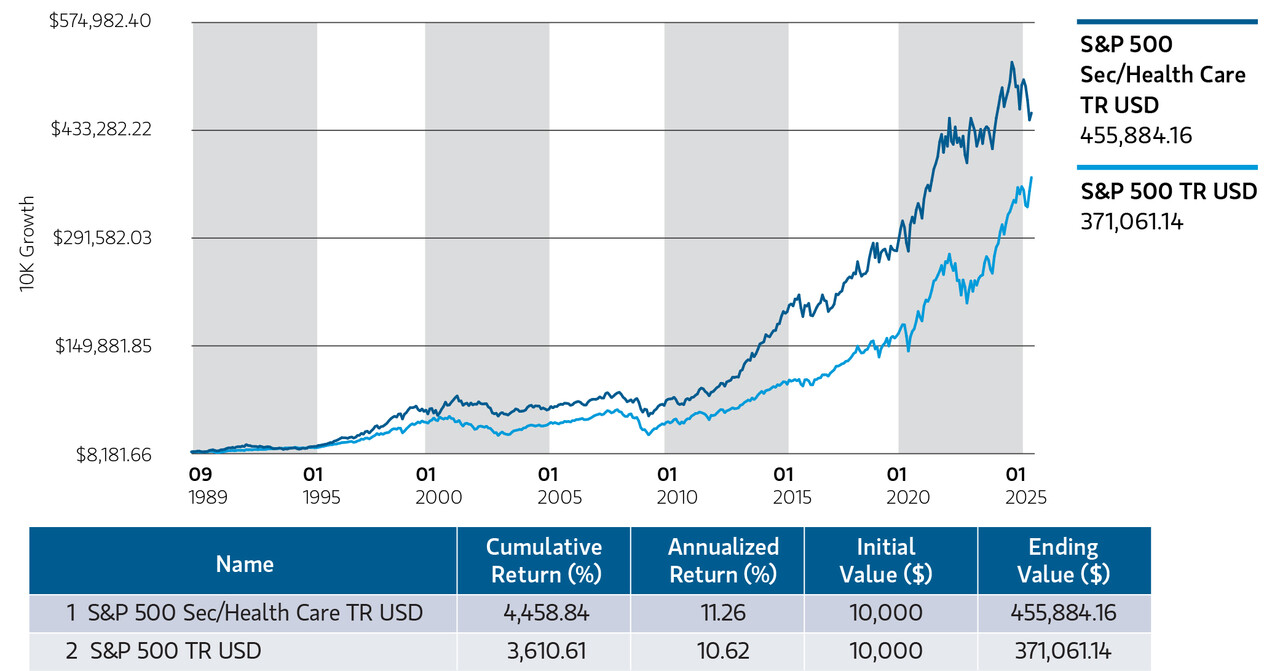

Although some overhangs may persist in the near term, health care’s long-term performance remains compelling. Since its inception in September 1989 through June 30, 2025, the S&P 500 Health Care Index has delivered an annualized return of 11.26%, outperforming the S&P 500 Index’s 10.62% return. This long-term outperformance has led to strong growth of capital over time as seen by the chart below.

Past performance is no guarantee of future results. It is not possible to invest directly in an index.

Source: Morningstar as of 6/30/2025.

DISPLAY 3

Past performance is no guarantee of future results. It is not possible to invest directly in an index.

Source: Morningstar as of 6/30/2025.

Moreover, health care still has powerful long-term growth drivers—most notably, tailwinds from shifting demographics and a steady stream of innovation. In the U.S. and across developed markets, baby boomers are reaching retirement age in large numbers, fueling increased demand for medicine, diagnostics, surgical procedures and hospital services.

On the innovation front, recent breakthroughs in the development of GLP-1 drugs for diabetes and obesity have unlocked a massive, largely untapped global market. Specifically, the number of obese adults is expected to increase to 1.25 billion this decade, while currently only around 562,000 patients worldwide are on anti-obesity medicines (AOMs).1 The AOM market reached a major milestone in 2024, with global spend surpassing $30 billion—marking a tenfold increase since 2020.2 At the same time, advances in robotic-assisted surgery and artificial intelligence (AI)—from drug trial design to commercial efforts—should help improve patient outcomes and support the sector’s long-term revenue potential.

Our “alpha anywhere” approach to health care

Our approach to health care investing focuses on identifying innovative companies with strong franchises across the entire health care system. We aim for a balanced portfolio across industries and geographies, while simultaneously maintaining valuation discipline and risk-awareness. In today’s environment, our focus remains on investing in companies that we believe can be long-term structural winners and are less influenced by policy and regulatory uncertainty.

Bottom line: Despite a range of headwinds in recent years, the health care sector has produced strong historical performance and stands to benefit from powerful secular trends, like AI and an aging demographic. In view of these potential tailwinds, we believe the sector offers investors attractive long-term upside potential.

1 Novo Nordisk, First Quarter 2025 investor presentation.

2 IQVIA, “Outlook for obesity in 2025: more than a transition year,” by Markus Gores, VP, EMEA Thought Leadership and Sarah Rickwood, VP, EMEA Thought Leadership. January 7, 2025.

Eaton Vance Equity Team

Eaton Vance Equity is comprised of six distinct investment teams of experienced, long-tenured investors. We employ bottom-up, research driven investment approaches designed to deliver attractive risk-adjusted long-term performance for clients. We utilize a structural approach to mitigate behavioral biases in investment decision-making. Eaton Vance Equity investment teams manage diverse strategies across U.S., international and global equity covering various market capitalization and investment styles.

Featured Insights

Standard & Poor’s 500® Index (S&P 500®) measures the performance of the large cap segment of the U.S. equities market, covering approximately 80% of the U.S. equities market. The Index includes 500 leading companies in leading industries of the U.S. economy.

Unless otherwise stated, index returns do not reflect the effect of any applicable sales charges, commissions, expenses, taxes or leverage, as applicable. It is not possible to invest directly in an index. Historical performance of the index illustrates market trends and does not represent the past or future performance of the fund.

Past performance is not a guarantee of future results.

Risk Considerations: The value of investments may increase or decrease in response to economic, and financial events (whether real, expected or perceived) in the U.S. and global markets. The value of equity securities is sensitive to stock market volatility. Diversification does not eliminate the risk of loss. Active management attempts to outperform a passive benchmark through proactive security selection and assumes considerable risk should managers incorrectly anticipate changing conditions.