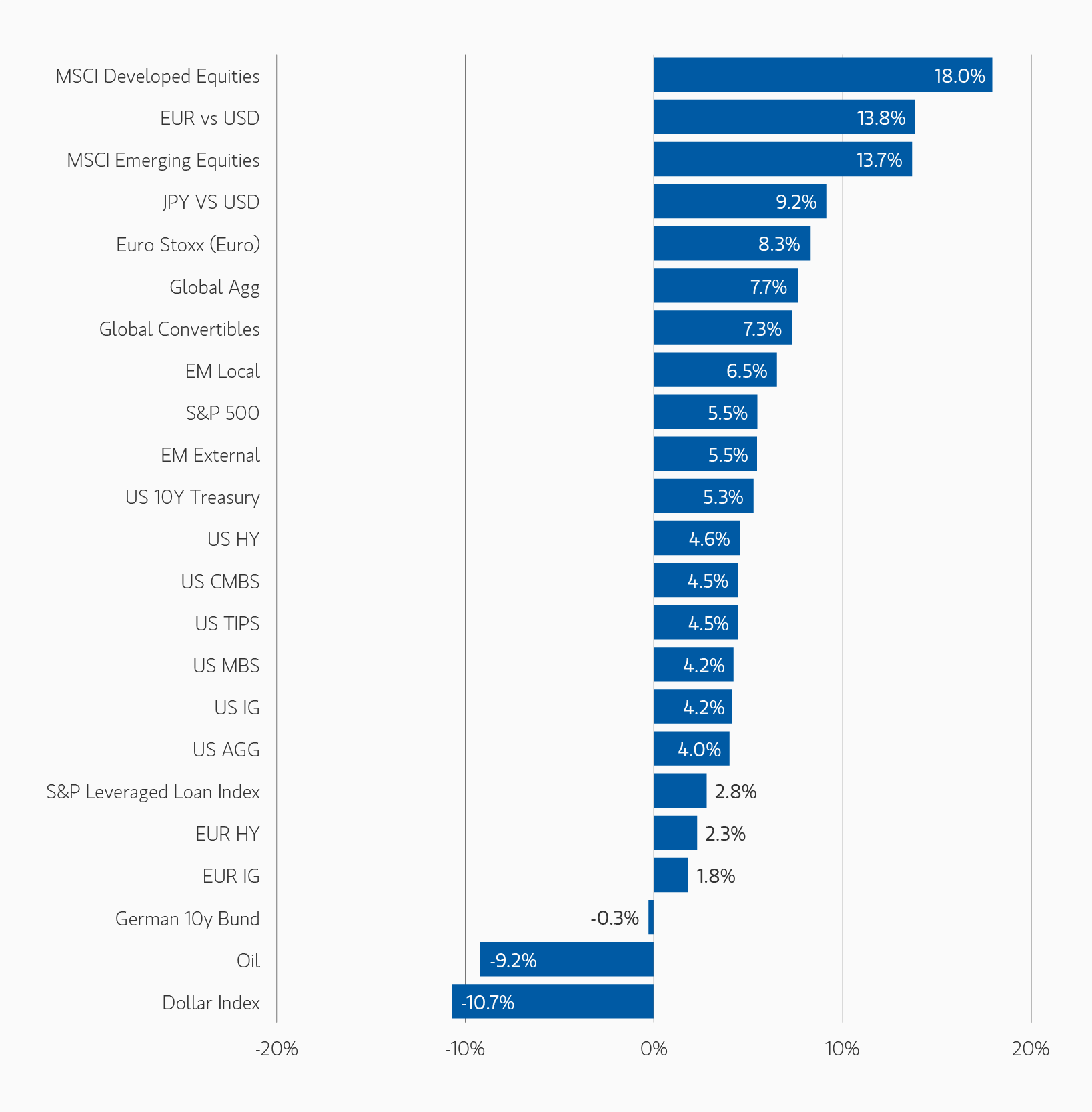

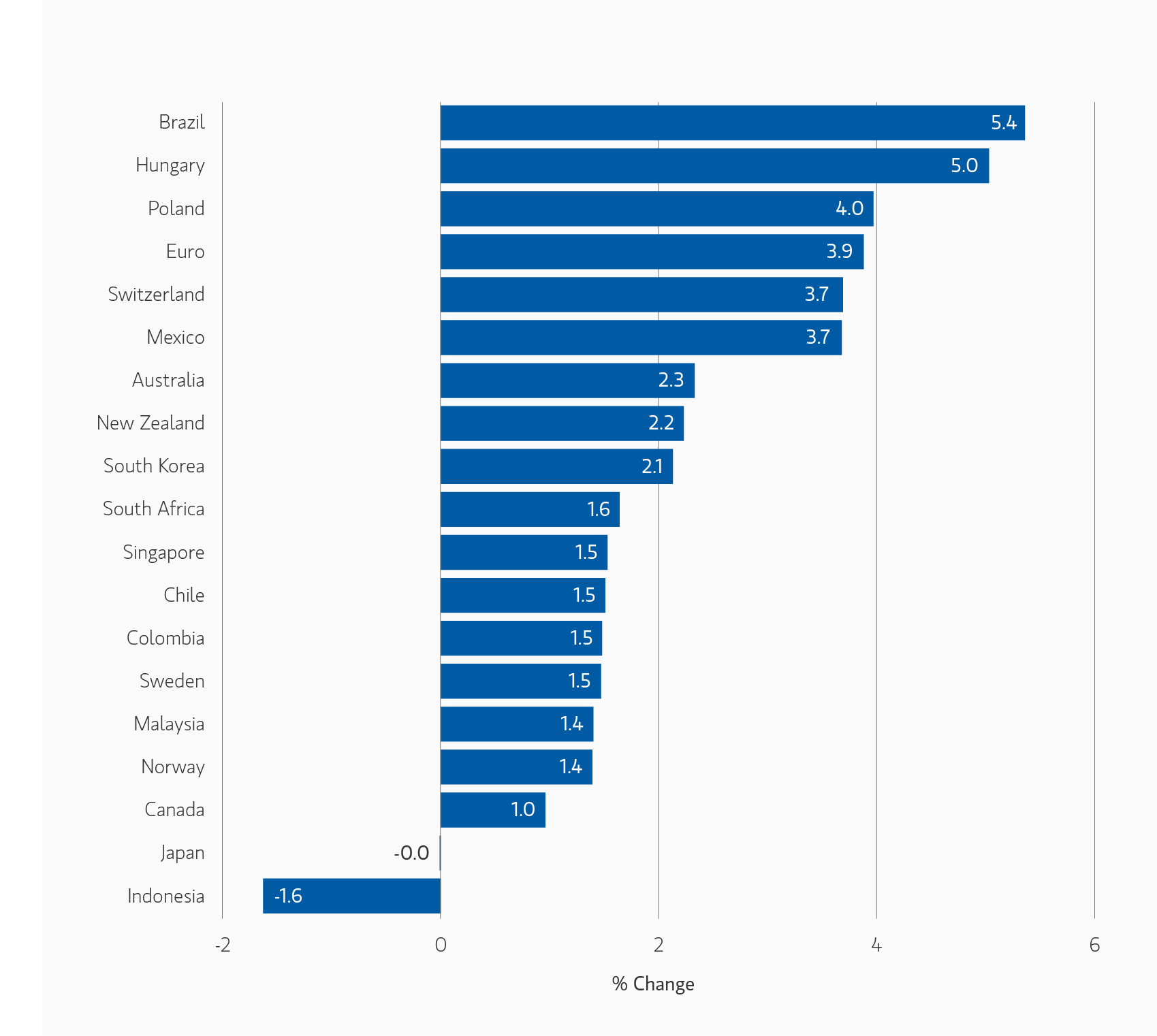

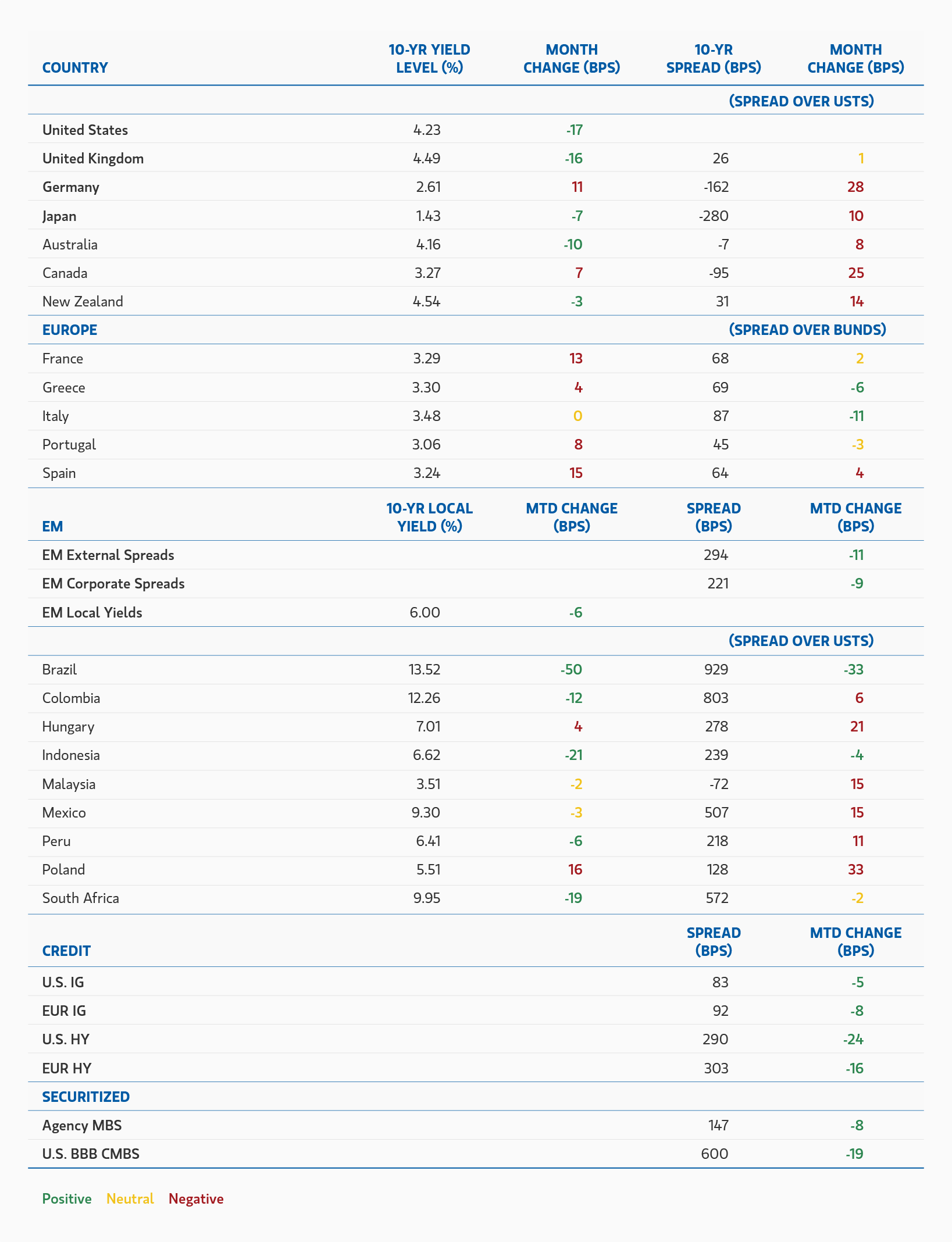

June was marked by a continuation of the risk-on sentiment that began earlier in the quarter, supported by resilient economic data, a modest decline in volatility, and easing geopolitical tension following the brief conflict between Israel and Iran. Developed market government bond yields were mixed: U.S. 10-year yields fell 17 basis points (bps) to 4.23%, while German Bund yields rose 10 bps amid hawkish ECB signals and increased fiscal spending. The U.S. dollar weakened 2.1% against a basket of currencies, with all G10 currencies except the yen appreciating, and Emerging Market (EM) currencies broadly outperforming.

Emerging market debt posted strong returns, buoyed by a weaker dollar, positive fund flows, and tightening spreads across both sovereign and corporate credit. Local rates outperformed global peers, and geopolitical risks had limited lasting impact on market sentiment. South Africa, Brazil, and Indonesia saw notable yield declines, while countries like Hungary and South Korea experienced modest increases.

Corporate credit rallied across the board. U.S. and European high yield outperformed investment grade, driven by strong technicals, solid corporate fundamentals, and declining Treasury yields. Euro Investment Grade (IG) led within investment grade, supported by robust demand and favorable issuance dynamics. Securitized products also performed well, with agency MBS spreads tightening by 8 bps and non-agency Residential Mortgage-Backed Securities (RMBS) and Commercial MBS (CMBS) spreads narrowing amid strong issuance and resilient credit fundamentals.

Looking ahead, markets are pricing in two to three Fed rate cuts by year-end, though inflationary risks from tariffs and fiscal expansion remain a key uncertainty. We remain constructive on duration in developed markets, favor steepening exposures in the U.S. and Europe, and continue to see value in EM debt and securitized credit, particularly agency MBS and residential mortgage-backed securities.

Fixed Income Outlook

Since the Fed began its rate-cutting cycle with a 50-bp bang last September, things have gotten oddly quiet—at least when it comes to short-term rates. It’s now been six months since the last 25 bp cut, and short-maturity yields have barely budged. Compared to the rollercoaster of 2022 through 2024, the current trading range feels almost serene.

Yes, the yield curve has steepened since that first cut. The 2s10s curve has gone from flat to modestly positive. But let’s keep it in perspective: we’re still only a bit above half the average steepness seen over the past forty years. If this setup feels familiar, it might be because it echoes the five-year stretch between the spring of 1995 and the peak of the tech bubble in early 2000. Back then, the Fed wrapped up a hiking cycle and spent the next several years gently nudging rates up and down within a 125-bp range in response to macroeconomic developments.

For now, the next Fed cut remains elusive—much like Beckett’s Godot. Core PCE, the Fed’s preferred inflation gauge, is stuck at 2.7%, exactly where it was last September. The unemployment rate, at 4.2%, is only marginally higher. Add in the delayed impact of tariffs and the likelihood that stricter immigration policy will tighten labor markets, and it’s a bit puzzling that the front end of the U.S. bond market is now pricing in as many as three 25 bp cuts by year-end—up from an already questionable two at the start of June. Looking further out, the market is forecasting five cuts by the end of next year.

Outside the U.S., rate cycles appear to be nearing their end. Markets have priced in just one more cut for the ECB and the Bank of Canada, and about one and a bit for the Riksbank. Only in the higher-yielding markets—the UK and Australia—do we still see expectations for three or more cuts. Meanwhile, the Bank of Japan is heading in the opposite direction. With realized inflation still above 3% year-over-year and wage growth remaining elevated, policy rates may finally rise meaningfully above zero. That said, the market still expects the policy rate to remain below 1% two years from now.

Rather than trying to trade central banks, we continue to believe the safer bet is to position for steepening at the long end of the yield curve—not just in the U.S., but in Europe as well. Japan and the UK have already seen sharp steepening, which suggests that the historical support from insurers and pension funds at the long end of the curve can no longer be taken for granted. In our view, steeper curves reflect the market’s ongoing concern about persistently large deficits and the challenge of absorbing government bond supply in parts of the curve where natural buyers—those matching long-dated liabilities—are becoming increasingly scarce.

June brought more of the same: a continuation of the post-Liberation Day decline in volatility, despite headlines around Iran and Israel and the legislative horse-trading over the “One Big Beautiful Bill Act.” Credit spreads tightened through pre-Liberation Day levels, and equity markets pushed above their March highs. Despite what many would consider tight monetary policy—with the Fed Funds target rate still 200 bps above CPI, another echo of the mid-1990s—the market remains bullish on the economy.

In the Eurozone, sovereign spreads are now at their tightest levels since before the euro sovereign crisis. In many cases, this tightening is fundamentally justified: most countries are on ratings upgrade trajectories, and their fiscal dynamics are the best they’ve been in over a decade. That said, it’s not a universal story. France and Belgium have both been downgraded over the past year. Still, OAT-Bund spreads are at their tightest in the last 12 months, and while France is now one of the higher-yielding euro sovereigns, it’s hard to argue that the market is truly worried about French fiscal risk.

The one major difference between now and 1995? The dollar. When Robert Rubin became Treasury Secretary under President Clinton, he famously declared that “a strong dollar is in our national interest”—and backed it up with action. That commitment outlasted his tenure, helped along by a federal budget surplus by 1998 and a roughly balanced net international investment position.

Today’s backdrop couldn’t be more different. Both the budget and current account are deep in deficit, and the gap between what foreigners own in U.S. assets and what Americans own abroad now exceeds 80% of U.S. GDP. We believe foreign investors—already large holders of Treasuries and U.S. equities—may begin demanding a higher premium to fund these imbalances. That premium, in our view, implies a weaker dollar. We’re positioned accordingly: short the dollar against a basket of developed and emerging market currencies.

Developed Market Rate/Foreign Currency

Monthly Review

Developed market interest rates rose in the first half of June, before falling back to close lower on the month. 10y Treasury yields fell 17 bps to 4.23%, and 10y government bond yields were also lower in the UK, Japan, Australia and New Zealand. However. 10y Bund yields rose 10 bps to 2.6%, driven by more hawkish than expected ECB meeting in early June and better than expected growth data. Risk markets continued to recover ahead of the early-July deadline for tariff negotiations, with the S&P breaching 6,200 to reach a fresh all-time high at the end of June. In general, U.S. economic data was encouraging and pointed to a minimal impact on prices from tariffs, a still-resilient labour market, and a stabilisation in inflation expectations. The jobs report for May suggested the economy added 139,000 jobs over the month – slightly more than expected by the market. Meanwhile, core CPI printed below market expectations for the fourth consecutive time, consistent with a broader global theme of weaker inflation. Prices in various goods categories showed that firms, at least while drawing down on inventories, were not passing costs onto consumers in a significant way. During the latter half of the month, a number of policymakers from the Fed signalled they might be open to a rate cut at the July meeting. The market now discounts around two-and-a-half cuts by year-end and a one-in-five likelihood of the FOMC resuming its easing cycle in July.

In the Eurozone, the ECB delivered a 25-bp rate cut but suggested they were ambivalent about easing policy much further. After initially flattening, the curve continued to steepen, led by the long-end, as Germany announced a larger-than-expected increase in issuance, as well as an earlier increase in fiscal outlays. News reports suggest the European Union is considering accepting a trade agreement with the U.S. that includes the 10% universal tariffs first introduced in April, with carve-outs for sectors including pharmaceuticals, semiconductors and aircraft.

Geopolitics was an additional source of volatility in June. The conflict between Israel and Iran escalated, leading to a brief but sharp rise in oil prices, amid fears of a closure of the Strait of Hormuz, or damage to energy infrastructure. However, the impact of the war on risk assets and bond markets was short-lived, given the rapid de-escalation in hostilities. Geopolitical volatility also pushed the U.S. dollar briefly higher in the middle of the month, but the Bloomberg dollar index eventually ended June 2.1% weaker. All G10 currencies barring the Japanese yen gained against the US dollar. High-yielding and cyclical currencies continued to outperform amid a positive risk environment.

Outlook

We remain overweight duration in DM markets, though recognise that the recent repricing of central bank rate paths – particularly in the U.S. – has made duration less attractive at current levels. We also acknowledge that the inflationary impact of tariffs may become more apparent only in the summer – something that might lead to fewer rate cuts being priced. We also retain our long-standing curve steepening exposures in U.S.Treasuries and Bunds, though in the latter market we have recently adjusted our exposures in favour of long-end steepening. In Japan, we remain underweight duration given a strong wage and inflation picture, which we think will lead to more hikes than the market currently prices. We also hold onto our inflation breakeven positions. We are short the U.S. dollar against a basket of currencies.

Emerging Market Rate/Foreign Currency

Monthly Review

Performance was strong for EMD markets as EM currencies broadly strengthened against the backdrop of a weakening USD and EM rates outperformed global rates. Spreads tightened for sovereign and corporate credit. Israel launched an attack on Iran on June 13 targeting nuclear facilities and military sites. Iran retaliated with attacks on Israel, and the conflict escalated further with U.S. airstrikes on Iran nuclear facilities. A ceasefire between Israel and Iran was agreed to 12 days after the conflict started and has held. In South Korea, the first Presidential election since former President Yoon Suk Yeol enacted martial law in December and was impeached occurred. Newly elected President Lee is part of the left-wing party, but he is not an established member of the party. One of his primary initiatives is to revive the Korean stock market, which generally trades at a discount. Asset class flows were positive for both hard and local currency fund with $2.1B for hard currency and $1.9B for local currency funds.1

Outlook

The U.S. Fed held rates at its June meeting despite pressure from the U.S. administration. Ahead of the spring IMF meetings, global growth expectations was revised down significantly based on the April 2 tariff announcements. Uncertainty lingers amid the 90-day pause and active negotiations continue at the individual country level. The level of impact that U.S. tariff policy could have on inflation remains uncertain, but global tariffs are translating to a deflationary event outside of the U.S. Negative demand shocks and excess supplies with need to be rerouted and this will likely put negative pressure on prices. Technicals are likely to be supportive for the asset class as investors are starting to show increased interest in both local and hard currency funds. Individual country selection, a focus on fundamentals, and the direction of change will continue to be critical to elevate the asset class.

Corporate Credit

Monthly Review

Risk assets rallied in June, supported by resilient data, a Middle East ceasefire, Section 899 removal, and strong technicals, with EUR IG outperforming U.S. IG. US-China trade talks yielded a tariff framework, while Germany’s budget plans boosted growth expectations. Central banks struck a cautious tone: the ECB cut rates but signalled a pause, the Fed stayed on hold with a hawkish tilt, and the BoE maintained its stance. Eurozone PMIs were flat, with German strength offset by softness elsewhere; U.S. data was mixed, with weak ISMs but solid NFP and wages. Inflation softened in the U.S. and Eurozone, with limited tariff impact so far. Technicals remained strong, with strong June issuance and robust demand.

Performance in the U.S. and global high yield markets grew even stronger in June amid a meaningful drop in Treasury yields and a deep bid for risk, with the S&P 500 closing the quarter at record a new record high. The market showed little reaction to armed conflict with Iran, though upon the ceasefire oil futures fell into the mid-$60s.2 Primary market volume again increased and was met with ample demand as investors’ concern over tariffs lessened and expectations for future rate decreases increased. Inflows into U.S. high yield retail funds remained strong and, when added to May’s inflow, were to sufficient to erase the extreme outflows experienced in April. Meanwhile, default activity continued its modest climb.3

Global convertible bonds performed well along with other risk assets in June despite geopolitical tensions rising in the Middle East. Returns in the asset class were again led by higher beta and higher delta issuers as global equities continued their march higher. Ultimately, global convertible bonds underperformed global equities, but outperformed global bonds during the month. June has historically been a strong month for new issuance and this past month was no exception. In total, $26.1 billion priced in June surpassing May’s total of $18.7 billion, which, at the time, was the largest monthly issuance total since March 2021. Issuance by region was led by the U.S., which accounted for approximately two thirds of the new issuance during the month. Year-to-date supply ended the month at $70.5 billion, which ahead of the $60.5 billion in new issuance over the same time period in 2024.4

Outlook

We remain cautiously constructive on credit, expecting low growth without a significant rise in downgrade or default risk. European policy remains supportive, while the U.S. fiscal picture is more mixed. Corporate fundamentals are solid, with firms maintaining low-risk strategies. Technicals are favourable, with manageable issuance and strong demand for IG yields. Looking ahead, we expect spreads to trade with some beta to trade headlines but do not expect a material change in the base case outlined above. At current levels spreads appear close to fair value so carry should be the main driver of return, though additional gains coming from sector and security selection are likely. Given the uncertain medium term fundamental backdrop, we have less confidence in material spread tightening, therefore we are a small long in spread duration with plenty capacity to add on weakness.

We begin the second half of 2025 with a cautious outlook. Peak risk and volatility emanating from evolving tariff and trade policy is likely behind us; however, the ultimate framework of international trade with the U.S. remains unclear. We expect the new framework will continue to impede economic growth and will act in concert with the “One Big Beautiful Bill” to stimulate higher, and stickier, inflation as the federal deficit under the current Bill would continue to balloon. Yields remain historically attractive, but the average spread in the high yield market, while approximately 50 bps above post-Global Financial Crisis (GFC) lows, reached in January, finished the second quarter below where it began the year and is susceptible to widening. We come to this conclusion after a thorough analysis of factors including U.S. and global economic growth, the evolving monetary policy of global central banks, consumer health, the fundamentals of high yield issuers, technical conditions, and valuations. Ultimately, while we believe the likelihood of a recession this year is low, we believe that caution is warranted and expect additional bouts of volatility in the months ahead.

We continue to remain constructive on the fundamentals of the global convertible bond market as we enter the second half of the year. Convertible bonds continue to exhibit their asymmetric profiles of reasonably balanced deltas and strong bond floors. Peak risk and volatility emanating from evolving tariff and trade policy is likely behind us; however, the ultimate framework of international trade with the U.S. remains unclear. Additionally, tensions in the Middle East seemed to have cooled, but time is needed to see if the ceasefire can hold over the medium-to-long term. The asset class’s bond floor feature will be particularly important if we see another uptick in volatility like we did in the second quarter. Despite being constructive on the fundamentals, we are cautious on the primary market, which is on pace to exceed 2024’s totals. While a majority of issuers continue to tap the market to refinance maturing debt in a relatively high-interest rate environment, the crypto-linked issuance trend that began at the end of 2024 has continued to accelerate this year, with more companies issuing debt to buy cryptocurrency. We believe this warrants caution, but also creates opportunity for a well-resourced investment teams focused on bottoms-up fundamental research.

Securitized Products

Monthly Review

Securitized credit markets experienced modest tightening in June, broadly in line with other fixed income sectors. However, agency MBS spreads tightened more meaningfully, having lagged in prior months. The U.S. Treasury curve bull steepened as softer inflation data revived expectations for Fed easing. Markets now price in two rate cuts for 2025—down from four in April—with the first expected in September.

Agency MBS spreads tightened by 8 bps to +147 bps over comparable Treasuries, remaining wide both historically and relative to other core fixed income sectors. The Fed’s MBS holdings declined by $17 billion to $2.13 trillion, now down $564 billion from their 2022 peak. U.S. banks modestly increased their MBS holdings to $2.682 trillion, a trend we expect to continue as SLR constraints ease and short-term rates decline. Money managers remained active buyers, drawn by attractive valuations.

June issuance remained strong across securitized sectors and was well absorbed. ABS issuance totaled $33.2 billion, in line with May. Non-agency CMBS issuance reached $11.8 billion, bringing 2025 YTD volumes to 56% above last year. Non-agency RMBS issuance rose 17% to $14.8 billion.5 Despite higher mortgage rates, residential credit fundamentals remained solid, supported by strong homeowner equity, low unemployment, and limited refinancing activity. Non-agency RMBS and ABS spreads tightened by 5–10 bps, while CMBS spreads narrowed by 10–20 bps. Within CMBS, high-end apartments, logistics, and luxury hotels continued to perform well, while Class B office remained under pressure.

Outlook

We expect agency MBS spreads to continue tightening in the second half of the year, supported by inflows from relative value investors and banks seeking attractive return profiles versus other core fixed income sectors and cash alternatives. However, we believe meaningful spread compression will likely require the Fed to begin cutting rates—something we anticipate later this year. Credit securitized spreads are likely to remain range-bound in the near term as markets await clarity on the economic impact of evolving tariff policies and further tightening in agency MBS spreads. Year-to-date, agency MBS has been one of the top-performing sectors, with securitized credit also delivering solid returns. As we enter July, we expect returns to be primarily driven by carry, supported by attractive yield levels. That said, current rate levels continue to strain household balance sheets, particularly among lower-income consumers. We expect continued stress in certain consumer ABS segments. Commercial real estate also remains challenged by elevated financing costs. In contrast, we maintain a constructive view on residential mortgage credit, which remains our preferred sector and the one area where we are comfortable extending down the credit spectrum. We remain more cautious on lower-rated ABS and CMBS. We continue to see strong relative value in agency MBS, especially when compared to investment-grade corporate spreads and historical agency MBS levels.

Featured Insights