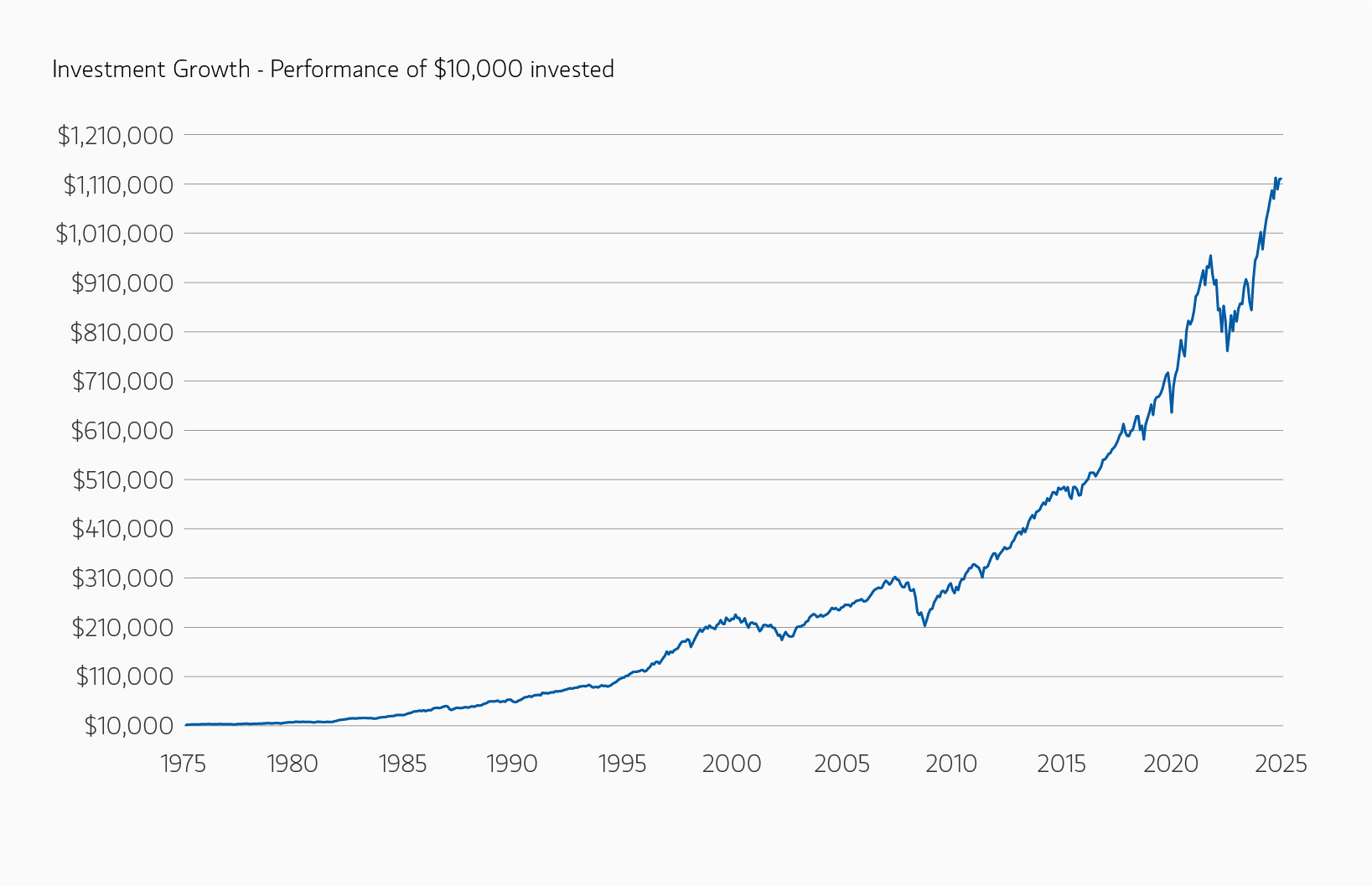

Performance leadership among asset classes has varied year to year, however a consistent balance of 60% U.S. stocks and 40% U.S. bonds may offer smoother returns than most individual asset classes.”

As one of the industry’s first mutual funds, the Eaton Vance Balanced Fund has endured a myriad of stories over the past 93 years, extolling the benefits of and refuting the claimed drawbacks of the common 60% U.S. stocks and 40% U.S. bonds strategy. Perhaps the long-running story of the consistency and stability of a balanced fund has been unexciting for headlines that often tailor to bull-minded investors. However in today’s environment, I believe the time-tested smart and simple strategy may be worthy of some positive attention. Through a single structure, a balanced fund can help investors achieve diversification with the expertise of portfolio managers guiding assets through varying market environments.

Over the years, the 60/40 strategy has navigated many of the headlines we see flashing across our screens today. Politics, policy, trade, tariffs, taxes, war, inflation, deflation and other factors are all bringing a heavy dose of uncertainty to markets. However, that uncertainty paired with the S&P 500 experiencing back-to-back years of 25%-plus returns may present a timely opportunity for investors to recalibrate expectations and reallocate assets.

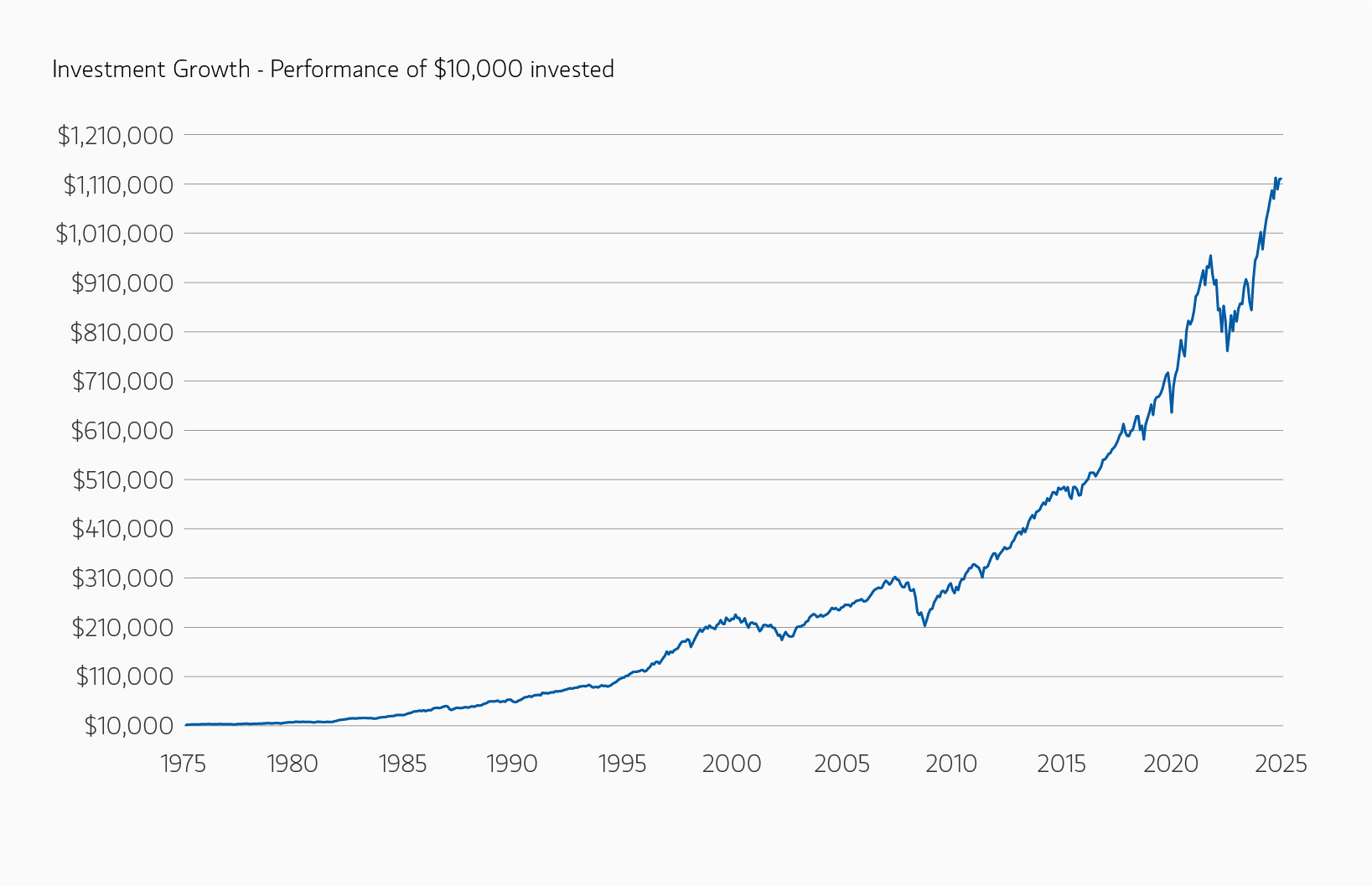

While the economic conditions of 2025 and beyond remain uncertain, the historical performance of the 60/40 strategy over various economic regimes indicates that the attractive growth and diversification benefits across a range of outcomes may make this a timely consideration as shown in the next two charts.

Growth over time, through varying economic conditions

As shown below, a hypothetical 60/40 strategy1 has demonstrated the ability to navigate varying economic conditions, making the portfolio an attractive long-term investment solution. While often utilized as the core of a portfolio, with clients additionally allocating to potentially more niche assets classes, a balanced fund may serve as a single fund starting point for new investors.

Attractive Capital Appreciation Since 1975

Source: 60% S&P 500, 40% Bloomberg Barclays US Aggregate Bond Index, rebalanced quarterly, As of 02/28/25. U.S. dollar amounts. Past performance is no guarantee of future results.

Attractive Capital Appreciation Since 1975

DISPLAY 1

Source: 60% S&P 500, 40% Bloomberg Barclays US Aggregate Bond Index, rebalanced quarterly, As of 02/28/25. U.S. dollar amounts. Past performance is no guarantee of future results.

A Historically Reliable Core Allocation

Performance leadership among asset classes has varied year to year, however a consistent balance of 60% U.S. stocks and 40% U.S. bonds may offer smoother returns than most individual asset classes, including reinvestment of distributions.

Annual Investment Performance by Asset Class (% Return)

Source: Eaton Vance. U.S. stocks are represented by the S&P 500 Index; Index returns do not reflect the effect of any applicable sales charges, commissions, expenses, taxes or leverage, as applicable. U.S. bonds are represented by Bloomberg U.S. Aggregate Bond Index; International stocks are represented by the MSCI EAFE Index; Emerging markets stocks are represented by the MSCI emerging-markets Index; International bonds are represented by Bloomberg Global Aggregate Bond ex U.S. Index; REITs are represented by Dow Jones U.S. Select Real Estate Securities Index; Commodities are represented by Bloomberg Commodity Index. 60/40 Portfolio represented by 60% S&P 500 and 40% Bloomberg Barclays US Aggregate Bond. Historical performance of the index illustrates market trends and does not represent the past or future performance of the fund. Investing involves risk, loss of principal. It is not possible to invest in an index.

Annual Investment Performance by Asset Class (% Return)

DISPLAY 2

Source: Eaton Vance. U.S. stocks are represented by the S&P 500 Index; Index returns do not reflect the effect of any applicable sales charges, commissions, expenses, taxes or leverage, as applicable. U.S. bonds are represented by Bloomberg U.S. Aggregate Bond Index; International stocks are represented by the MSCI EAFE Index; Emerging markets stocks are represented by the MSCI emerging-markets Index; International bonds are represented by Bloomberg Global Aggregate Bond ex U.S. Index; REITs are represented by Dow Jones U.S. Select Real Estate Securities Index; Commodities are represented by Bloomberg Commodity Index. 60/40 Portfolio represented by 60% S&P 500 and 40% Bloomberg Barclays US Aggregate Bond. Historical performance of the index illustrates market trends and does not represent the past or future performance of the fund. Investing involves risk, loss of principal. It is not possible to invest in an index.

Fixed Income for Income, Diversification and Risk Mitigation

By incorporating a portfolio of U.S. bonds alongside U.S. equity exposure, a balanced approach can capture attractive income opportunities across fixed income sectors, while potentially mitigating volatility experienced in the equity landscape. Further, in today’s environment, high starting yields are aiding in fixed incomes compelling proposition of delivering income, and total return and an actively managed approach can exploit inefficiencies compared to passive peers.

Bottom Line: Simple investment strategies like the 60/40 portfolio offer a place for long-term investors seeking diversification and attractive risk adjusted returns. An asset allocation framework like utilized in a balanced fund, could be a solution for 2025 as clients look to stay invested, while remaining focused on long term investment goals.

1 Hypothetical 60/40 strategy based on hypothetical index blend of 60% S&P 500, 40% Bloomberg Barclays US Aggregate Bond Index, rebalanced quarterly.

Eaton Vance Equity Team

Eaton Vance Equity is comprised of six distinct investment teams of experienced, long-tenured investors. We employ bottom-up, research driven investment approaches designed to deliver attractive risk-adjusted long-term performance for clients. We utilize a structural approach to mitigate behavioral biases in investment decision-making. Eaton Vance Equity investment teams manage diverse strategies across U.S., international and global equity covering various market capitalization and investment styles.

Featured Products

Featured Insights

Risk Considerations: The value of investments held by the Fund may increase or decrease in response to economic, and financial events (whether real, expected or perceived) in the U.S. and global markets. The Fund invests in other underlying funds in a fund-of-funds structure. The Fund’s performance is dependent upon the performance of the underlying funds and the Fund is subject to all of the risks of the underlying funds. The value of equity securities is sensitive to stock market volatility. As interest rates rise, the value of certain income investments is likely to decline. Investments in debt instruments may be affected by changes in the creditworthiness of the issuer and are subject to the risk of non-payment of principal and interest. The value of income securities also may decline because of real or perceived concerns about the issuer’s ability to make principal and interest payments. Contractual restrictions may impede the Fund’s ability to buy or sell loans and loans may be subject to an extended settlement process. Investments in foreign instruments or currencies can involve greater risk and volatility than U.S. investments because of adverse market, economic, political, regulatory, geopolitical, currency exchange rates or other conditions. The Fund is exposed to liquidity risk when trading volume, lack of a market maker or trading partner, large position size, market conditions, or legal restrictions impair its ability to sell particular investments or to sell them at advantageous market prices. The impact of the coronavirus on global markets could last for an extended period and could adversely affect the Fund’s performance. No fund is a complete investment program and you may lose money investing in a fund. The Fund may engage in other investment practices that may involve additional risks and you should review the Fund prospectus for a complete description.

Past performance is not a guarantee of future results.

Please consider the investment objective, risks, charges and expenses of the fund carefully before investing. The prospectus contains this and other information about the fund. To obtain a prospectus (which includes the applicable fund's current fees and expenses, if different from those in effect as of the date of this fact sheet), download one at https://funds.eatonvance.com/all-mutual-funds.php or contact your financial professional. Please read the prospectus carefully before investing.