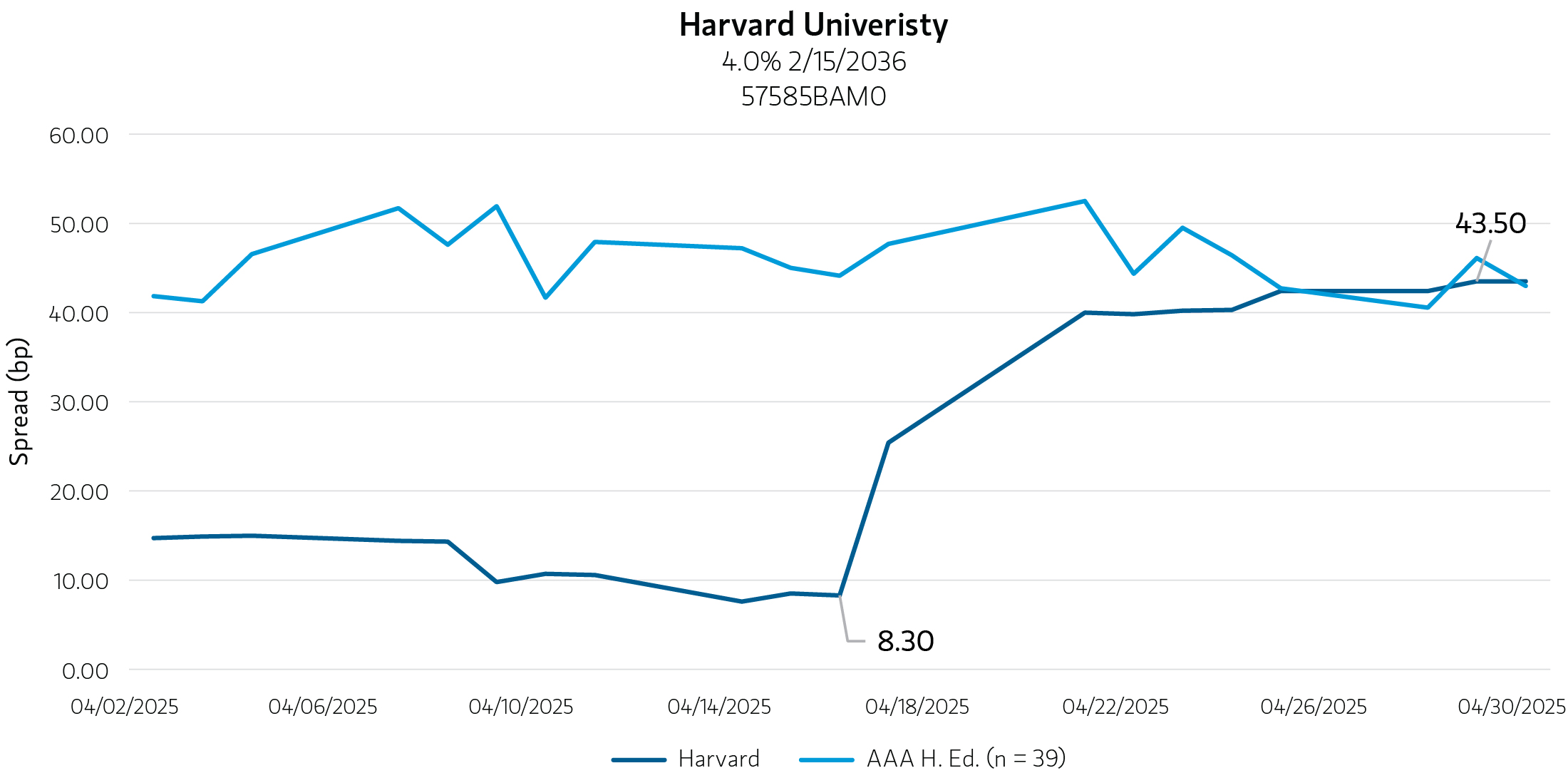

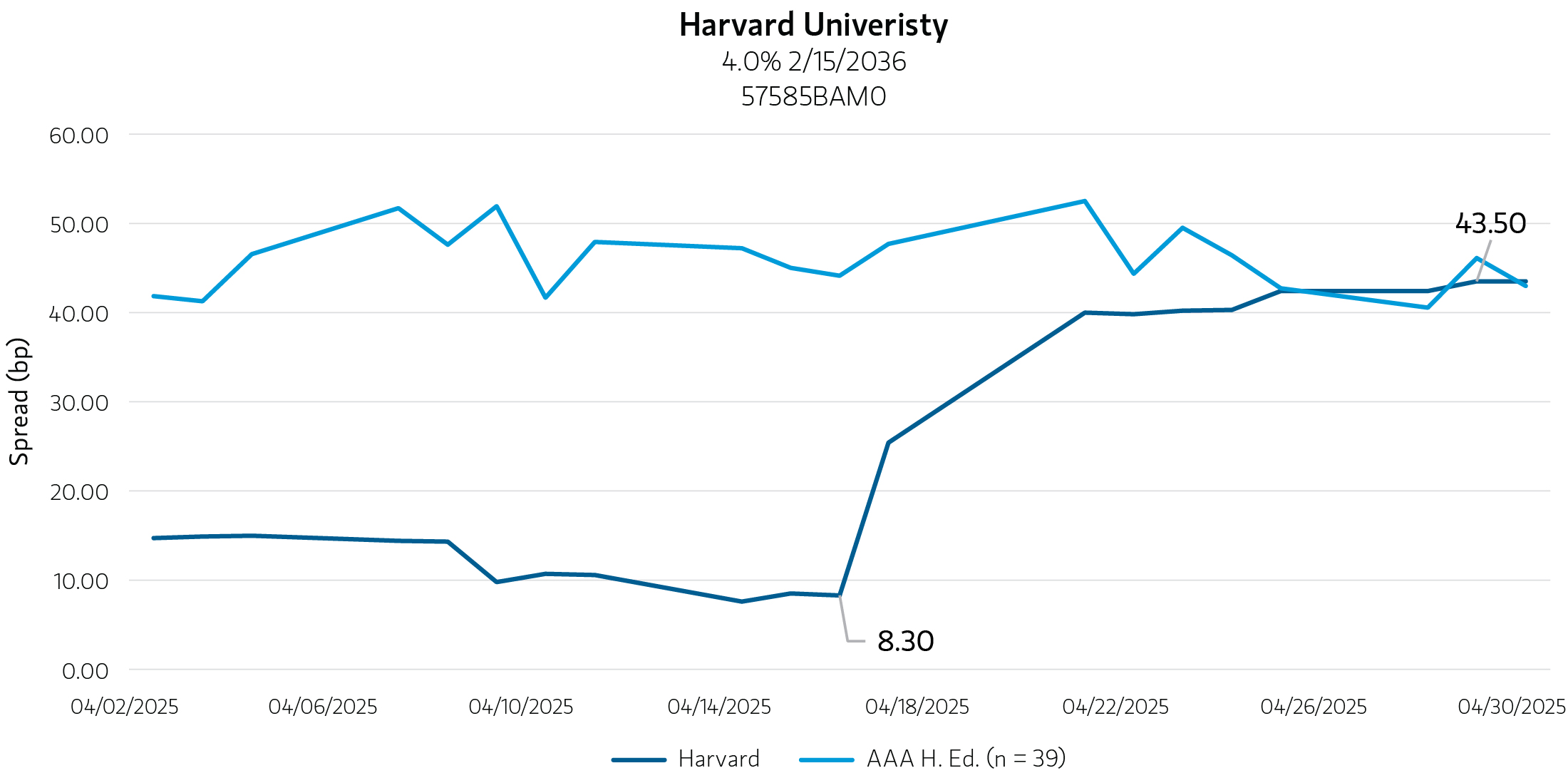

While some investors may be pricing in a political risk premium into highly-rated credits like Harvard, Harvard’s yield premium has been completely erased compared to the universe of AAA-rated higher education bonds.”

The bond ratings of universities like Harvard and Columbia are unlikely to be tarnished by threats to cut off billions of dollars in federal aid and research grants, or to revoke their tax-exempt status. With healthy finances, robust fundraising and durable demand for leading academic programs, we believe schools like Harvard are at a very low risk of default.

Last month, the federal government said it would freeze $2.2 billion in grants and $60 million in contracts to Harvard, and more to other top colleges and universities, seeking sweeping policy changes, including an overhaul of diversity and inclusion (DEI) programs, screening of international applicants, stricter crackdowns on protests and other arbitrary criteria. The Trump administration also claimed it could revoke the 501(c)(3)1 status for institutions allegedly promoting what it deems anti-American values.

Federal funding decisions must be apolitical

Executive agencies such as the Department of Education (DOE) and National Institutes of Health (NIH) have discretion over which institutions receive research grants. While these agencies may set grant conditions via regulation, delays, restrictions or by denying future funding, they it must act apolitically. Federal agencies can adjust the terms of awards through formal rule making, but any changes must comply with applicable laws (e.g. Title VI of the Civil Rights Act2), and importantly, are subject to legal challenge.

There are measures to prevent the federal government from withholding funding arbitrarily or retroactively. For example, the Impoundment and Control Act of 1974 prohibits the president from unilaterally withholding congressionally appropriated federal funds. Any attempt to intercept funds without a lawful reason or due process is likely illegal3 and subject to further review. Moreover, the 1998 IRS Restructuring and Reform Act prohibits ordering the IRS to investigate or audit specific taxpayers.

Revoking tax-exempt status requires a legal basis

There is one instance of the IRS repealing the tax-exempt status of a university on ideological grounds. In Bob Jones University v. United States (1983), the school had an internal policy prohibiting interracial dating, which the

IRS, and later the Supreme Court of the United States (SCOTUS) deemed to “violate fundamental public policy”.4 There is nothing to suggest any of the universities currently facing grant freezes have engaged in similar conduct. While there isn't a blanket prohibition against punishing specific institutions by name, legislation that singles out and punishes particular entities can face significant legal challenges in the U.S.

It is important to note that any proposed federal law to defund or tax a specific institution like Harvard or any other school need to be properly vetted. The Bill of Attainder Clause of the U.S. Constitution, which prohibits Congress from singling out an individual or institution for punishment without due process.

While some investors may be pricing in a political risk premium into highly rated credits like Harvard, Harvard’s yield premium has been completely erased compared to the universe of AAA-rated higher education bonds.5 Harvard, considered a benchmark in the market, now trades at the same level as other similarly rated credits, widening 35 basis points (bps) in just two weeks.

We view such skittish moves as reactionary selling because Harvard retains extremely sound credit fundamentals. This is evident based on several facts, including:

- 8.7x cash & investments to debt

- 9.8x cash & investments to annual operations

- $53 billion endowment ($2.58 million per full-time equivalency student)6

Harvard University 4.0% 2/15/2036

Source: Bloomberg. Data as of April 30, 2025. Past performance is no guarantee of future results. All information is provided for informational purposes only, is subject to change, and should not be deemed as a recommendation to buy or sell the securities mentioned or securities in the sectors shown. The index rate is the AAA MMD (Municipal Market Data) yield curve.

Harvard University 4.0% 2/15/2036

DISPLAY 1

Source: Bloomberg. Data as of April 30, 2025. Past performance is no guarantee of future results. All information is provided for informational purposes only, is subject to change, and should not be deemed as a recommendation to buy or sell the securities mentioned or securities in the sectors shown. The index rate is the AAA MMD (Municipal Market Data) yield curve.

Bottom Line: Harvard University maintains a high credit rating of AAA from Standard & Poor's and Moody's, indicating a very low risk of default. We believe bond markets may be overreacting in pricing Harvard and other top schools' debt. Any actions against the federal government to target universities based on perceived or alleged bias or ideology would likely face steep legal odds and would need to be examined prior to being enacted. The Trump administration also noted that it is considering revoking (or limiting) 501(c)(3) status for institutions that promote what the current administration classifies as “anti-American” values.

1 To be tax-exempt under section 501(c)(3) of the Internal Revenue Code, an organization must be organized and operated exclusively for exempt purposes.

2 STitle VI of the Civil Rights Act of 1964 prohibits discrimination based on race, color or national origin in any program or activity receiving federal financial assistance.

3 STitle VI termination procedure requirements laid out here https://www.law.cornell.edu/cfr/text/34/100.8 The Trump admin has not complied with these requirements. Also, this sentence should read “without a lawful reason” currently says “with a lawful reason”

4 Source: Justia U.S. Supreme Court Center

5 SAAA-rated higher education bonds represent the highest creditworthiness among college and university debt instruments, signaling very low risk of default. The index performance is provided for illustrative purposes only and is not meant to depict the performance of a specific investment.

6 Harvard University FY2024 ACFR as of June 30, 2024

Municipals Team

Our team is a leader in municipal bond management, with significant market presence, among the largest and deepest municipal investment teams in the country, and broad selection of municipal strategies.

Featured Insights

Definitions

Ratings are relative and subjective and are not absolute standards of quality. An individual bond holding’s credit quality rating does not remove market or default risk. Credit ratings are based largely on the ratings agency’s analysis at the time of rating. The rating assigned to any particular security is not necessarily a reflection of the issuer’s current financial condition and does not necessarily reflect its assessment of the volatility of a security’s market value or of the liquidity of an investment in the security. The AAA rating is the rating agencies highest credit rating.

Spreads generally refer to the difference between two prices, rates, or yields. It's a measure of the gap between what you pay to buy something and what you can sell it for, or the difference in yields between two different investments.

Risk Considerations

There is no assurance that a portfolio will achieve its investment objective. Portfolios are subject to market risk, which is the possibility that the market values of securities owned by the portfolio will decline and that the value of portfolio shares may therefore be less than what you paid for them. Market values can change daily due to economic and other events (e.g., natural disasters, health crises, terrorism, conflicts, and social unrest) that affect markets, countries, companies or governments. It is difficult to predict the timing, duration, and potential adverse effects (e.g., portfolio liquidity) of events. Accordingly, you can lose money investing in a portfolio. Fixed-income securities are subject to the ability of an issuer to make timely principal and interest payments (credit risk), changes in interest rates (interest rate risk), the creditworthiness of the issuer and general market liquidity (market risk). In a rising interest-rate environment, bond prices may fall and may result in periods of volatility and increased portfolio redemptions. In a declining interest-rate environment, the portfolio may generate less income. Longer-term securities may be more sensitive to interest rate changes. An imbalance in supply and demand in the municipal market may result in valuation uncertainties and greater volatility, less liquidity, widening credit spreads and a lack of price transparency in the market. There generally is limited public information about municipal issuers. Income from tax-exempt municipal obligations could be declared taxable because of changes in tax laws, adverse interpretations by the relevant taxing authority or the non-compliant conduct of the issuer of an obligation and may subject to the federal alternative minimum tax.

There is no guarantee that any investment strategy will work under all market conditions, and each investor should evaluate their ability to invest for the long-term, especially during periods of downturn in the market.

A separately managed account may not be appropriate for all investors. Separate accounts managed according to the particular strategy may include securities that may not necessarily track the performance of a particular index. Please consider the investment objectives, risks and fees of the Strategy carefully before investing. A minimum asset level is required. For important information about the investment managers, please refer to Form ADV Part 2.

The views and opinions and/or analysis expressed are those of the author or the investment team as of the date of preparation of this material and are subject to change at any time without notice due to market or economic conditions and may not necessarily come to pass.

This material has been prepared on the basis of publicly available information, internally developed data and other third-party sources believed to be reliable. However, no assurances are provided regarding the reliability of such information and the Firm has not sought to independently verify information taken from public and third-party sources.

This material is a general communication, which is not impartial and all information provided has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy. The information herein has not been based on a consideration of any individual investor circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal or regulatory advice. To that end, investors should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.

This material is not a product of Morgan Stanley’s Research Department and should not be regarded as a research material or a recommendation.

The Municipal Market Data (MMD) index is a benchmark used to track the performance of the U.S. municipal bond market. It specifically measures the interest rate of AAA-rated, uninsured general obligation bonds. This index is published by Municipal Market Data and is used by investors and traders to understand the prevailing interest rates and yields in the municipal bond market.

The indexes are unmanaged and do not include any expenses, fees or sales charges. It is not possible to invest directly in an index. Any index referred to herein is the intellectual property (including registered trademarks) of the applicable licensor. Any product based on an index is in no way sponsored, endorsed, sold or promoted by the applicable licensor and it shall not have any liability with respect thereto.

The Firm has not authorised financial intermediaries to use and to distribute this material, unless such use and distribution is made in accordance with applicable law and regulation. Additionally, financial intermediaries are required to satisfy themselves that the information in this material is appropriate for any person to whom they provide this material in view of that person’s circumstances and purpose. The Firm shall not be liable for, and accepts no liability for, the use or misuse of this material by any such financial intermediary.

This material may be translated into other languages. Where such a translation is made this English version remains definitive. If there are any discrepancies between the English version and any version of this material in another language, the English version shall prevail.

The whole or any part of this material may not be directly or indirectly reproduced, copied, modified, used to create a derivative work, performed, displayed, published, posted, licensed, framed, distributed or transmitted or any of its contents disclosed to third parties without the Firm’s express written consent. This material may not be linked to unless such hyperlink is for personal and non-commercial use. All information contained herein is proprietary and is protected under copyright and other applicable law.

Eaton Vance is part of Morgan Stanley Investment Management. Morgan Stanley Investment Management is the asset management division of Morgan Stanley.

DISTRIBUTION

This material is only intended for and will only be distributed to persons resident in jurisdictions where such distribution or availability would not be contrary to local laws or regulations.

MSIM, the asset management division of Morgan Stanley (NYSE: MS), and its affiliates have arrangements in place to market each other’s products and services. Each MSIM affiliate is regulated as appropriate in the jurisdiction it operates. MSIM’s affiliates are: Eaton Vance Management (International) Limited, Eaton Vance Advisers International Ltd, Calvert Research and Management, Eaton Vance Management, Parametric Portfolio Associates LLC and Atlanta Capital Management LLC.

This material has been issued by any one or more of the following entities:

EMEA:

This material is for Professional Clients/Accredited Investors only.

In the EU, MSIM and Eaton Vance materials are issued by MSIM Fund Management (Ireland) Limited (“FMIL”). FMIL is regulated by the Central Bank of Ireland and is incorporated in Ireland as a private company limited by shares with company registration number 616661 and has its registered address at 24-26 City Quay, Dublin 2, D02 NY 19, Ireland. Outside the EU, MSIM materials are issued by Morgan Stanley Investment Management Limited (MSIM Ltd) is authorised and regulated by the Financial Conduct Authority. Registered in England. Registered No. 1981121. Registered Office: 25 Cabot Square, Canary Wharf, London E14 4QA.

In Switzerland, MSIM materials are issued by Morgan Stanley & Co. International plc, London (Zurich Branch) Authorised and regulated by the Eidgenössische Finanzmarktaufsicht ("FINMA"). Registered Office: Beethovenstrasse 33, 8002 Zurich, Switzerland.

Outside the US and EU, Eaton Vance materials are issued by Eaton Vance Management (International) Limited (“EVMI”) 125 Old Broad Street, London, EC2N 1AR, UK, which is authorised and regulated in the United Kingdom by the Financial Conduct Authority.

Italy: MSIM FMIL (Milan Branch), (Sede Secondaria di Milano) Palazzo Serbelloni Corso Venezia, 16 20121 Milano, Italy. The Netherlands: MSIM FMIL (Amsterdam Branch), Rembrandt Tower, 11th Floor Amstelplein 1 1096HA, Netherlands. France: MSIM FMIL (Paris Branch), 61 rue de Monceau 75008 Paris, France. Spain: MSIM FMIL (Madrid Branch), Calle Serrano 55, 28006, Madrid, Spain. Germany: Germany: MSIM FMIL (Frankfurt Branch), Grosse Gallusstrasse 18, 60312 Frankfurt am Main, Germany (Gattung: Zweigniederlassung (FDI) gem. § 53b KWG). Denmark: MSIM FMIL (Copenhagen Branch), Gorrissen Federspiel, Axel Towers, Axeltorv2, 1609 Copenhagen V, Denmark.

MIDDLE EAST

Dubai: MSIM Ltd (Representative Office, Unit Precinct 3-7th Floor-Unit 701 and 702, Level 7, Gate Precinct Building 3, Dubai International Financial Centre, Dubai, 506501, United Arab Emirates. Telephone: +97 (0)14 709 7158). This document is distributed in the Dubai International Financial Centre by Morgan Stanley Investment Management Limited (Representative Office), an entity regulated by the Dubai Financial Services Authority (“DFSA”). It is intended for use by professional clients and market counterparties only. This document is not intended for distribution to retail clients, and retail clients should not act upon the information contained in this document.

This document relates to a financial product which is not subject to any form of regulation or approval by the DFSA. The DFSA has no responsibility for reviewing or verifying any documents in connection with this financial product. Accordingly, the DFSA has not approved this document or any other associated documents nor taken any steps to verify the information set out in this document, and has no responsibility for it. The financial product to which this document relates may be illiquid and/or subject to restrictions on its resale or transfer. Prospective purchasers should conduct their own due diligence on the financial product. If you do not understand the contents of this document, you should consult an authorised financial adviser.

US

NOT FDIC INSURED | OFFER NO BANK GUARANTEE | MAY LOSE VALUE | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY | NOT A DEPOSIT

Latin America (Brazil, Chile Colombia, Mexico, Peru, and Uruguay)

This material is for use with an institutional investor or a qualified investor only. All information contained herein is confidential and is for the exclusive use and review of the intended addressee, and may not be passed on to any third party. This material is provided for informational purposes only and does not constitute a public offering, solicitation or recommendation to buy or sell for any product, service, security and/or strategy. A decision to invest should only be made after reading the strategy documentation and conducting in-depth and independent due diligence.

ASIA PACIFIC

Hong Kong: This material is disseminated by Morgan Stanley Asia Limited for use in Hong Kong and shall only be made available to “professional investors” as defined under the Securities and Futures Ordinance of Hong Kong (Cap 571). The contents of this material have not been reviewed nor approved by any regulatory authority including the Securities and Futures Commission in Hong Kong. Accordingly, save where an exemption is available under the relevant law, this material shall not be issued, circulated, distributed, directed at, or made available to, the public in Hong Kong. Singapore: This material is disseminated by Morgan Stanley Investment Management Company and may not be circulated or distributed, whether directly or indirectly, to persons in Singapore other than to (i) an accredited investor (ii) an expert investor or (iii) an institutional investor as defined in Section 4A of the Securities and Futures Act, Chapter 289 of Singapore (“SFA”); or (iv) otherwise pursuant to, and in accordance with the conditions of, any other applicable provision of the SFA. This publication has not been reviewed by the Monetary Authority of Singapore. Australia: This material is provided by Morgan Stanley Investment Management (Australia) Pty Ltd ABN 22122040037, AFSL No. 314182 and its affiliates and does not constitute an offer of interests. Morgan Stanley Investment Management (Australia) Pty Limited arranges for MSIM affiliates to provide financial services to Australian wholesale clients. Interests will only be offered in circumstances under which no disclosure is required under the Corporations Act 2001 (Cth) (the “Corporations Act”). Any offer of interests will not purport to be an offer of interests in circumstances under which disclosure is required under the Corporations Act and will only be made to persons who qualify as a “wholesale client” (as defined in the Corporations Act). This material will not be lodged with the Australian Securities and Investments Commission.

Japan:

For professional investors, this document is circulated or distributed for informational purposes only. For those who are not professional investors, this document is provided in relation to Morgan Stanley Investment Management (Japan) Co., Ltd. (“MSIMJ”)’s business with respect to discretionary investment management agreements (“IMA”) and investment advisory agreements (“IAA”). This is not for the purpose of a recommendation or solicitation of transactions or offers any particular financial instruments. Under an IMA, with respect to management of assets of a client, the client prescribes basic management policies in advance and commissions MSIMJ to make all investment decisions based on an analysis of the value, etc. of the securities, and MSIMJ accepts such commission. The client shall delegate to MSIMJ the authorities necessary for making investment. MSIMJ exercises the delegated authorities based on investment decisions of MSIMJ, and the client shall not make individual instructions. All investment profits and losses belong to the clients; principal is not guaranteed. Please consider the investment objectives and nature of risks before investing. As an investment advisory fee for an IAA or an IMA, the amount of assets subject to the contract multiplied by a certain rate (the upper limit is 2.20% per annum (including tax)) shall be incurred in proportion to the contract period. For some strategies, a contingency fee may be incurred in addition to the fee mentioned above. Indirect charges also may be incurred, such as brokerage commissions for incorporated securities. Since these charges and expenses are different depending on a contract and other factors, MSIMJ cannot present the rates, upper limits, etc. in advance. All clients should read the Documents Provided Prior to the Conclusion of a Contract carefully before executing an agreement. This document is disseminated in Japan by MSIMJ, Registered No. 410 (Director of Kanto Local Finance Bureau (Financial Instruments Firms)), Membership: The Japan Securities Dealers Association, the Investment Trusts Association, Japan, the Japan Investment Advisers Association and the Type II Financial Instruments Firms Association.