The green- and other sustainable-labelled debt market provides a broad range of opportunities to finance the climate transition and real-world decarbonisation. Financing low-carbon transition and adaptation requires investors to pull all available levers: at Calvert, we believe green and other sustainable finance instruments will continue to play a meaningful role, leading the way through high standards for capital allocation transparency and impact reporting.

Reason 1: Issuer diversification and format innovation keep green bond attractiveness high.

Green bonds remain the label of choice in the sustainable debt market to finance environmental projects and assets, representing close to 40% of transition finance globally1. The green bond market has grown to over $3 trillion in total outstanding market value, despite facing a slowdown in issuance over the second quarter of 2025.2 Whilst macroeconomic uncertainty and divergence in sustainability regulation across different jurisdictions have contributed to some of this deceleration in new issuance, segments of the green bond market maintain positive momentum, with notable differentiation in terms of issuer type and geography.

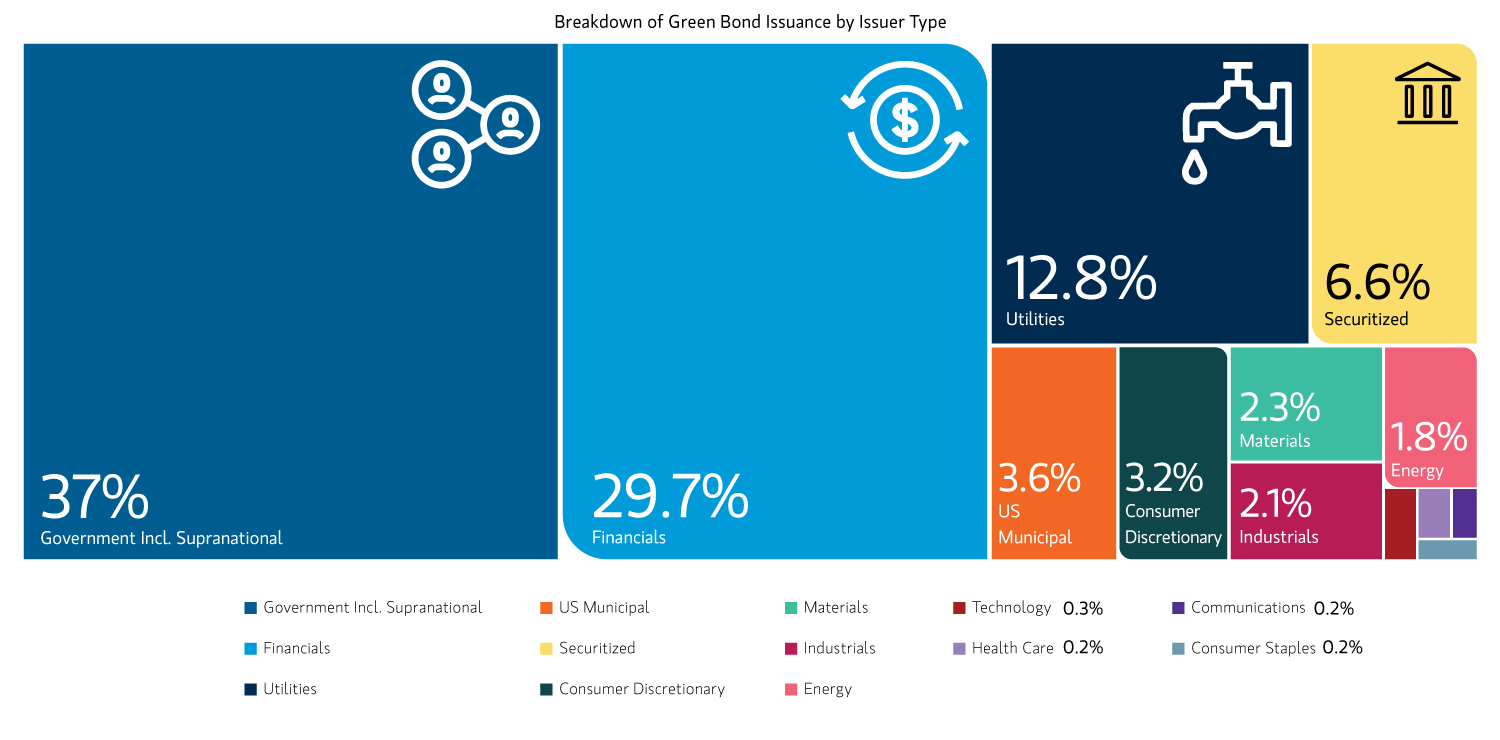

Sovereign, supranational and agency (“SSA”) issuers and securitisations have driven much of the 2025 issuance to date. These jointly account for over 40% of green bond volumes in the first half of 20253 (see chart below).

These volumes and more diversified bond maturities from SSAs, alongside some new issuers, are helping broaden the opportunity set for multi-sector investors to finance climate-related and environmental projects. For example, approximately 70% of sovereign issuers specifically, held in the Bloomberg Global Aggregate Index have now issued in green or other sustainable-labelled formats4.

SSAs often play a pivotal role in driving innovation of bond formats and establishing best market practice for other issuers. For instance, Japan’s issuance of Climate Transition Bonds has been reflected by an uptick in Japanese corporations issuing under the transition bond label, with the transition bond market recording strong issuance at the start of 2025. Across the Asia Pacific region, green and other sustainable bond issuance reached over $150 billion year to date,5 broadening the universe and potential for global asset managers to invest with a climate lens. Multilateral development banks are also increasingly focusing their attention on “originate-to-share" models that provide new channels, including via securitisation, to free up more capital and provide credit enhancements and risk mitigation for emerging markets lending.

While not all labels and formats may be appropriate for any product, such innovation is welcome, as it helps expand the investment opportunity set for responsible fixed income investors and allows each investor to focus on those instruments that best align with their specific climate-related objectives.

Reason 2: Accelerating climate progress: green bonds are broadly delivering on their impact intention.

Currently representing around 40% of transition finance 6, green bonds continue to be one of the preferred instruments to raise capital to drive climate action. And they seem to be delivering on their intent: in addition to the direct benefit of “avoided emissions” (i.e. the decrease in GHG emissions resulting from switching to a lower-carbon alternative versus using a fossil fuel-based product or process), or increased energy savings resulting directly from the financed projects, research shows green bond issuers tend to display greater declines in their total GHG emissions and improvements in carbon efficiency following an initial green issuance, compared to non-green bond issuers. 7 This effect appears to be more remarkable among issuers in higher-emitting sectors.8

Moreover, some studies have also found a correlation between the issuance of green debt and enhanced climate commitments at the corporate level.9 In our view, this points to the signalling role of green bonds with respect to such commitments, and their use case as preferred vehicles, where appropriate, to action climate strategies.

Reason 3: Green bonds can help expand the climate finance toolkit for bond issuers and investors.

In 2024, global economic losses from natural disasters soared to $328 billion,10 and 2025 is shaping up to follow suit, having already reached $162 billion in the first half of the year.11

In addition to the ongoing need for investment in climate change mitigation, we believe climate resilience and adaptation deserve greater attention from investors. Furthermore, companies and government entities need proof of demand for investable technology and infrastructure projects, as well as guidance on their identification. Hence, the development of new frameworks like the Climate Bonds Initiative’s Resilience Taxonomy (now embedded in their Climate Bonds Standard),12 can help issuers identify and classify physical assets and projects that can contribute to promoting climate adaptation and resilience. Similarly, the release of ICMA’s practitioner’s guide on “Sustainable Bonds for Nature”13 provides guidance on biodiversity-related projects, which may also promote climate change mitigation and adaptation.

In combination with innovative bond formats and structures, these thematic developments offer the potential to direct capital towards previously underfinanced climate and environmental projects. This continued diversification offers fixed income investors an expanded set of opportunities, helping to offset some of the political and regulatory headwinds which have slowed down issuance, and helping to keep the momentum in the green and broader sustainable finance market.

Seizing the transition: exploring climate-related investment beyond labels.

The size of the green bond market and the associated regional, issuer, sector and maturity coverage of the available universe of securities, allow responsible fixed income investors to construct diversified sustainable portfolios. This labelled universe can be augmented with vanilla bonds from issuers with robust climate credentials, further enhancing economic diversification for investors and the potential long-term positive environmental impact.

Climate-focused investment continues to grow, primarily supported by spending on electrified transport, renewable energy, and power grids, indicating ongoing capital allocation in sectors such as energy to support the low-carbon transition. Whilst green and sustainable debt continues to play a key role in financing some of these discrete projects, fixed income investors are increasingly looking to build climate-focused portfolios based on the decarbonisation strategy and performance of the whole company, issuer, or products and technologies they offer through their business.

Calvert’s Approach to Climate Investing

As highlighted in our whitepaper on Calvert’s approach to climate investing,14 we aim to help our clients identify and invest in the key drivers and enablers of climate solutions across sectors, and in companies and other issuers that are ahead of their peers in implementing their climate plans. This effort builds on Calvert’s specialised sector research, active engagement, and range of climate investing strategies, which aim to address the components of the climate transition, from ambition to execution, and ultimately to decarbonisation outcomes.

1 Source: BNEF, YE-2024

2 Source: Environmental Finance, as of August 2025.

3 Source: Bloomberg Intelligence, June 2025. Includes government, supranational, and securitised issuers. Bonds may be self-labelled.

4 Source: Environmental Finance, as of August 2025. Sovereign issuers’ labelled debt may not be held in the Bloomberg Global Aggregate Index.

5 Source: Bloomberg Intelligence, June 2025.

6 Source: Bloomberg, YE-2024.

7 Source: J. Demski, Y. Dong, P. McGuire, and B. Mojon, Growth of the green bond market and greenhouse gas emissions, BIS, March 2025.

8 Source: J. Demski, Y. Dong, P. McGuire, and B. Mojon, Growth of the green bond market and greenhouse gas emissions, BIS, March 2025.

9 Source: Fitch, July 2025.

10 Source: Hurricanes and earthquakes could lead to global insured losses of USD 300 billion in a peak year, SwissRe Institute, April 2025.

11 Source: Natural disasters have cost us $162 billion this year. Insurance covered most of it, World Economic Forum, 2025.

12 Climate Bonds Initiative, Climate Bonds Resilience Taxonomy Methodology, 2024.

13 ICMA (International Capital Markets Association), Sustainable Bonds for Nature, June 2025.

14 “A Holistic Approach to Climate Investing”, Calvert Research and Management, April 2025.

Featured Insights

RISK CONSIDERATIONS

There is no assurance that a Portfolio will achieve its investment objective. Portfolios are subject to market risk, which is the possibility that the market values of securities owned by the Portfolio will decline and that the value of Portfolio shares may therefore be less than what you paid for them. Fixed-income securities are subject to the ability of an issuer to make timely principal and interest payments (credit risk), changes in interest rates (interest rate risk), the creditworthiness of the issuer and general market liquidity (market risk). In a rising interest-rate environment, bond prices may fall and may result in periods of volatility and increased portfolio redemptions. In a declining interest-rate environment, the portfolio may generate less income. ESG Strategies that incorporate impact investing and/or Environmental, Social and Governance (ESG) factors could result in relative investment performance deviating from other strategies or broad market benchmarks, depending on whether such sectors or investments are in or out of favor in the market. As a result, there is no assurance ESG strategies could result in more favorable investment performance.

A separately managed account may not be appropriate for all investors. Separate accounts managed according to the Strategy include a number of securities and will not necessarily track the performance of any index. Please consider the investment objectives, risks and fees of the Strategy carefully before investing. A minimum asset level is required.

For important information about the investment managers, please refer to Form ADV Part 2.

The views and opinions are those of the author as of the date of publication and are subject to change at any time due to market or economic conditions and may not necessarily come to pass. The views expressed do not reflect the opinions of all investment personnel at Morgan Stanley Investment Management (MSIM) and its subsidiaries and affiliates (collectively the Firm”), and may not be reflected in all the strategies and products that the Firm offers.

Charts and graphs provided herein are for illustrative purposes only. Past performance is no guarantee of future results.