T.S. Eliot’s line “April is the cruellest month” seemed alarmingly true at the start of the month. President Donald Trump’s Liberation Day announcement of unexpectedly large tariff increases set off a chain reaction undermining equities, bonds and the U.S. dollar. Indeed, the shock to markets was on par with past emerging markets and G20 financial crises, in that equities fell, credit spreads widened, bond yields rose (including government bond yields), and the currency fell. There were also parallels to the U.K. market turmoil experienced during Brexit and former British Prime Minster Liz Truss’s unfortunate 2022 attempt to reflate the economy with large deficit spending.

In response to the extreme market volatility, the Trump administration subsequently postponed tariff implementation for 90 days and rescinded (for now) certain tariffs on autos and other critical imports. This helped stem the market meltdown and reinforced a belief that the market reaction to U.S. trade policy had reached its low point. Notably, the velocity of the recovery was as dramatic as the sell-off.

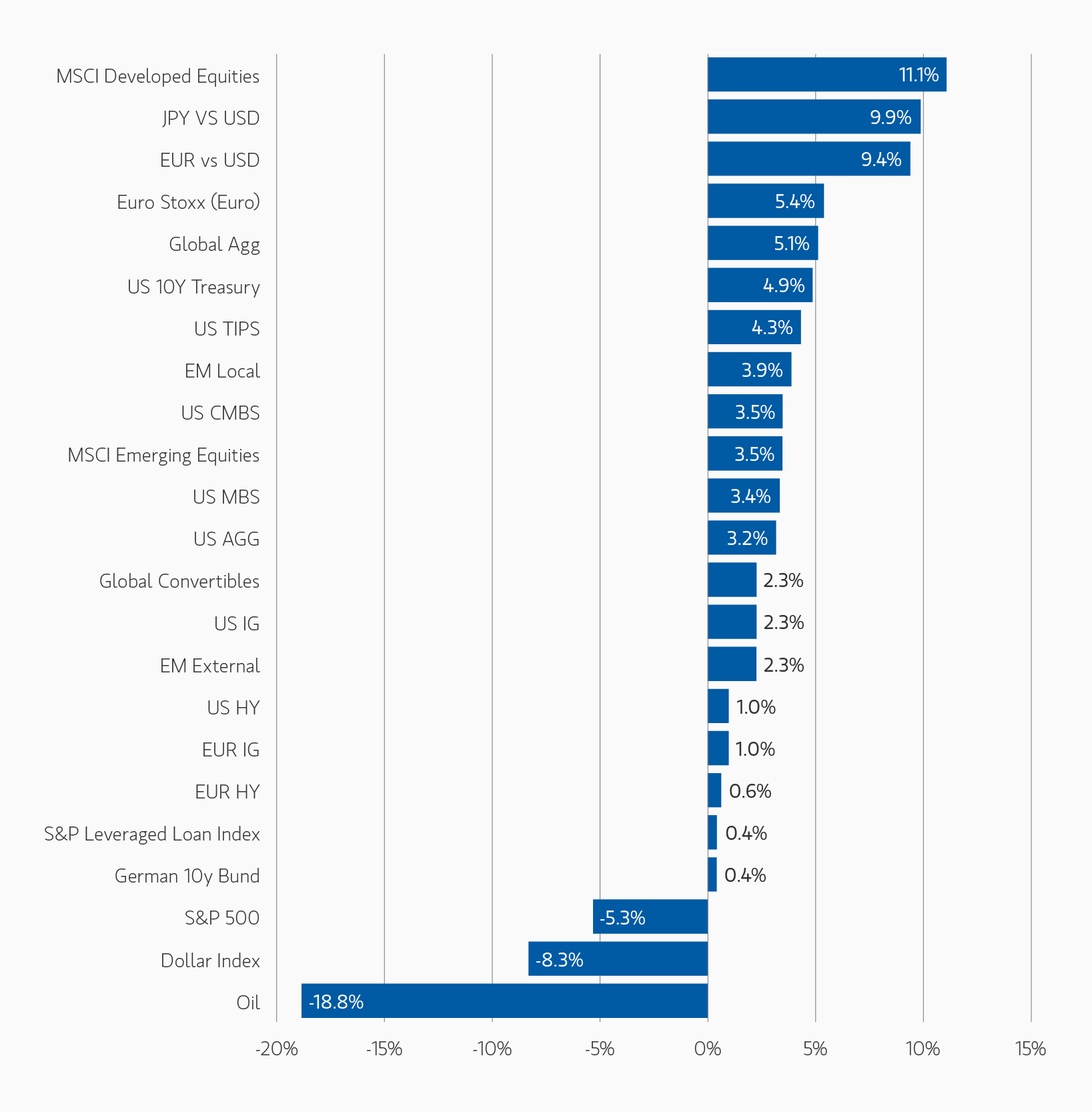

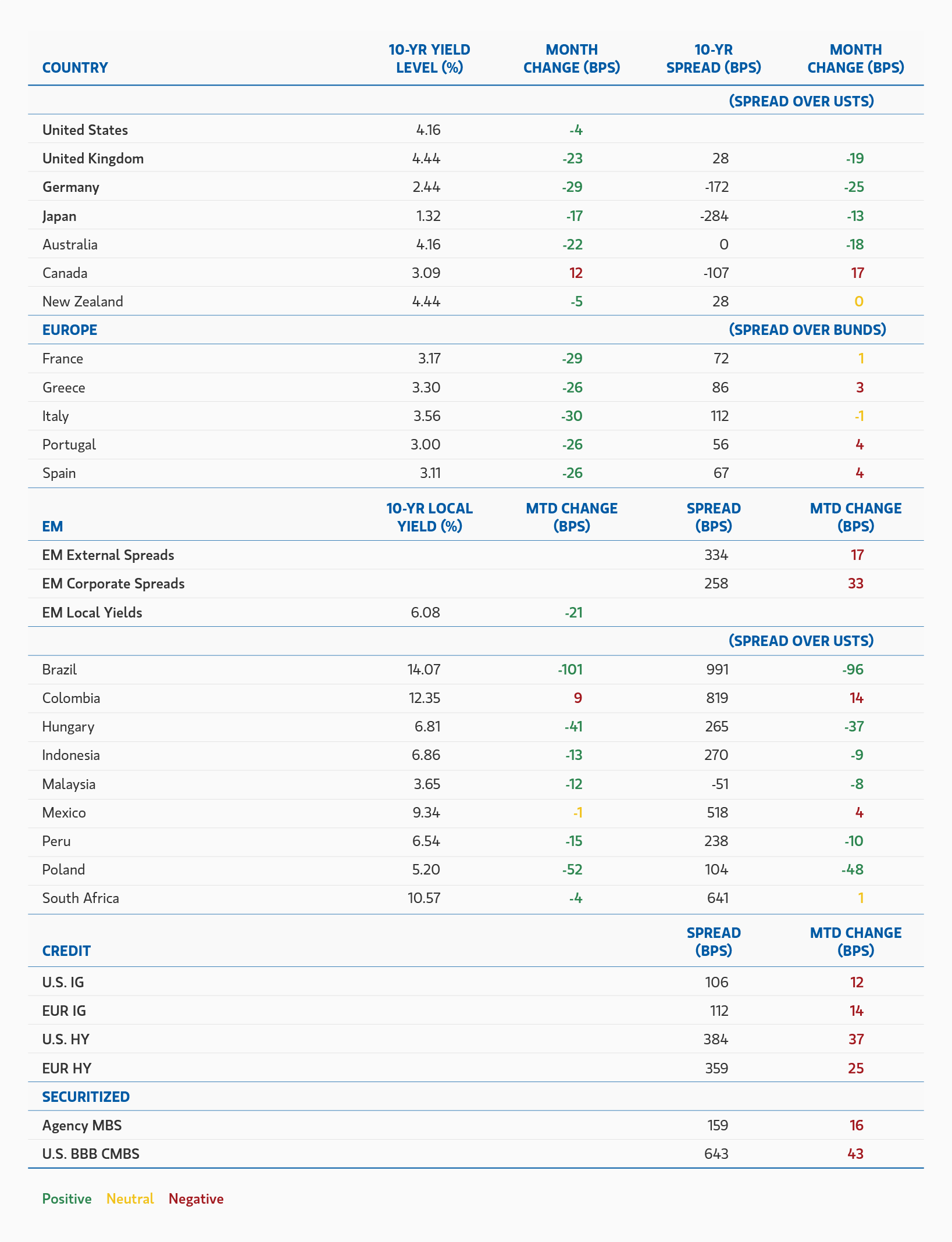

By the end of the month, April looked a bit unremarkable as measured by market movements. 10-year U.S. Treasury yields fell by 4 basis points (bps), with non-U.S. government market bond yields down by more (Germany’s 10-year yield fell 29 bps, UK 23 bps, Australia 22 bps, and Japan 17 bps), except in Canada and New Zealand. U.S. credit spreads were the relative big losers, with U.S. investment grade credit spreads widening 12 bps and U.S. high yield credit spreads widening 37 bps. Europe did not fare much better with Euro-Investment Grade spreads widening 14 bps and Euro HY spreads widening 25 bps. The S&P 500 Index was down less than 1% and even more surprisingly, the MSCI World ex-U.S. Index ended the month trading near record highs. These results give little indication of the remarkable intra-month volatility. The S&P 500 fell almost 11% between April 2 and April 8; U.S. high yield spreads widened 110 basis points; U.S. Treasury 10-year yields rose 24 bps from the end of March to April 11; and the U.S. dollar fell almost 5% over the same period.

Fixed Income Outlook

By May 5, most stock indexes and U.S. Treasury yields were close to where they started on April 2. However, the dollar and credit spreads remain meaningfully weaker from where they were at the start of April and somewhat out of line relative to U.S. Treasury yields and equity prices. Whether or not that gap will close—via weaker equities or stronger credit—will likely depend on three factors: the ultimate path of tariffs, the strength of the U.S. economy, and level of inflation.

The recovery in markets was driven not only by the apparent backing down of the U.S. administration on tariff policy, but also by recent economic data, which has been much less dire than worst-case scenarios. There is no doubt that the outlook for growth and inflation has deteriorated since April 2. But, so far, it is difficult to see in U.S. or global data. Both the manufacturing and service sectors continued to perform well, and despite the noise coming from the U.S. economy, global gross domestic product (GDP) only decreased at a rate of -0.3% in the first quarter. April data also appears relatively unalarming so far. However, expectations of future growth continue to slide globally. U.S. consumer confidence has fallen precipitously, and business sentiment indicators have been declining in most countries. This divergence between current conditions and expectations will eventually close, but by how much and when are open questions.

Given this backdrop, our view is that the U.S. and global economies will likely slow significantly in the second half of this year. It will take time for the still-elevated tariff levels to hit output, income and prices. Frontloading of imports into the U.S. flatters global production and at the same time portends a possibly significant slowdown outside the U.S. in the third and fourth quarters. The big question is what will happen when high prices hit the U.S. consumer and output is hit by slower demand and slower production post inventory build. While employment has been holding steady across the world despite this tariff shock, it is not clear whether it will remain resilient if sentiment and confidence remain at present levels (or slide further) as the year progresses.

The situation is compounded by the likely inability of U.S. fiscal and monetary policy to offset this coming shock. Policy flexibility in countries outside of the U.S. gives them more freedom to offset the probable aggregate demand shock of lower U.S. import demand in the second half of the year. Both monetary and fiscal policy are likely to be eased in response to weaker demand, cushioning the blow to their economies and potentially closing the growth gap to the U.S., thereby making the U.S. economy and potentially its asset markets seem less “exceptional”.

In contrast, the U.S. Federal Reserve’s (Fed) ability to ease policy is likely to be significantly constrained given the inflationary consequences of higher tariffs and the risk of embedded inflation expectations after the already bad experience of the pandemic inflation shock. Moreover, the negative growth implications are likely to take time to materialise, so any policy easing is unlikely before summer at the earliest. If, however, growth deteriorated faster than expected, the Fed will likely ease aggressively despite elevated inflation. U.S. fiscal policy remains constrained by existing high deficits and Republicans’ difficulty with passing a budget reconciliation bill in Congress. As of now, any net fiscal stimulus seems unlikely this year, and it will be considered a success if Congress manages to preserve the tax cuts in the Tax Cuts and Jobs Act of 2017.

Recession risks are elevated everywhere—and probably the highest in North America given the nature of the tariff shock and the more limited policy flexibility there. Whether or not the U.S. and/or global economy tip into recession (and how deeply) will depend on: i) how high tariffs go; ii) whether or not incipient economic or asset price weakness causes the Trump administration to reverse course; and iii) how confident households and corporates are in absorbing the shock without radically cutting spending. Given that the U.S. private sector is still in good financial health, we currently expect only a shallow recession, with year-on-year growth remaining positive but below 2%.

What this means is that U.S. bond yields are stuck near current levels and are unlikely to move out of recent ranges unless there is surprisingly good or bad news on the trade front. The U.S. Treasury yield curve is likely to maintain its steepening bias given higher risk premiums on U.S. assets and the stagflationary nature of the current economic environment. Credit spreads are likely to remain in the ranges defined by movements in April. Spreads will not likely to return to early 2025 or late 2024 levels, nor are they likely to surpass the panicked highs seen in the first two weeks of April. Yields look reasonably attractive relative to history, but maybe not so high given the elevated levels of uncertainty about the next few months. Keeping interest rate risk close to neutral for now seems the best policy, in our view, and opportunistically reacting to sharp movements either way. While continued pressure is likely given the tariff situation, credit fundamentals remain reasonably strong. In addition, corporate behaviour tends to become more conservative during uncertain times, which usually benefits creditors. This suggests that spreads are unlikely to widen to the highs seen in previous recessionary periods. At some point, with some differentiation among sectors and wider spreads, we expect corporate bonds to be a more attractive buy. Euro investment grade exposure is preferred at the margin, given the European Union’s greater flexibility on monetary and fiscal policy to respond to the tariff shock. The high yield market is more vulnerable, but we also do not anticipate a widening to usual recessionary levels. And, there is always the chance that, per most investors’ expectations, the current proposed tariff rates will be negotiated down over the next few months.

Securitized credit and U.S. agency mortgage-backed securities (MBS) have also been affected by tariff risks and heightened market volatility. That said, this sector remains our favourite overweight. Agency MBS has been one of the best-performing sectors in 2025, while securitized credit has held its own. Returns over the next few months are likely to be dominated by carry and not capital gains. Any spread tightening is not likely to occur until either tariff risks diminish and/or the Fed cuts interest rates (a possibility in the second half of the year). We believe the most attractive opportunities remain in the residential mortgage segment, and we are more willing to go down the credit spectrum there. Consumer asset-backed securities (ABS) and commercial real estate securities remain challenged by current financial levels. We believe agency MBS remain attractive relative to investment grade corporate credit.

The outlook for the U.S. dollar has also become problematic since the start of April. The Trump administration’s tariff policies are undermining the exceptionality of the U.S. economy. The inability of U.S. Treasury yields to fall in the initial days following the Liberation Day tariff announcement points to the rising risk premiums attached to U.S. assets and diminishes their attractiveness. The fact that much of the world is likely overweight dollar assets also bodes poorly, given the large U.S. current account deficit that needs financing and the potential for non-U.S. investors to diversify out of the U.S. The combination of large twin deficits, high valuation, and eroding trust in the U.S. economy and policymaking make it likely the dollar will fall further over the course of 2025. In addition, recent rallies in Asian currencies suggest that a grand bargain may be in the offing between the smaller, primarily export-oriented Asian countries and the U.S. over-allowing/encouraging currency depreciations in exchange for leniency on tariffs. This situation needs to be monitored as it may also apply to China. However, the dollar has fallen very quickly in recent weeks and a bit of consolidation is likely over the near term. We remain attentive to opportunities to sell the dollar versus other currencies in the weeks/months ahead.

Developed Market Rate/Foreign Currency

Monthly Review

April was a particularly volatile month in global markets, mainly because of the aggressive trade policy announcements by the Trump administration. From their peak in mid-February, global equities declined more than 16%, 10y U.S. Treasury yields fell by 60 bps and investment grade credit spreads widened 40 bps. However, by month-end, following more moderate tariff announcements, risk assets had largely recovered from their slump, but government bonds largely held on to their gains as markets priced in more rate cuts from central banks. Market volatility was amplified by the unwinding of popular leveraged trades, such as U.S. swap spreads and the Treasury-futures basis. On net, global interest rates fell over the course of the month, led by German Bunds which reversed their sell-off in March in response to Germany’s expansionary fiscal policy plans.

In early April, the US administration announced larger-than-expected tariffs on key trading partners including China, the European Union, and Japan. Although the tariffs were initially labelled as 'reciprocal', the rates seemed to have been determined by countries' bilateral goods trade surplus with the U.S., rather than existing tariff rates on U.S. goods. Following stresses in financial markets, the U.S. eased its stance by reducing the tariff rate to 10% for all partners except China, and delayed implementation for 90 days. Beijing responded with tariffs of its own on U.S. goods and was met with further escalation, triggering concerns about the potential impact on the world’s two largest economies. The U.S. tariff rate on China is now 145% for most goods, while China’s rate on the U.S. is 125%. U.S. economic data – particularly survey data – showed downside risks to economic growth and consumer strength, as well as upside risks to inflation and price expectations. The U.S. Q1 GDP data highlighted significant stockpiling by U.S. importers ahead of the tariffs.

In the euro area, markets priced more easing from the European Central Bank (ECB) following the tariff announcements, given U.S. tariffs are likely to be negative for growth and most likely disinflationary as well. Euro appreciation and falling commodity prices are also likely to bring down inflation. Despite a small upside surprise on the April inflation print, the German yield curve continued to steepen as shorter maturity bonds benefited more from the market pricing more ECB rate cuts. As of the end of April, markets priced 67 bps of cuts by year end, and a terminal ECB rate of around 1.5%.

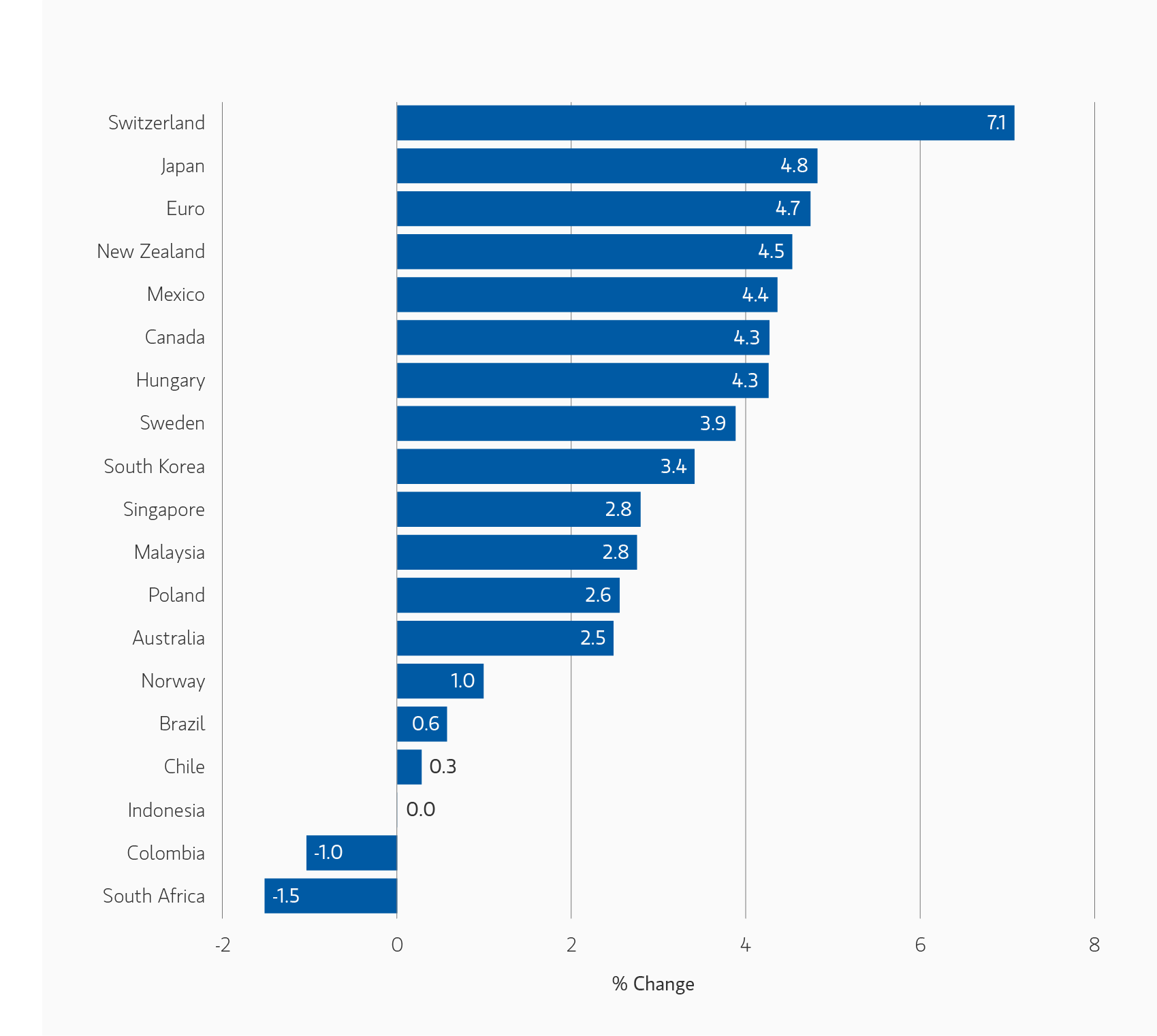

In currency markets, April saw a rapid and broad-based depreciation of the U.S. dollar, though the selloff stabilised towards the end of the month. Safe-haven currencies, including the Swiss franc and Japanese yen, were the largest winners, but emerging market currencies also registered gains against the greenback. The Bloomberg dollar index fell 4.0% over the month, though at one point was down 4.6%. Markets became concerned about international investors reducing long-held overweight positions in U.S. assets – including Treasury bonds – and/or increasing currency hedges on their investments.

Outlook

We are overweight duration in development markets (DM) given the deteriorating growth outlook. We also retain curve steepening exposures in U.S. Treasuries and Bunds. With increased downside risks to economic activity in the U.S. and globally, we think short maturity bonds are more attractive if central banks could cut more aggressively, thus helping to steepen the curve. Cross-market, we remain overweight duration in the U.S., UK and New Zealand versus Australia and Japan. In Japan, we remain long inflation breakevens but have reduced the size of our duration underweight given the poorer global growth outlook. We maintain a positive view on the Japanese yen against the Chinese renminbi.

Emerging Market Rate/Foreign Currency

Monthly Review

Performance was mixed for Emerging Markets Debt (EMD) coming out of a volatile month for global markets. Local markets had positive performance as they continued to be supported by a weakening U.S. dollar. Hard currency sovereign and corporate credit spreads widened during the month, like most credit markets during the broader volatility. U.S. Treasury yields also rose during the period adding a drag to returns. President Trump’s April 2 tariff announcements were sweeping and drastic, and the 90-day pause subsequently after caused whiplash in the markets. The IMF and World Bank held their semi-annual meeting in Washington, D.C., but ahead of the meetings global growth was notably revised down compared to the IMF’s January 2025 outlook. Progress towards a peace agreement between Russia and Ukraine continued as Ukraine and the U.S. signed a minerals deal. Heightened uncertainty turned investors risk-off as flows were negative for both hard and local currency funds but hard currency funds in particular saw their largest 1-month outflows since Fall 2022.1

Outlook

Emerging markets debt is positioned to remain attractive. U.S. foreign policy is likely to keep the dollar weaker and real yield differentials are attractive particularly if we start to see slowdowns in global growth, this will be supportive of local assets. We saw spreads widen for both hard currency sovereign and corporate credit during April volatility, similar to other credit markets, and this introduced an attractive entry point. Concerns surrounding U.S. foreign policy and tariffs keeps uncertainty heighted. Focusing on country fundamentals and positive policy developments will remain crucial to navigate the diverse landscape of emerging markets.

Corporate Credit

Monthly Review

In April, volatility spiked and uncertainty increased as higher-than-anticipated reciprocal tariff rates announced by the U.S. government led the market to factor in a higher probability of recession. Risk assets sold off, with European investment grade spreads closing the month 14 bps wider. On Liberation day, Trump administration announced a base 10% global tariff rate, with higher rates on particular countries based on the goods trade deficit. A week later Trump announced a 90-day pause on additional tariffs, excluding China, which faced an increased 125% tariff rate. The ECB delivered another 25 bps cut, flagging additional growth risks. In the U.S., Cleveland Fed’s Hammack noted the Fed could move in June with clear data. Euro area PMIs pointed to a growth deceleration, while U.S. survey data indicated stagflationary concerns. March’s flash inflation print in Europe was in line with expectations, while U.S. CPI data came in below expectations. Corporate earnings were mixed, notable weakness in autos, chemicals and luxury goods. Defensive sectors like telecoms, utilities and consumer products have fared better. Some companies have removed full year guidance citing the uncertain trade policy and economic outlook. Banks have delivered another uneventful but very strong earnings season. Technical factors weakened, with net outflows from investment-grade funds and gross primary issuance at the higher end of expectations.

U.S. and global high yield markets were exceptionally volatile in April. Following the announcement of new U.S. tariff policy on “Liberation Day”, the average spread-to-worst in the U.S. high yield market leapt by approximately 100 bps over the subsequent four trading days before reaching a mid-month peak of approximately 475 bps as investors shifted capital to higher quality assets amid increased fears of recession. U.S. high yield retail funds set a record for weekly withdrawals in the second week of the month, while the primary market was virtually shuttered until late April. Ultimately, the high yield market was orderly and price discovery efficient, bid-ask spreads widened, but remained relatively range bound, and institutional capital provided for willing buyers at appropriate, lower levels. Amid the ongoing uncertainty and volatility in risk markets the high yield market slowly climbed back and, ultimately, income generated in April almost perfectly offset what was only a modest month-over-month decline in bond prices by month-end.2

Global convertible bonds generated positive total returns during a volatile April driven by the new tariffs policies announced by the U.S. In terms of performance by region, U.S. and European issuers generated positive returns while Chinese issuers lagged due to the concerns about a brewing trade war between the U.S. and China. Ultimately, global convertible bonds underperformed global bonds and modestly underperformed global equities on a USD-hedged basis in April. New supply was limited during the month amid the volatile market environment as well as the corporate earnings blackouts. Only $2.3 billion priced across five deals during the month, which marked the weakest month since late 2022. Year-to-date supply in the asset class ended April at $25.6 billion, which is modestly behind the $29 billion that was issued over the same time period in 2025.3

Outlook

Looking forward, our base case remains constructive for credit supported by expectations for low growth but not a material rise in downgrade or default risk, fiscal policy that remains supportive of growth/employment/ consumption and strong corporate fundamentals, supported by corporate strategy that is low risk. When looking at credit spreads, we view market valuations as fair relative to the uncertain outlook but strong fundamental and technical backdrop and see carry as the main driver of return, with additional gains coming from sector and, increasingly, security selection. We are likely entering a period of tariff negotiation and lower market volatility (relative to April). While tail risks have decreased following the 90-day pause (supportive short term), uncertainty remains high and recession/stagflation risks have increased. Given the uncertain medium-term fundamental backdrop (U.S./Trump policy uncertainty, political tensions, uncertain growth outlook, above target inflation in the U.S. and increased idiosyncratic news flow) we have less confidence in material spread tightening.

We continue to be cautious on the high yield market as we begin May. This outlook includes the dynamic and uncertain evolution of trade, immigration and tax policy, the expectation for stickier inflation, slowing economic growth with an increased probability of recession, and elevated volatility. Yields have grown more historically attractive and the average spread in the high yield market increased to 417 bps in April, closing in on the all-time median. From our vantage point, valuations remain susceptible to further widening. We come to this conclusion after a thorough analysis of factors including the effects of trade policy, evolving monetary policy of global central banks, U.S. and global economic growth, consumer health, the fundamentals of high yield issuers, technical conditions, and valuations. Ultimately, we believe that caution is warranted and expect more comprehensive price realization, particularly in the lower-rated and more challenged segments of leveraged credit.

We continue to remain constructive on the global convertible bond market as we begin May. Convertible bonds held up well in April amidst the market volatility and we expect that to continue given their asymmetric return profile, particularly their bond floor feature. Additionally, we believe primary issuance will pick up despite limited issuance in April. Corporations will need to continue balancing their financing needs with relatively high interest rates as well as the evolving monetary policies from global central banks.

Securitized Products

Monthly Review

Current coupon agency MBS spreads continued to widen in April, in sympathy with other fixed income credit markets. Spreads widened 15 bps in April to +159bp above comparable duration U.S. Treasuries. Agency MBS spreads remain wide, both relative to other core fixed income sectors and from a historical perspective. The Fed’s MBS holdings shrank by $16 billion in April to $2.165 trillion, and are now down $530 billion from its peak in 2022. U.S. Banks holdings held steady in April at $2.667 trillion; bank MBS holdings are still down $335 billion since early 2022. Securitized credit spreads widened more significantly due to increased volatility and credit concerns that emerged in April. After a busy first quarter, April issuance slowed materially with many issuers either pulling or delaying scheduled deals. This lighter supply was easily absorbed, and deals were generally well-subscribed, albeit at these new wider spread levels.

Outlook

We expect U.S. agency MBS spreads to tighten as we expect inflows from relative-value investors and banks due to the attractive return profile of this sector versus other core fixed income sectors and cash alternatives. We don’t, however, think this spread tightening will come until the Fed cuts interest rates in the second half of the year. We expect securitized credit spreads to remain at wider levels until we have more clarity about the economic impacts from Tariff policies. Agency MBS has been one of the best performing sectors YTD and securitized credit has also performed well. We believe that returns will result primarily from cashflow carry in the coming months as we enter May with attractive yields. We still believe that current rate levels remain stressful for many borrowers and will continue to erode household balance sheets, causing stress for some consumer ABS, particularly involving lower income borrowers. Commercial real estate also remains challenged by current financing rates. Residential mortgage backed securities (RMBS) remain our favorite sector and is the one sector where we remain comfortable going down the credit spectrum, as we remain more cautious regarding lower rated ABS and CMBS. We remain positive on Agency MBS valuations as they continue to remain attractive versus investment-grade corporate spreads and versus historical agency MBS spreads.

Featured Insights