Key takeaways

- Constructive macro and credit backdrop: Robust earnings, mid-cycle fundamentals and anticipated Fed cuts support continued preferred performance in 2026.

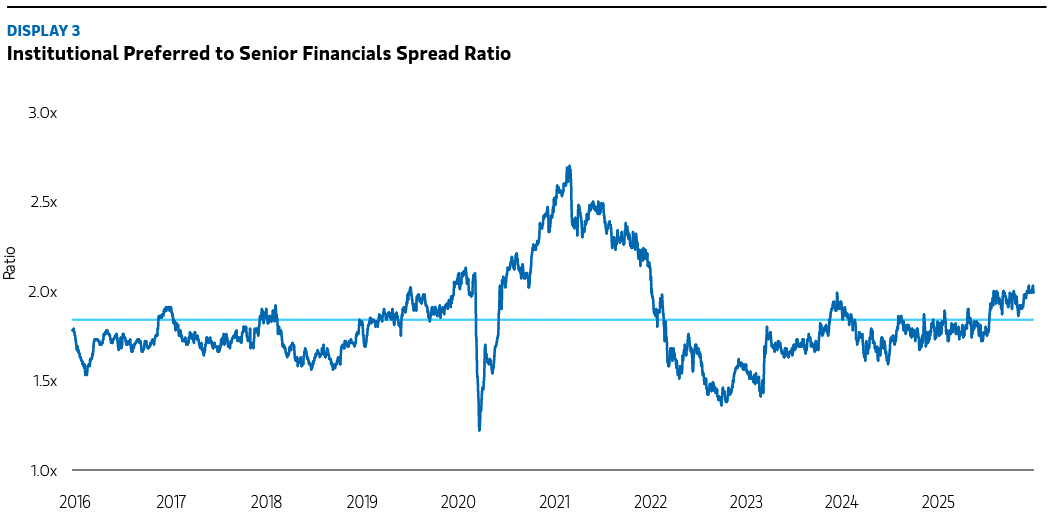

- Valuations remain reasonable relative to alternatives in fixed income, with institutional preferred spreads largely unchanged over the past year.

- Bank supply should stay limited, as evolving regulatory requirements temper issuance, while financial sector fundamentals remain strong heading into 2026.

- Hybrid and preferred structures offer compelling relative value, allowing investors to move down the capital structure to capture incremental yield.

2026 outlook for the preferred securities market

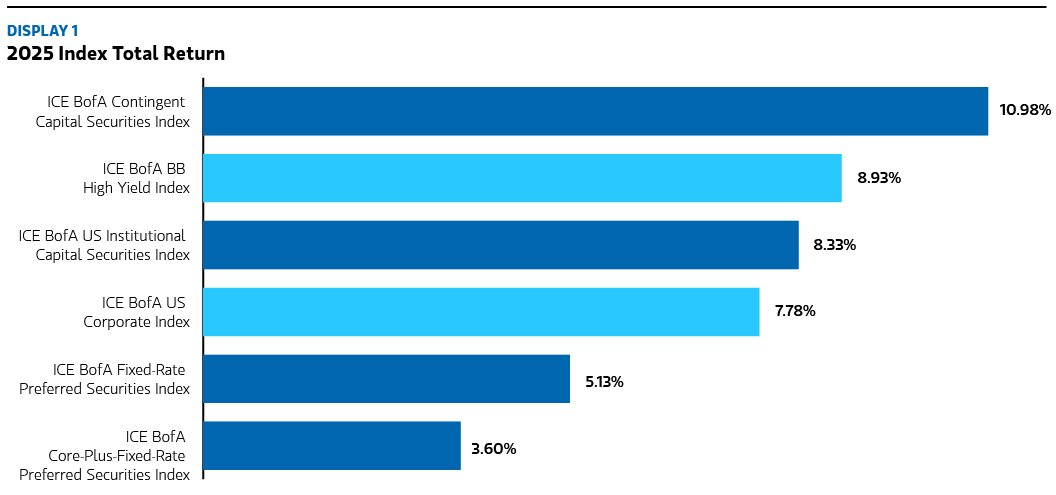

Preferreds delivered another year of attractive performance in 2025, with the ICE BofA Fixed Rate Preferred Index returning 5.13% at year-end. Looking ahead, a supportive macro backdrop characterized by healthy corporate earnings, mid-cycle credit fundamentals and the prospect of additional Fed easing positions the asset class for continued resilience. Valuations in the institutional preferred market remain similar to those of a year ago, while regulatory changes are likely to limit net bank supply. Together, these conditions suggest another year of positive returns in 2026.

Valuations remain attractive relative to other risk assets

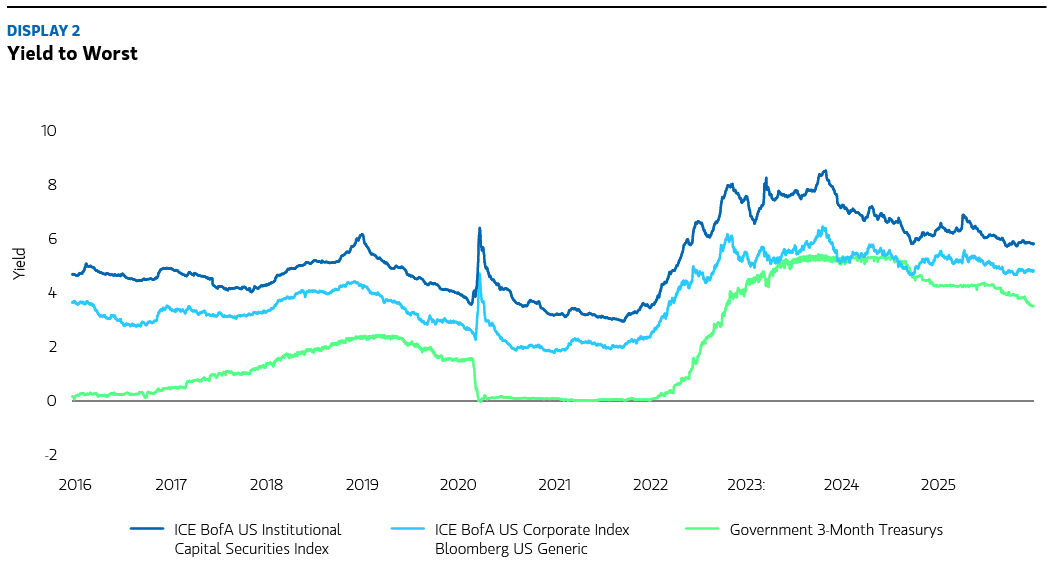

Despite a strong year for risk markets, with equities near all-time highs and investment-grade credit spreads near historic tights, preferred valuations have been largely range-bound. Total returns in 2025 have been driven primarily by coupon income, with a tailwind from rates as the two-year Treasury yield fell from 4.24% at the start of the year to roughly 3.47% at year-end.

The ICE US Institutional Capital Securities Index spread stands at 185 basis points (bps), four bps wider than during 2025 and essentially unchanged since mid-2024. In contrast to other markets, where stretched valuations may warrant caution, preferreds continue to offer a reasonable entry point for investors seeking incremental tax advantaged income.

Bank supply dynamics: Regulatory shifts limiting issuance in 2026

US money-center banks returned to positive net supply in 2025, as clarity around regulatory requirements improved. This issuance helped anchor valuations and was met with healthy investor demand. Notably, a major money-center bank priced a preferred security in December at a reset spread of 300 bps—43 bps wider than comparable issuance in November 2024—as many banks traded wider year over year (YoY).

Looking to 2026, changes to the supplementary leverage ratio (SLR) rules should enable previously constrained banks to let portions of their Additional Tier 1 (AT1) capital decline. As a result, while some institutions still have capacity to issue, we expect overall net supply to be modest, providing ongoing technical support for the asset class.

In Europe, we anticipate bank AT1 supply to drop after a very active 2025. Fewer upcoming calls, elevated opportunistic pre-funding in the current year and only modest growth in bank balance sheets should lead to a decline in issuance. While this should support the asset class, we prefer older vintage structures to more recently issued securities in this segment.

Retail $25-par market: Improving relative value but limited catalysts

The $25-par retail preferred market lagged institutional securities in 2025, with the ICE BofA Core Plus Fixed Rate Preferred Index rising only 3.6% as spreads drifted wider amid a steepening yield curve.

Relative value compared with the institutional market is now as favorable as it’s been in three years, matching mid-2025 levels, but retail preferreds remain more expensive. A sustained period of flatter curves and lower long-end rates—conditions that would typically support this segment—appears less likely in 2026. Additional Fed cuts may further steepen the curve, and long-end rates may remain anchored by nominal GDP growth above 4%. Together, this could limit the potential for retail preferreds outperforming institutional securities in the near term.

Sector outlook: Financials standing out amid diverging sector performance

Within investment-grade credit, some sectors may see modest spread widening next year, driven by elevated capital-expenditure needs related to AI infrastructure and increased merger and acquisition (M&A) activity. But these pressures are uneven across sectors. Financials, representing the majority of the preferred market, continue to demonstrate a compelling mix of strong fundamentals, reasonable valuations and limited supply.

US banks posted record net interest income in 2025, further supported by a rebound in corporate dealmaking that boosted fee-based revenue. A steepening yield curve and continued economic expansion should support moderate loan growth and modest improvement in net interest margins in 2026. M&A activity also appears poised to grow toward levels last seen between 2016 and 2019.

Credit quality across the sector remains robust. Despite isolated concerns around lower-income consumers and risks emerging from nonbank financial institutions, charge-offs and delinquencies in consumer lending improved YoY. On balance, the sector enters 2026 with high capitalization, strong revenue growth, and stable asset quality—a solid foundation for preferred investors.

Yankee AT1: Attractive yield but less room for compression

Total return on the ICE USD Contingent Capital Index topped 10% last year, outperforming US preferreds as spreads compressed for European banks. While the sector has richened compared with US counterparts, we see value amid strong fundamentals and attractive yield differential.

Further tightening could be limited by ongoing regulatory noise in Europe next year. However, European bank earnings have rebounded relative to US peers, and the outlook is bright with positive net interest and fee income trends. Capital is elevated and supported by strong earnings generation, while asset quality is less exposed to problem sectors over the past year, in our view.

Corporate hybrids: Expanding market with attractive structures

Outside the qualified dividend income preferred space, the corporate hybrid market continues to expand. Rating-agency methodology changes allowing 50% equity credit for hybrids, combined with intensifying capital needs—particularly for utilities amid rising energy demand—have supported increased issuance.

Structures evolved in 2025, with investors favoring securities featuring 10-year calls, 30-year maturities and protective features such as coupon floors. Strong demand has compressed subordinated-to-senior ratios, but hybrids still offer appealing compensation for subordination and attractive relative value compared with BB-rated high yield.

In addition, hybrid issuance broadened beyond utilities in 2025, with Canadian telecom, healthcare and refining companies entering the market. We expect this trend to continue as corporates seek rating support and financing flexibility in an active M&A environment.

Conclusion: Another income-driven year ahead

Bringing these elements together, we expect preferred securities to deliver returns consistent with long-term historical averages—approximately 6%—with income providing the majority of performance. Given robust corporate earnings, a supportive macro backdrop and solid financial-sector fundamentals, we remain comfortable moving down the capital structure to capture the additional yield available in preferred and hybrid securities.

Featured Insights

Index Definitions

The ICE BofA Contingent Capital Securities Index is designed to track the performance of investment-grade and below-investment-grade contingent capital debt.

The ICE BofA BB High Yield Index is a financial index that tracks the performance of US dollar-denominated, below-investment-grade corporate debt publicly issued in the US domestic market.

The ICE BofA US Institutional Capital Securities Index is a capitalization-weighted index that tracks the performance of fixed-rate US-dollar-denominated preferred securities issued in the US domestic market.

The ICE BofA US Corporate Index is a comprehensive index that tracks the performance of US dollar-denominated investment-grade corporate debt publicly issued in the US domestic market.

The ICE BofA Fixed Rate Preferred Securities Index is an unmanaged index of fixed-rate, preferred securities issued in the U.S.

The ICE BofA Core Plus Fixed Rate Preferred Securities Index is a capitalization-weighted index that tracks the performance of fixed-rate US dollar-denominated preferred securities issued in the US domestic market.

Risk considerations

There is no assurance that a portfolio will achieve its investment objective. Portfolios are subject to market risk, which is the possibility that the market values of securities owned by the portfolio will decline. Market values can change daily due to economic and other events (e.g. natural disasters, health crises, terrorism, conflicts and social unrest) that affect markets, countries, companies or governments. It is difficult to predict the timing, duration, and potential adverse effects (e.g. portfolio liquidity) of events. Accordingly, you can lose money investing in this portfolio. Please be aware that this portfolio may be subject to certain additional risks. Fixed-income securities are subject to the ability of an issuer to make timely principal and interest payments (credit risk), changes in interest rates (interest-rate risk), the creditworthiness of the issuer and general market liquidity (market risk). In a rising interest-rate environment, bond prices may fall and may result in periods of volatility and increased portfolio redemptions. In a declining interest-rate environment, the portfolio may generate less income. Longer-term securities may be more sensitive to interest rate changes. Preferred Securities As with fixed-income securities, which also make fixed payments, the market value of preferred stock is sensitive to changes in interest rates. Preferred stock generally decreases in value if interest rates rise and increases in value if interest rates fall. The views and opinions and/or analysis expressed are those of the author or the investment team as of the date of preparation of this material and are subject to change at any time without notice due to market or economic conditions and may not necessarily come to pass. Furthermore, the views will not be updated or otherwise revised to reflect information that subsequently becomes available or circumstances existing, or changes occurring, after the date of publication. The views expressed do not reflect the opinions of all investment personnel at Morgan Stanley Investment Management (MSIM) and its subsidiaries and affiliates (collectively “the Firm”), and may not be reflected in all the strategies and products that the Firm offers.

Forecasts and/or estimates provided herein are subject to change and may not actually come to pass. Information regarding expected market returns and market outlooks is based on the research, analysis and opinions of the authors or the investment team. These conclusions are speculative in nature, may not come to pass and are not intended to predict the future performance of any specific strategy or product the Firm offers. Future results may differ significantly depending on factors such as changes in securities or financial markets or general economic conditions.This material has been prepared on the basis of publicly available information, internally developed data and other third-party sources believed to be reliable. However, no assurances are provided regarding the reliability of such information and the Firm has not sought to independently verify information taken from public and third-party sources.

This material is a general communication, which is not impartial and all information provided has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy. The information herein has not been based on a consideration of any individual investor circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal or regulatory advice. To that end, investors should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.

The indexes do not include any expenses, fees or sales charges. It is not possible to invest directly in an index. Any index referred to herein is the intellectual property (including registered trademarks) of the applicable licensor. Any product based on an index is in no way sponsored, endorsed, sold or promoted by the applicable licensor and it shall not have any liability with respect thereto.

The Firm has not authorised financial intermediaries to use and to distribute this material, unless such use and distribution is made in accordance with applicable law and regulation. Additionally, financial intermediaries are required to satisfy themselves that the information in this material is appropriate for any person to whom they provide this material in view of that person’s circumstances and purpose. The Firm shall not be liable for, and accepts no liability for, the use or misuse of this material by any such financial intermediary.

This material may be translated into other languages. Where such a translation is made this English version remains definitive. If there are any discrepancies between the English version and any version of this material in another language, the English version shall prevail.

The whole or any part of this material may not be directly or indirectly reproduced, copied, modified, used to create a derivative work, performed, displayed, published, posted, licensed, framed, distributed or transmitted or any of its contents disclosed to third parties without the Firm’s express written consent. This material may not be linked to unless such hyperlink is for personal and non-commercial use. All information contained herein is proprietary and is protected under copyright and other applicable law.

Eaton Vance, is part of Morgan Stanley Investment Management, the asset management division of Morgan Stanley.

NOT FDIC INSURED. OFFER NO BANK GUARANTEE. MAY LOSE VALUE. NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY. NOT A DEPOSIT.