Now that the One Big Beautiful Bill Act (OBBA) has been signed in law, there is more clarity around the expiring provisions of the Tax Cuts and Jobs Act of 2017. One in particular is the gift and lifetime exemption has been made permanent with an increase to $15 million per individual or $30 million per couple in 2026. The higher exemptions allow investors to distribute more assets to family members free of gift taxes. As baby boomers prepare to pass down $105 trillion to younger generations -- including $18 trillion going to charities1 -- over the next 24 years, it is important for advisors to have a holistic approach when considering clients’ personal circumstances as well as strategies to create a comprehensive wealth plan. Some $54 trillion will be transferred between spouses -- including nearly $40 trillion going to widowed women in the baby boomer generation -- before it’s transferred intergenerationally to heirs. Heirs are currently inheriting around $2.5 trillion annually from baby boomers and that amount is expected to increase in the next 5 to 10 years. It’s helpful to start having conversations with clients and their family members to ensure each generation’s goals are represented in the overall plan.

Charitable planning may enable advisors to build stronger connections across generations while helping clients with tax and estate planning objectives. Amid the largest-yet intergenerational wealth transfer, 64% of advisors consider lifetime gifting, donations and charitable trusts or foundations as an effective tool, according to Cerulli.

How to reduce your estate with annual gifting and qualified gifts to education/medical expenses

Clients with a large estate may gift $19,000 per year (or $38,000 per married couple) to any number of individuals free of gift taxes.

In addition to distributing annual gifts, there are no limits on when qualified funds for education or medical expenses are paid to individuals. For example, grandparents may want to help a grandchild pay for tuition (room and board are not exempt) by sending the funds to the institution directly and that amount will not count towards the annual and lifetime gift exclusions.

Consider a Charitable Remainder Trusts (CRT) or a Legacy Income Trusts (LIT)

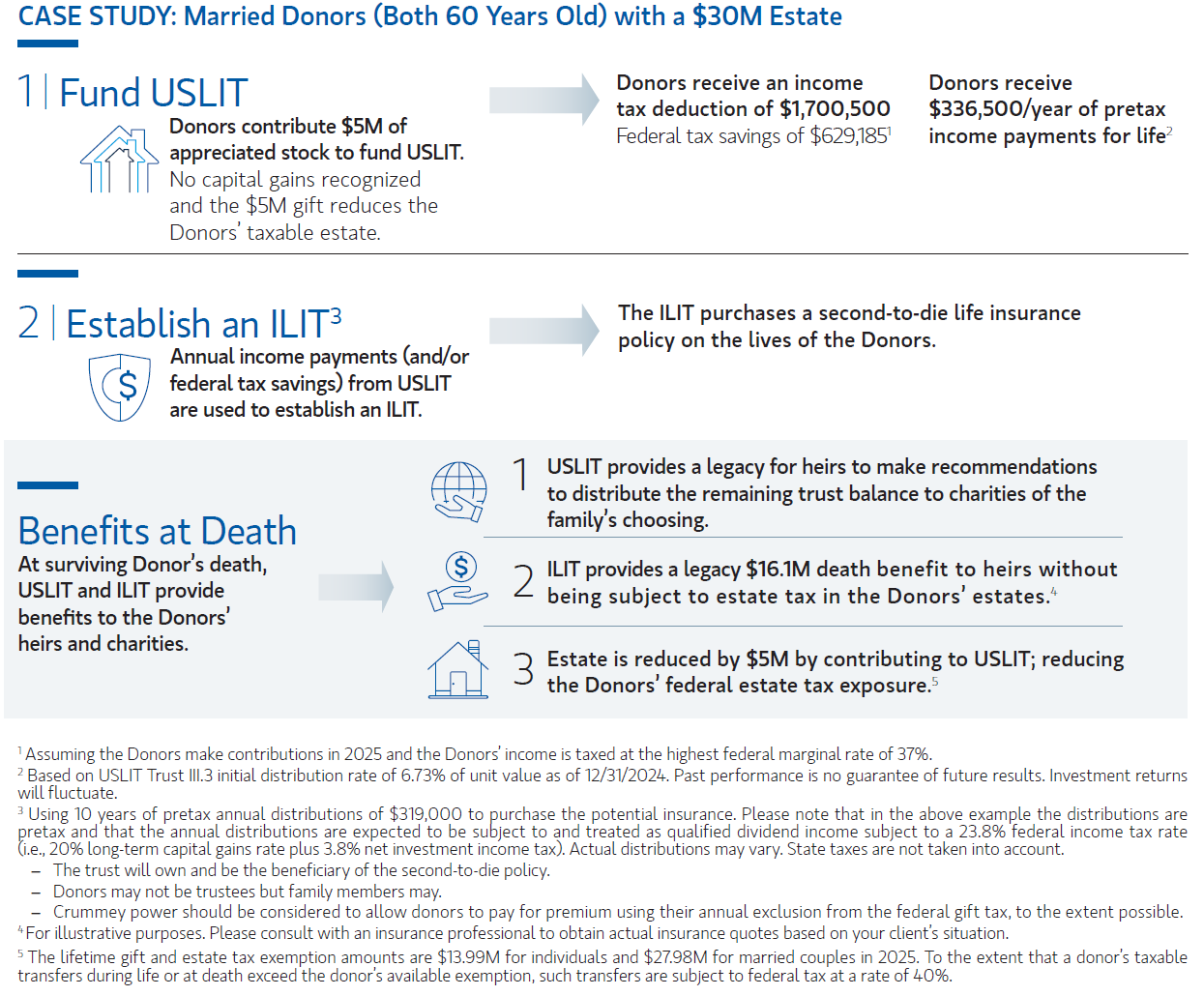

Establishing a Charitable Remainder Trust (CRT) allows the donor to distribute income over time to beneficiaries rather than giving a lump sum, which may be beneficial for those who may want to control the distributions. By establishing a CRT, donors can gift an appreciated asset (reducing their estate), receive an upfront charitable deduction and name income beneficiaries to receive an income stream for a lifetime payout or term of years. At the end of the term of the trust, monies can be left for beneficiaries’ favorite charities.

Donors who are interested in these objectives without setting up a charitable trust may want to consider a Legacy Income Trust (LIT) as a turnkey alternative. A LIT does not require clients to establish a trust (no upfront cost) with potentially better benefits, such as distributions comprised of qualified dividend income (QDI). A LIT also allows up to 10 income beneficiaries which provides for younger and more participants than a CRT, which typically has two to five beneficiaries (no 10% required remainder value), all with lower administration and cost.

How to utilize higher exemptions

The 2025 gift and estate tax lifetime exemption are $13.99 million for single filers and $27.98 million for joint filers, allowing more to be distributed to heirs free of federal gift or estate tax while these exemptions remain available.

Since LIT can provide higher deductions than CRTs, this enables a smaller gift that is applied to the estate allowing donors to maximize their distributions to family members.2 Here is a flyer to see how a LIT can help take advantage of the higher gift and lifetime exemptions.

Wealth transfer with an irrevocable life insurance trust (ILIT)

Clients with a large estate who do not want to utilize the gift and lifetime exemptions by naming children as income participants may consider replacing a gifted asset with a life insurance policy that can be passed on to family members.

Donors can gift an appreciated asset to a CRT or LIT without capital gains and increase the value to generate income while removing the assets from the grantor’s taxable estate. If structured properly, income gifted to an irrevocable life insurance trust (ILIT) can qualify for the annual gift exemptions while any remaining funds count towards gift and lifetime exemptions. This may create potentially higher inheritance for the heirs.

Bottom line: Now that there is more certainty with the Gift and lifetime exemptions made permanent, this may be an opportune time to review your client’s estate plan to see if any revisions should be made. With the largest intergenerational wealth transfer already underway, financial advisors may play a major role in helping their clients attain the best possible outcomes. Advisors should speak to and involve family members to learn how to best address all aspects of estate planning, including tax efficiency and charitable giving.

1 Cerulli

2 Legacy Income Trusts are pooled income funds (PIFs) described in Internal Revenue Code Section 642(c)(5) established in 2025 by the Gift Trust, with the original series established in 2019. For young PIFs (less than three years of operating history), funds use the highest annual average Internal Revenue Code Section 7520 rate to calculate the deductions. PIFs established in 2025 use a 4.0% rate for deductions. This is more favorable than similar vehicles like Charitable Remainder Unitrusts (CRUTs) which use the current month or prior two months Section 7520 rate as well as the payout rate, and other factors in determining the charitable deductions. Here is a Charitable Income Tax Deduction Comparison Calculator to compare deductions for these vehicles.

Featured Insights

Disclaimer

The views expressed are those of the authors and are current only through the date stated. These views are subject to change at any time based upon market or other conditions, and Eaton Vance disclaims any responsibility to update such views. These views may not be relied upon as investment advice and, because investment decisions for Eaton Vance are based on many factors, may not be relied upon as an indication of trading intent on behalf of any Eaton Vance fund. The discussion herein is general in nature and is provided for informational purposes only. There is no guarantee as to its accuracy or completeness. Past performance is no guarantee of future results.

Nothing in this blog should be construed as tax advice. The discussion is general in nature and is not intended to serve as the primary or sole basis for investment or tax-planning decisions. Prospective investors should consult with a tax or legal advisor before making any investment decision.

Investing entails risks and there can be no assurance that Eaton Vance will achieve profits or avoid incurring losses. All investments are subject to potential loss of principal. The views and strategies described may not be suitable for all investors.

It is not possible to invest directly in an index. Past performance is no guarantee of future results.

Eaton Vance is part of Morgan Stanley Investment Management, the asset management division of Morgan Stanley. Eaton Vance does not provide tax or legal advice. Prospective investors should consult with a tax or legal advisor before making any investment decision.

NOT FDIC INSURED | OFFER NO GUARANTEE | MAY LOSE VALUE | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY | NOT A BANK DEPOSIT