key points

- Emerging Market (EM) debt markets had strong performance in the second quarter, as the weakening U.S. dollar boosted currencies, while sovereign credit tightened and EM rates outperformed global rates.

- Tariff uncertainty appears to be disinflationary in the EM, giving EM central banks the leeway to keep cutting rates. We see continued weakening of the USD as a tailwind for the sector.

- In the third quarter, we still see significant value in EM debt. We believe that especially in this environment, value is best identified through country-level macroeconomic and political research, and stand-alone analysis of risk factors like currency, credit and interest rates.

EM debt markets had strong performance in the second quarter, with positive contributions from almost all the risk factors that drive returns for the local currency sovereign, hard currency sovereign and corporate EM debt segments. The weakening U.S. dollar boosted currencies, while sovereign credit tightened and EM rates outperformed global rates.

President Trump’s April 2 “Liberation Day” tariff announcements dominated headlines for much of the quarter and initially sparked considerable volatility in global markets, including EM. As is often the case with macro-driven selloffs, the market tends to “over correct.” Thus, despite an initial widening of most sovereign credit spreads, many came back in as Trump paused the tariffs for 90 days and volatility subsided.

Emerging markets debt had strong performance in the second quarter as EM currencies strengthened vs. a weakening U.S. dollar, EM rates outperformed global rates, and sovereign and corporate spreads tightened"

While tariffs generally strengthen the currency of the country imposing them, in this case they clouded the U.S. economic outlook and worked against the USD. As a result, investors looked for global investment opportunities and implemented short-dollar trades, which added to downward pressure on the USD.

Asset class flows during the quarter underscored that trend. While the flows were negative overall, local currency funds had net positive inflows of $1.4 billion, compared with negative $5.1 billion for hard currency funds, which are denominated in USD. In both fund categories, outflows were heavy in April but turned positive in May and June.

Downward rate pressure

The tariff uncertainty also contributed downward pressure on EM interest rates, as Trump’s announcements served as a “disinflationary shock” for EM, and consensus projections fell for EM growth and inflation. While the U.S. Federal Reserve held rates steady in June, EM central banks continued to cut rates, as did the ECB and several developed market central banks.

EM debt investors also appeared to shrug off the potential trade war between the U.S. and China. While many countries tried to negotiate after Trump’s tariff salvo, China came back with reciprocal tariffs – threatened levels reached 145% on Chinese goods and 125% on U.S. goods, before a truce was called. Yet the tension remains, as both countries accused each other of violating the truce.

Similarly, continuing violence in the Mideast and Europe failed to significantly rattle world markets, even as ceasefires in Ukraine and Gaza proved to be elusive. Israel had the world on edge with its 12-day battle with Iran in June. Despite the conflict escalating with U.S. airstrikes on Iran nuclear facilities, a ceasefire was agreed to and has generally held . After a spike in oil prices leading up to the conflict, prices settled at the end of month lower than the start of the quarter.

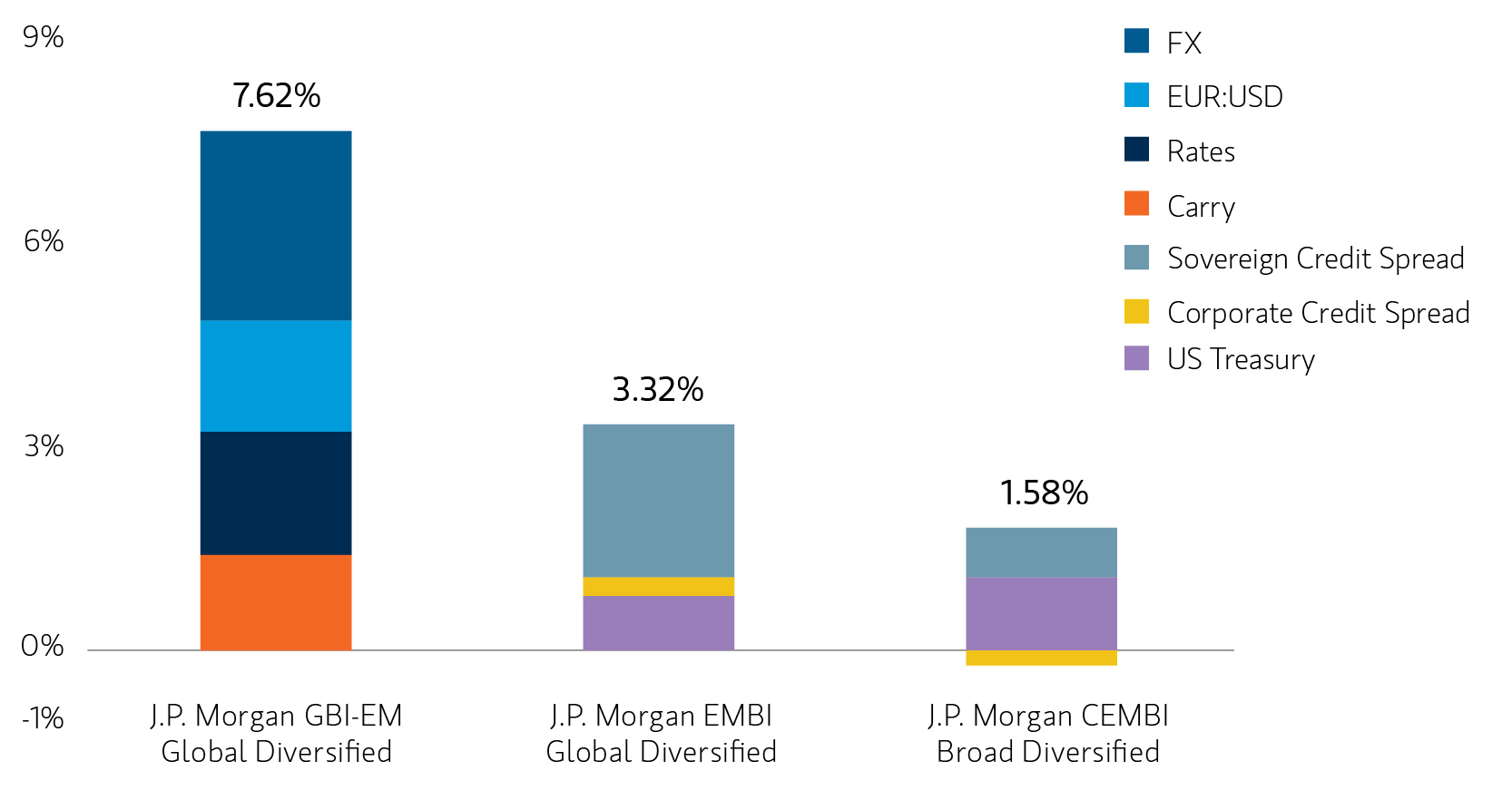

Display 1 shows the performance of the three EM debt sectors, with the local currency index returning an especially strong 7.62%. As discussed, currencies were the biggest driver with EM rates rally also contributing. The hard currency sovereign index returned 3.32%, with spread compression contributing two-thirds of the gain, including lower-quality credits like Ecuador, Ghana and Egypt. The hard currency corporate index returned 1.58%, benefiting from U.S. Treasury rates falling and sovereign spread tightening.

All 3 EM Debt sectors had strong 2Q25 performance

Source: J.P. Morgan, Morgan Stanley Investment Management calculations. As of June 30, 2025. Corporate Credit Spread and Sovereign Credit Spread return attributions are modelled by decomposing the overall spread return to its two components: the sovereign spread and the corporate spread over the sovereign. It is not possible to invest directly in an index. Data provided is for informational use only. Past performance is no guarantee of future results.

3Q25 Outlook

U.S. tariff policy is likely to remain a major wild card, especially as the 90-day pause set by Trump expires and active bilateral negotiations continue. The potential inflationary impact in the U.S. remains uncertain, and the U.S. Fed is watching keenly for signs of pricing pressure while also fending off pressure from Trump to lower rates.

But outside the U.S., tariff uncertainty appears to be disinflationary, giving EM central banks the leeway to keep cutting rates. While forecasts for EM growth and inflation are both down from a year ago, we see continued weakening of the USD as a tailwind for the sector. Asset flows from investors are also likely to be supportive, continuing the inflows to both local and hard currency funds we saw in May and June. We believe this trend reflects shifting sentiments by global investors: away from the belief in “U.S. exceptionalism” and toward an increasingly attractive EM opportunity set.

With more than 100 countries in the EM universe, many have minimal trade with the U.S. and will be less directly impacted by tariffs, but others more so. This environment underscores the importance of country-level macroeconomic and political research, and stand-alone analysis of specific risk factors like currency, credit and interest rates.

Bottom line: In the third quarter, we still expect to see significant value in EM debt, despite the strong performance in the first half of the year. For one, real-yield differentials remain wide in favor of EM over developed markets. EM issuers represent an expanding opportunity set – especially those outside of the major benchmarks -- but require significant analytical expertise to identify the best opportunities. As always, we will continue our focus on differentiation amongst countries and credits as the best way to deliver EM value for our clients.

Featured Insights

There is no guarantee that any investment strategy will work under all market conditions, and each investor should evaluate their ability to invest for the long-term, especially during periods of downturn in the market.

A separately managed account may not be appropriate for all investors. Separate accounts managed according to the Strategy include a number of securities and will not necessarily track the performance of any index. Please consider the investment objectives, risks and fees of the Strategy carefully before investing. A minimum asset level is required.

For important information about the investment managers, please refer to Form ADV Part 2.

The views and opinions and/or analysis expressed are those of the author or the investment team as of the date of preparation of this material and are subject to change at any time without notice due to market or economic conditions and may not necessarily come to pass. Furthermore, the views will not be updated or otherwise revised to reflect information that subsequently becomes available or circumstances existing, or changes occurring, after the date of publication. The views expressed do not reflect the opinions of all investment personnel at Morgan Stanley Investment Management (MSIM) and its subsidiaries and affiliates (collectively “the Firm”), and may not be reflected in all the strategies and products that the Firm offers.

Forecasts and/or estimates provided herein are subject to change and may not actually come to pass. Information regarding expected market returns and market outlooks is based on the research, analysis and opinions of the authors or the investment team. These conclusions are speculative in nature, may not come to pass and are not intended to predict the future performance of any specific strategy or product the Firm offers. Future results may differ significantly depending on factors such as changes in securities or financial markets or general economic conditions.

This material has been prepared on the basis of publicly available information, internally developed data and other third-party sources believed to be reliable. However, no assurances are provided regarding the reliability of such information and the Firm has not sought to independently verify information taken from public and third-party sources.

This material is a general communication, which is not impartial and all information provided has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy. The information herein has not been based on a consideration of any individual investor circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal or regulatory advice. To that end, investors should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.

Charts and graphs provided herein are for illustrative purposes only. Past performance is no guarantee of future results.

This material is not a product of Morgan Stanley’s Research Department and should not be regarded as a research material or a recommendation.

The Firm has not authorised financial intermediaries to use and to distribute this material, unless such use and distribution is made in accordance with applicable law and regulation. Additionally, financial intermediaries are required to satisfy themselves that the information in this material is appropriate for any person to whom they provide this material in view of that person’s circumstances and purpose. The Firm shall not be liable for, and accepts no liability for, the use or misuse of this material by any such financial intermediary.

This material may be translated into other languages. Where such a translation is made this English version remains definitive. If there are any discrepancies between the English version and any version of this material in another language, the English version shall prevail.

The whole or any part of this material may not be directly or indirectly reproduced, copied, modified, used to create a derivative work, performed, displayed, published, posted, licensed, framed, distributed or transmitted or any of its contents disclosed to third parties without the Firm’s express written consent. This material may not be linked to unless such hyperlink is for personal and non-commercial use. All information contained herein is proprietary and is protected under copyright and other applicable law.

Eaton Vance, Atlanta Capital, Parametric and Calvert are part of Morgan Stanley Investment Management. Morgan Stanley Investment Management is the asset management division of Morgan Stanley.

DISTRIBUTION

This material is only intended for and will only be distributed to persons resident in jurisdictions where such distribution or availability would not be contrary to local laws or regulations.

MSIM, the asset management division of Morgan Stanley (NYSE: MS), and its affiliates have arrangements in place to market each other’s products and services. Each MSIM affiliate is regulated as appropriate in the jurisdiction it operates. MSIM’s affiliates are: Eaton Vance Management (International) Limited, Eaton Vance Advisers International Ltd, Calvert Research and Management, Eaton Vance Management, Parametric Portfolio Associates LLC, and Atlanta Capital Management LLC.

This material has been issued by any one or more of the following entities:

EMEA

This material is for Professional Clients/Accredited Investors only.

In the EU, MSIM and Eaton Vance materials are issued by MSIM Fund Management (Ireland) Limited (“FMIL”). FMIL is regulated by the Central Bank of Ireland and is incorporated in Ireland as a private company limited by shares with company registration number 616661 and has its registered address at 24-26 City Quay, Dublin 2 , DO2 NY19, Ireland.

Outside the EU, MSIM materials are issued by Morgan Stanley Investment Management Limited (MSIM Ltd) is authorised and regulated by the Financial Conduct Authority. Registered in England. Registered No. 1981121. Registered Office: 25 Cabot Square, Canary Wharf, London E14 4QA.

In Switzerland, MSIM materials are issued by Morgan Stanley & Co. International plc, London (Zurich Branch) Authorised and regulated by the Eidgenössische Finanzmarktaufsicht ("FINMA"). Registered Office: Beethovenstrasse 33, 8002 Zurich, Switzerland.

Outside the US and EU, Eaton Vance materials are issued by Eaton Vance Management (International) Limited (“EVMI”) 125 Old Broad Street, London, EC2N 1AR, UK, which is authorised and regulated in the United Kingdom by the Financial Conduct Authority.

Italy: MSIM FMIL (Milan Branch), (Sede Secondaria di Milano) Palazzo Serbelloni Corso Venezia, 16 20121 Milano, Italy. The Netherlands: MSIM FMIL (Amsterdam Branch), Rembrandt Tower, 11th Floor Amstelplein 1 1096HA, Netherlands. France: MSIM FMIL (Paris Branch), 61 rue de Monceau 75008 Paris, France. Spain: MSIM FMIL (Madrid Branch), Calle Serrano 55, 28006, Madrid, Spain. Germany: MSIM FMIL Frankfurt Branch, Große Gallusstraße 18, 60312 Frankfurt am Main, Germany (Gattung: Zweigniederlassung (FDI) gem. § 53b KWG). Denmark: MSIM FMIL (Copenhagen Branch), Gorrissen Federspiel, Axel Towers, Axeltorv2, 1609 Copenhagen V, Denmark.

MIDDLE EAST

Dubai: MSIM Ltd (Representative Office, Unit Precinct 3-7th Floor-Unit 701 and 702, Level 7, Gate Precinct Building 3, Dubai International Financial Centre, Dubai, 506501, United Arab Emirates. Telephone: +97 (0)14 709 7158).

This document is distributed in the Dubai International Financial Centre by Morgan Stanley Investment Management Limited (Representative Office), an entity regulated by the Dubai Financial Services Authority (“DFSA”). It is intended for use by professional clients and market counterparties only. This document is not intended for distribution to retail clients, and retail clients should not act upon the information contained in this document.

This document relates to a financial product which is not subject to any form of regulation or approval by the DFSA. The DFSA has no responsibility for reviewing or verifying any documents in connection with this financial product. Accordingly, the DFSA has not approved this document or any other associated documents nor taken any steps to verify the information set out in this document, and has no responsibility for it. The financial product to which this document relates may be illiquid and/or subject to restrictions on its resale or transfer. Prospective purchasers should conduct their own due diligence on the financial product. If you do not understand the contents of this document, you should consult an authorised financial adviser.

U.S.

NOT FDIC INSURED | OFFER NO BANK GUARANTEE | MAY LOSE VALUE | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY | NOT A DEPOSIT

Latin America (Brazil, Chile Colombia, Mexico, Peru, and Uruguay)

This material is for use with an institutional investor or a qualified investor only. All information contained herein is confidential and is for the exclusive use and review of the intended addressee, and may not be passed on to any third party. This material is provided for informational purposes only and does not constitute a public offering, solicitation or recommendation to buy or sell for any product, service, security and/or strategy. A decision to invest should only be made after reading the strategy documentation and conducting in-depth and independent due diligence.

ASIA PACIFIC

Hong Kong: This material is disseminated by Morgan Stanley Asia Limited for use in Hong Kong and shall only be made available to “professional investors” as defined under the Securities and Futures Ordinance of Hong Kong (Cap 571). The contents of this material have not been reviewed nor approved by any regulatory authority including the Securities and Futures Commission in Hong Kong. Accordingly, save where an exemption is available under the relevant law, this material shall not be issued, circulated, distributed, directed at, or made available to, the public in Hong Kong. Singapore: This material is disseminated by Morgan Stanley Investment Management Company and should not be considered to be the subject of an invitation for subscription or purchase, whether directly or indirectly, to the public or any member of the public in Singapore other than (i) to an institutional investor under section 304 of the Securities and Futures Act, Chapter 289 of Singapore (“SFA”); (ii) to a “relevant person” (which includes an accredited investor) pursuant to section 305 of the SFA, and such distribution is in accordance with the conditions specified in section 305 of the SFA; or (iii) otherwise pursuant to, and in accordance with the conditions of, any other applicable provision of the SFA. This publication has not been reviewed by the Monetary Authority of Singapore. Australia: This material is provided by Morgan Stanley Investment Management (Australia) Pty Ltd ABN 22122040037, AFSL No. 314182 and its affiliates and does not constitute an offer of interests. Morgan Stanley Investment Management (Australia) Pty Limited arranges for MSIM affiliates to provide financial services to Australian wholesale clients. Interests will only be offered in circumstances under which no disclosure is required under the Corporations Act 2001 (Cth) (the “Corporations Act”). Any offer of interests will not purport to be an offer of interests in circumstances under which disclosure is required under the Corporations Act and will only be made to persons who qualify as a “wholesale client” (as defined in the Corporations Act). This material will not be lodged with the Australian Securities and Investments Commission.

Japan

For professional investors, this material is circulated or distributed for informational purposes only. For those who are not professional investors, this material is provided in relation to Morgan Stanley Investment Management (Japan) Co., Ltd. (“MSIMJ”)’s business with respect to discretionary investment management agreements (“IMA”) and investment advisory agreements (“IAA”). This is not for the purpose of a recommendation or solicitation of transactions or offers any particular financial instruments. Under an IMA, with respect to management of assets of a client, the client prescribes basic management policies in advance and commissions MSIMJ to make all investment decisions based on an analysis of the value, etc. of the securities, and MSIMJ accepts such commission. The client shall delegate to MSIMJ the authorities necessary for making investment. MSIMJ exercises the delegated authorities based on investment decisions of MSIMJ, and the client shall not make individual instructions. All investment profits and losses belong to the clients; principal is not guaranteed. Please consider the investment objectives and nature of risks before investing. As an investment advisory fee for an IAA or an IMA, the amount of assets subject to the contract multiplied by a certain rate (the upper limit is 2.20% per annum (including tax)) shall be incurred in proportion to the contract period. For some strategies, a contingency fee may be incurred in addition to the fee mentioned above. Indirect charges also may be incurred, such as brokerage commissions for incorporated securities. Since these charges and expenses are different depending on a contract and other factors, MSIMJ cannot present the rates, upper limits, etc. in advance. All clients should read the Documents Provided Prior to the Conclusion of a Contract carefully before executing an agreement. This material is disseminated in Japan by MSIMJ, Registered No. 410 (Director of Kanto Local Finance Bureau (Financial Instruments Firms)), Membership: the Japan Securities Dealers Association, The Investment Trusts Association, Japan, the Japan Investment Advisers Association and the Type II Financial Instruments Firms Association.